If your existing interest-only mortgage deal is approaching its end, it’s crucial to explore remortgaging options before transitioning to your lender’s standard variable rate (SVR). Typically, most mortgages offer lower interest rates than the SVR, leading to reduced monthly payments on a new deal.

When considering a new mortgage or remortgage, you have two primary choices: a repayment mortgage, where you pay back both the loan capital and interest over the term, or continuing with an interest-only mortgage. This guide focuses on interest-only remortgages and mortgage renewals, providing you with essential information to determine if this option is the right choice for your financial needs.

What is an interest-only remortgage?

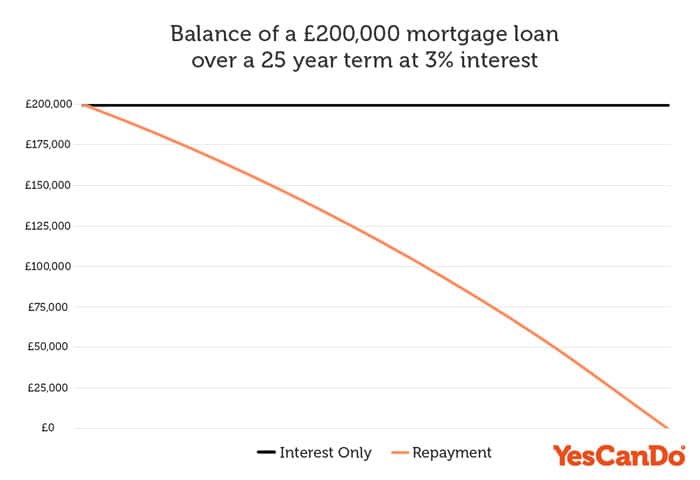

An interest-only mortgage is quite different from a repayment mortgage. Instead of paying back both the loan capital and interest each month, your monthly payments consist of paying just the interest. This means that the repayments on your mortgage will be significantly lower if you choose a mortgage on an interest only basis. However, you will need to pay back the loan capital as a lump sum at the end of the term.

The primary appeal of a mortgage that is interest-only lies in the lower monthly repayments. This can make it an attractive option for borrowers who need to manage their cash flow more effectively or those who expect a significant increase in their income in the future. However, the trade-off is that you won’t be reducing the principal balance of your mortgage throughout the term. This can put more pressure on you to save or invest wisely to ensure you can repay the lump sum at the end of the mortgage term.

What is the difference between a repayment mortgage and an interest-only mortgage?

A repayment mortgage requires you to make monthly payments that cover both the loan capital and the interest. Over time, the principal balance of the mortgage is reduced, and by the end of the term, the loan is fully repaid. An mortgage that is interest-only, on the other hand, requires you to make mortgage payments that cover only the interest. The principal balance remains unchanged throughout the term, and you will need to repay the loan capital as a lump sum at the end of the mortgage term.

Interest-only Remortgage: Things to consider

How does remortgaging work? Before remortgaging, it is wise to consider several factors.

How are you going to repay the loan capital?

The most crucial consideration is your ability to repay the loan capital at the end of the term. If you don’t have the funds available when your mortgage term ends, your home may be repossessed. In some cases, you may be allowed an extension on your mortgage, but this isn’t guaranteed.

Therefore, be sure to have a repayment strategy in place before you take out a mortgage that is interest-only. Your lender will want to see proof of this strategy anyway, so you will need to consider how you are going to repay the capital before you make your mortgage application.

Which lender will you choose?

Not all lenders provide interest-only mortgages, so your options may be limited. Of those that do, you want to find the lender that will give you the best deal for somebody in your financial situation.

Searching the market for the appropriate lender can be time-consuming, but that is where we come in. At YesCanDo Money, our mortgage experts have access to thousands of deals across the whole mortgage market and can help you save money by finding you the best mortgage deal and the most appropriate lender.

Assessing the long-term financial impact

Interest-only mortgages can seem like an attractive option due to their lower monthly mortgage payments. However, it’s essential to weigh the long-term financial impact of choosing this type of mortgage. Consider the following factors when assessing the long-term financial impact:

- Total cost of interest: With an mortgage that is interest-only, you’ll pay more interest over the term compared to a repayment mortgage, as the principal balance remains unchanged.

- Repayment strategy: Develop a feasible plan to save or invest in order to repay the loan capital at the end of the term.

- Market fluctuations: Consider the potential impact of changing interest rates, property values, and investment returns on your ability to repay the loan capital.

- Flexibility: Interest-only mortgages may offer short-term cash flow advantages, but be mindful of how the need for a lump sum repayment might affect your long-term financial flexibility.

- Retirement planning: Consider how the timing of your mortgage term aligns with your retirement goals, as repaying a large lump sum close to retirement could impact your overall retirement savings.

- Financial discipline: Assess your ability to maintain financial discipline to save, invest, and manage the risks associated with a mortgage that is interest-only.

By taking these factors into account, you can make a more informed decision about whether an interest-only mortgage is the right choice for your long-term financial goals.

Comparing interest-only vs. repayment mortgages

Before deciding what type of mortgage is right for you, it’s important to compare all mortgages. Repayment mortgages may have higher payments, but you’ll be gradually reducing your loan balance over the term. This can provide greater long-term financial stability and peace of mind.

Interest-only Mortgages and their Benefits

Interest-only mortgages can offer a range of benefits, including:

Lower monthly payments

With an interest-only mortgage, your monthly repayments will be lower than with a capital repayment mortgage, giving you more flexibility in managing your monthly budget.

Affording a more expensive property

Lower monthly repayments mean you might be able to afford a more expensive property or move to a more desirable neighbourhood.

Short-term purchase flexibility

An interest-only mortgage can be a good option if you’re not yet ready to buy your ‘forever home.’ You can buy a house with the intention of selling it at the end of the mortgage term, using the sale proceeds to pay off the capital loan amount and move onto another mortgage or property.

Time to save or invest

As your monthly repayments will be smaller, you may be in a better position to save or invest for the final lump sum. This can help ensure you have the funds available to repay the capital at the end of the term.

Eligibility for an Interest-Only Remortgage

The eligibility criteria for interest-only mortgages are similar to repayment mortgages, with one key difference: you need a repayment plan to prove your ability to pay the final lump sum. If the lender is satisfied with your repayment plan, you may be eligible for their interest-only mortgages if you meet the rest of their criteria.

Other factors affecting your eligibility include:

- Your credit score

- Your income

- Your employment status

- Your age

- Your loan-to-value (LTV) ratio

Some lenders may deny your application if you have a bad credit history, are self-employed, or are over a certain age. However, there are specialist lenders on the market that will still consider you for a mortgage. Most lenders will only consider an interest-only mortgage if you have a low LTV (under 60%) and if you earn an above-average income.

How to Pay Off an Interest-Only Mortgage

You will need a mortgage repayment plan in place to satisfy your potential mortgage lender. The Financial Conduct Authority has insisted on this to ensure mortgage lenders don’t lend money without checking for proof of repayment first. This is in the best interest of both borrowers and lenders, as it alleviates the financial risk for both parties.

The repayment requirements vary between lenders, but as a rough guide, these are some of the repayment vehicles that lenders will typically accept:

- Savings accounts

- Pension schemes

- Investment bonds

- Endowment policies

- Stocks and shares

- The sale of another property

- The sale of other assets

- Another remortgage

Our mortgage advisers can give you further advice about how to repay an interest-only mortgage, so get in touch with our team to learn more about repayment vehicles and the specific lenders that will accept your proposed repayment plan.

Interest-Only Mortgage Interest Rates

The mortgage interest rate offered on an interest-only deal will depend on several factors:

- The loan-to-value ratio (LTV): Lower LTV ratios can result in better mortgage rates.

- Your repayment vehicleSome repayment vehicles are considered higher risk than others. Choosing a lower-risk repayment vehicle can help you secure lower interest rates.

- Your credit history: A better credit history typically results in more favorable interest rates.

- The term of the mortgage: The length of the term may also impact the interest rate.

- The overall mortgage market: Interest rates are influenced by the economic climate and the wider mortgage market.

To secure the best interest rate on your interest-only mortgage, it’s essential to compare deals from multiple lenders. Our team of mortgage advisers at YesCanDo Money can help you find the best interest-only mortgage rates based on your individual circumstances.

Buy-to-Let Interest-Only Mortgage

Interest-Only Buy-to-Let Mortgages are a popular type of interest-only mortgage. This is because landlords often choose to invest rental income into maintaining the property or paying off other debts instead of paying down the mortgage balance.

With a buy to let remortgage, the rental income generated from the property is expected to cover the monthly interest payments. At the end of the term, the landlord can either sell the property to repay the loan capital or refinance the mortgage if they wish to keep the property.

It’s essential to carefully consider the rental market and property values in the area where you intend to purchase a buy-to-let property. This will help ensure that your investment is sustainable and that you can cover your mortgage payments and still make a profit.

Case Study: Jane's Interest-Only Remortgage Experience

How YesCanDo Can Help with Your Interest-Only Mortgage

Our team at YesCanDo Money is experienced in helping borrowers navigate the complexities of the mortgage market. We can provide you with expert advice, support, and guidance to help you make an informed decision about which type of mortgage is the right choice for you.

Our mortgage advisers can search the entire mortgage market to find the best interest-only mortgage deals for your circumstances, taking into account factors like interest rates, fees, and repayment strategies. We’ll work with you to ensure you understand the implications of choosing an interest-only mortgage, and we’ll help you find a lender that suits your needs and financial situation.

Conclusion

Interest-only remortgages can be a viable option for borrowers seeking lower monthly payments and more financial flexibility. However, it’s essential to carefully consider your ability to repay the loan capital at the end of the term and have a solid repayment strategy in place. Our team at YesCanDo Money can help you assess your options and find the best interest-only mortgage for your unique situation.

FAQs

Can I switch from an interest-only mortgage to a repayment mortgage?

Yes, you can switch from an interest-only mortgage to a repayment mortgage, either by remortgaging with a new lender or by discussing a change in terms with your existing lender. Keep in mind that switching to a mortgage that is on a repayment basis will result in higher monthly payments, as you will now be paying both the principal and the interest each month.

What is the criteria for an interest-only mortgage?

To qualify for an interest-only mortgage, you must meet certain criteria, including having a solid repayment strategy to pay off the loan capital at the end of the term. Lenders will also assess your credit score, income, employment status, age, and loan-to-value (LTV) ratio. Most lenders require a low LTV (under 60%) and an above-average income for interest-only mortgage applicants.

How long can you stay on interest-only mortgage?

Interest-only mortgages typically have terms ranging from 5 to 25 years. The length of time you can stay on an interest-only mortgage depends on the specific terms agreed upon with your lender. However, it’s essential to have a plan in place to repay the loan capital at the end of the term.

Can I remortgage an interest-only mortgage?

Yes, you can remortgage an interest-only mortgage. When your existing mortgage deal ends or if you want to switch to a different type of mortgage, you can remortgage with a new lender or renegotiate with your current lender. Remortgaging can help you find a better interest rate, more suitable terms, or consolidate debts, depending on your financial situation and goals.