Fee Free Mortgage Service | Expert Advice | We Do Everything For You

Fee Free Mortgage Broker Swansea

- Expert Mortgage Advice

- We Complete Your Application

- Access To The Best Mortgage Rates

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

Home » Areas We Serve » Mortgage Broker Wales » Mortgage Broker Swansea

Our Fee-Free Mortgage Services

Remortgage

Expert remortgage advice

No matter your reason for remortgaging, be it to find a great new deal or to release equity, our mortgage advisors are here for you. Our fantastic team has access to all the best deals so you can avoid the high-interest rates that some lenders might impose on your monthly repayments.

First Time Buyers

Start your journey with us

Buying a first home can be exciting but we understand how stressful it can be too. If you're currently looking for brokers in Swansea, know that our mortgage advisors are here to help. We are here to make the home buying journey easy for you, so get in touch for expert mortgage advice and access to the most affordable mortgage deals.

Moving Home

Moving home mare easy

Are you ready to embark on the home buying journey again? If so, get in touch with our team of mortgage advisors. We will help you get your next mortgage, so this is one less thing you will have to stress about during your move.

Buy To Let

Mortgages for landlords

We have access to the best buy-to-let mortgages so get in touch if you're planning on making a real estate investment. Our expert team of mortgage brokers has years of experience supporting landlords, so benefit from the unique mortgage services we can offer you.

Fee-Free Mortgage Advisor Swansea

How to get a mortgage in Swansea

We really do make getting a mortgage seem easy.

Step 1: Get in touch

Call us on 033 0088 4407 or message us here. We will then make contact and ask you a few questions about your situation and arrange a call or video call meeting. Remember we charge. NO FEE for our service!

Step 2: Mortgage Advice

A local online mortgage advisor will contact to have a chat over the phone. This will allow us to get a clear understanding of what you want to achieve and how we can help. We communicate online.

Step 3: We Compare

We will search the WHOLE mortgage market and get you the best rates and deals. We look at the best overall value of the home loan deal for you and your situation. Get the best rates and deals!

Step 4: Mortgage Ready

Once you choose your best available deal, we will get the application for your mortgage started for you. Once your application is successful you will receive a decision in principle (DIP). Most estate agents require a DIP to accept an offer.

YesCanDo Mortgage Process

What You Can Expect From Our Mortgage Broker in Swansea

YesCanDo Money is authorised and regulated by the Financial Conduct Authority (FCA), so you can be guaranteed an honest, unbiased, and professional service. We will make sure that you fully understand all of the mortgage options that are open to you. We promise that you will NEVER have to pay any more than you need to.

As a whole of market mortgage adviser, we have access to deals from both high street lenders and niche mortgage lenders, so no matter your needs and circumstances, we will be able to find the best mortgage for you.

Highly Rated Swansea Mortgage Brokers

As YesCanDo is authorised and regulated by the financial conduct authority, you can be assured of an unbiased and professional service. Our customers have benefited from the mortgage solutions that we have offered them, and you can see evidence of our expert mortgage advice by checking out the many excellent reviews we have received on Google, Facebook, and Trustpilot.

We Compare 14,000+ Mortgage Deals

With so many deals and lenders out there, you will spend a lot of time and effort if you search for a mortgage alone. Thankfully, we are here to help. We will search the entirety of the mortgage market for you and will advise you on the lender and best deal that we think is right for you.

Mortgage brokers that give expert mortgage advice

Our customers are at the heart of everything we do, so be assured that we will do all that is possible to help you get a great new mortgage. Every member of our caring and highly experienced team has your best interests at heart, which you will discover for yourself when you use our services.

Mortgages In Swansea

Mortgage Rates In Swansea

Mortgage rates in Swansea depend on the Bank of England base rate, the criteria set by the lender, and the type of property you are considering. To find out what you may be able to afford, talk to an estate agent, use our mortgage calculators, and benefit from our expert mortgage advice.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Property Prices In Swansea

The price of a property in Swansea will depend on the type of property you choose and the area you move into. The table below indicates the average property prices in Swansea.

| Property Type | Average Property Price | Monthly Mortgage Repayment * |

|---|---|---|

| Flat/Apartment in Swansea | £149,835 | £526.74 a month* |

| Terraced House in Swansea | £168,895 | £593.75 a month* |

| Semi-Detached House in Swansea | £212,592 | £747.36 a month* |

| Detached House in Swansea | £395,550 | £1,390.54 a month* |

Average Swansea property prices based on figures posted here »

* (Monthly mortgage repayment based on average price paid with a 90% Loan To Value – 1.3% 2 year fixed rate – 25 year term)

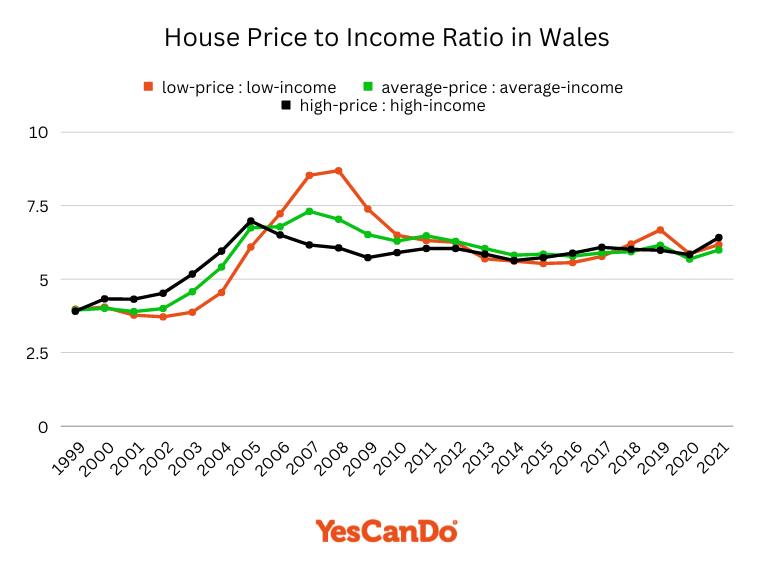

House Price to Income ratio in Wales

In the UK, affordability of housing is defined by comparing the price range of houses to average household incomes.

This graph was created by YesCanDo | Data Source: Office of National Statistics (ONS)

Keypoints

- Since 2011, the affordability of housing for various percentiles in Wales has been comparable when measured at the 10th, 50th and 90th percentile.

- As the 2021 fiscal year concluded, England homes had a mean price of 8.7 times more than the average yearly disposable family income; Wales was 6.0 and Scotland was 5.5 ratios in terms of home pricing versus salary earnings per household!

Highly Rated Mortgage Broker Swansea

Proudly Boasting a 5-Star Trustpilot Rating

Our clients’ satisfaction speaks volumes about our service quality. YesCanDo Money is proud to have earned a 5-star rating on Trustpilot, reflecting our dedication to providing top-notch, personalised mortgage advice and services. We take pride in our commitment to excellence, ensuring that every client receives the best possible guidance and support.

I built YesCanDo Money from 20 years of being a local independent financial advisor where customer service was of utmost importance to me. Around 7 years ago my sons (Matthew & Sam) joined the business and since then we have grown our fee free mortgage broker to provide the same level of service but online and to the whole of the UK. We are proud to have looked after the people of Swansea and around the UK for over 30+ years. We hope we can help you soon too.

Steve Roberts - Founder

Our expert mortgage advisers help you to achieve your best mortgage.

OR FILL IN OUR FORM

"*" indicates required fields

Meet Our Mortgage Team

Expert Swansea Mortgage Broker

Our highly experienced team is committed to helping you gain access to the perfect mortgage deal. As we are CeMap qualified and regulated by the financial conduct authority, you can be assured of expert advice and support, throughout your mortgage journey. But beyond our professional credentials, we would like you to know that we are a friendly bunch too! We look forward to helping you get your next mortgage, so get in touch with us today and make your first initial enquiry.

Read our mortgage, insurance and property help guides.

Living In Swansea

Swansea, a maritime city located in South Wales, has a lot to offer people thinking of moving into the area. With beautiful waterfront locations, nineteen stunning beaches, and all the amenities one can expect from a vibrant city, it is the perfect place to live for those wanting urban living and close proximity to areas of scenic beauty.

If you’re relocating to Swansea, you will be glad to hear that house prices are very affordable. The average price for a property here is around £180,802. Popular areas to move into include the Maritime Quarter, which is a great spot for people wanting to live close to the city centre, and the villages around The Gower Peninsula for those who want to live a rural coastal lifestyle. The charming district of Mumbles is another area worth considering, with its Victorian housing and beautiful hilltops that offer fabulous views overlooking the sea.

Get a mortgage with the help from YesCanDo