The Preferred Glasgow Mortgage Advisor

- Expert Mortgage Advice

- We Complete Your Application

- Access To The Best Mortgage Rates

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

Home » Areas We Serve » Mortgage Broker Scotland » Mortgage Broker Glasgow

Our Fee-Free Mortgage Broker Glasgow Services

Remortgage

Being Independent we search the whole market to get you the best mortgage deal. We make sure that the mortgage application is submitted efficiently, saving you time and money.

First Time Buyers

We specialise in helping first time buyer get on the property ladder. We make mortgages and their application process easy. Experts at guiding you through every step of buying your first home.

Moving Home

We will get you the best mortgage and fast! This allows you to put an offer in on your dream home just days after your view it. Why not put an offer in this week!?

Buy To Let

We have vast experience with landlords. We can get you the best buy-to-let rates and mortgage deals for you. We also offer a fully managed property lettings service.

Fee-Free Mortgage Advisors In Glasgow

As a whole of market mortgage brokers, we can access the best mortgage deals in the UK from both high street and specialist mortgage lenders. We do everything for you, from giving you free impartial mortgage advice that is tailored to your specific set of financial circumstances to making the application on your behalf when we have helped you decide on a lender. We do all of this and more to ensure a hassle and stress-free experience for you.

Furthermore, our award-winning service is FEE-FREE so you won’t be faced with any upfront or hidden charges. All Mortgage brokers are paid a commission by mortgage lenders but the majority also require payments from their customers too. This can be anywhere between £500 to £2000. As WE DON’T CHARGE our customers, you will make significant savings should you decide to use our mortgage services.

Benefits Of Choosing YesCanDo Money

- Independent mortgage adviser team

- Fee-free Glasgow mortgage advisory services

- A team dedicated to finding you the right mortgage deal

- Amazing customer service

- Practical support throughout the mortgage process

- Fast turnaround time on getting a mortgage

- Solicitor quotes & recommendations

- Advice for first-time buyers, home movers, and landlords

- Get a great Remortgage deal

- Life Assurance advice and services

- Mortgage protection services

How to get a mortgage

We really do make getting a mortgage seem easy.

Step 1: Get in touch

Call us on 033 0088 4407 or message us here. We will then make contact and ask you a few questions about your situation and arrange a call or video call meeting. Remember we charge. NO FEE for our service!

Step 2: Mortgage Advice

A local online mortgage adviser will contact you to have a chat over the phone. This will allow us to get a clear understanding of what you want to achieve and how we can help. We communicate online.

Step 3: We Compare

We will search the WHOLE mortgage market and get you the best rates and deals. We look at the best overall value of the home loan deal for you and your situation. Get the best rates and deals!

Step 4: Mortgage Ready

Once you choose the best available deal, we will get the application started for you. Once your application is successful you will receive a decision in principle (DIP). Most estate agents require a DIP to accept an offer.

Getting A Mortgage In Glasgow

- Your income

- Your living expenses

- Your credit history

- The amount you can put down for a deposit

- The type of mortgage and the mortgage terms

How to improve your chances of getting accepted for a mortgage

It’s a good idea to take steps to improve your financial situation before making your application as this will improve your chances of getting a mortgage product with the lowest interest rates. In this regard, you should do what you can to boost your credit score, especially if you notice it is less than ‘good’ when checking your report on Experian, Equifax, or ClearScore.

You should also reduce your living expenses. Not only will this give you more savings for a potentially bigger deposit but it will also minimise the chances of your application being rejected.

When your financial situation has improved, you will be in a better position to keep up repayments on your mortgage. We can offer further advice on this should you decide to choose our services.

What YesCanDo Money can do for you

Whether you’re a first-time buyer looking to climb the first rung on the property ladder, a seasoned home mover, a landlord, or somebody looking for a great remortgage deal, we are here for you. With access to 14,000 mortgage deals from over 90 different lenders, we can search the market to find the right mortgage for your set of circumstances.

Making sure you get the best deal

We can also advise you on the different types of mortgages that are available, from those that are most suitable for first-time buyers to the range of buy-to-let mortgages that can be accessed by landlords. We can explain the mortgage terms of each to you and give you independent advice on how to get the best deal.

We do everything for you, for FREE

After sourcing the most attractive and well-tailored mortgage for your needs, we will also take care of all the paperwork associated with the application process. We will keep in regular contact with the lender too, as this way, we will be able to keep you in the loop with regards to the status of your application.

Your appointed representative will do all this and more for you, so consider us your number one choice for your Glasgow mortgage.

Read our mortgage, insurance and property help guides.

Mortgage Rates In Glasgow

Glasgow Property Prices

Over the past year, Glasgow properties have been selling for an average of £214,668. As in most places, different housing types in Glasgow will vary slightly when it comes to their respective average sold prices.

| Property Type | Average Property Price | Monthly Mortgage Repayment * |

|---|---|---|

| Flat/apartment in Glasgow | £166,500 | £791 a month * |

| Terraced House in Glasgow | £202,893 | £964 a month * |

| Semi-Detached House in Glasgow | £249,268 | £1,184 a month * |

| Detached House in Glasgow | £405,104 | £1,924 a month * |

Average property prices in Glasgow based on Zoopla figures here » | * (Monthly mortgage payments based on a 90% Loan To Value – 4% two year fixed rate – 25 year term. Rates will vary.)

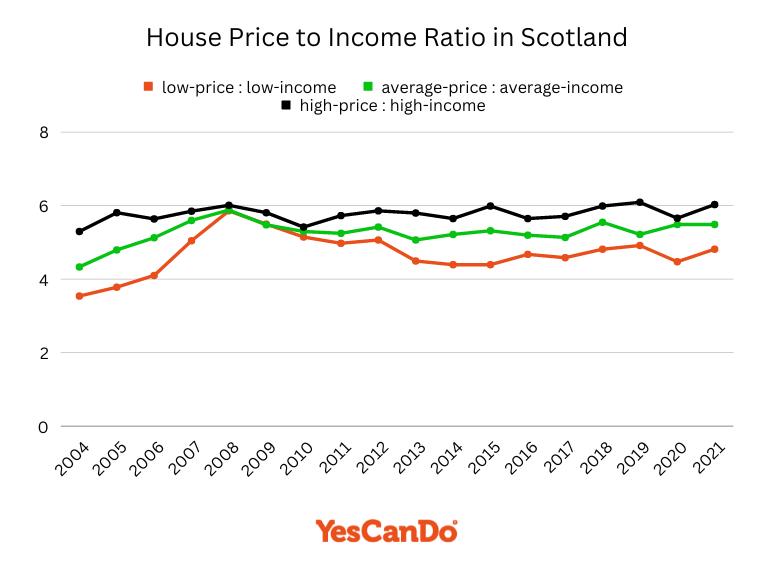

House Price to Income ratio in Scotland

In Scotland, affordability of housing is defined by comparing the price range of houses to average household incomes.

This graph was created by YesCanDo | Data Source: Office of National Statistics (ONS)

Keypoints

- In Scotland, the median house price is a staggering £166,000 while the median income sits at £30,300. This presents an intimidating ratio of 5.5 years worth of earnings needed to purchase a home!

- At the end of the financial year 2021, houses in England cost a mean 8.7 times more than an average annual disposable family income; Wales saw 6.0 and Scotland had 5.5 ratios respectively for house pricing versus salary earnings per household!

- Evidently, Scotland’s lower-cost homes are more accessible to low-income households than mid-priced housing is for middle income households or high priced housing would be to higher earners – all this according to the same percentile ratio of affordability.

Highly Rated Mortgage Broker Glasgow

Proudly Boasting a 5-Star Trustpilot Rating

Our clients’ satisfaction speaks volumes about our service quality. YesCanDo Money is proud to have earned a 5-star rating on Trustpilot, reflecting our dedication to providing top-notch, personalised mortgage advice and services. We take pride in our commitment to excellence, ensuring that every client receives the best possible guidance and support.

Our expert mortgage advisers help you to achieve your best mortgage rate.

OR FILL IN OUR FORM

"*" indicates required fields

Why Choose Us As Your Glasgow Mortgage Advisers?

Free impartial mortgage advice

If you’re looking for sound advice, consider the services of our expert team. Whether you’re looking to buy a property or make savings via a new remortgage deal, we can point you towards the best rate for your particular set of circumstances.

Access to 90+ mortgage lenders including main highstreet banks

We have access to all the main lenders, including Barclays, Halifax, NatWest, etc., but we also have contact with niche and specialist lenders that may be able to give you a better mortgage offer than those being advertised on the high street.

Advice from an independent mortgage broker that cares

Your appointed mortgage consultant will be with you every step of the way, from comparing mortgages in search of the best rate and deal to managing your application and liaising with your mortgage lender. Whether it’s your first mortgage or your 3rd remortgage your adviser will also be on hand to answer any questions via phone, email, or video call, so there is no limit to the free advice and support that we are able to offer you.

Fee Free mortgage broker that does everything for you

As there is no fee attached to any of our services, you are guaranteed to save money if you choose us as your mortgage brokers. And as we will also search the market for the most affordable products, we guarantee that you will also save money on your monthly payments.

Meet Our Mortgage Brokers Team

Our independent mortgage advisors are hard-working, friendly, and highly experienced in all aspects of the process. They will take time to fully understand your personal circumstances and will be with you throughout your mortgage journey, from the initial meeting where they get to know your needs, right through to the moment when you finally accept a mortgage offer.

We provide mortgage advice across England. If you live in Glasgow and would like to talk to a specialist advisor about your Glasgow mortgage then please feel free to get in touch.