A common question asked by our customers is this one: What size mortgage can I get with my income?

Mortgage lenders will base the borrowing amount on a number of different factors, one of which will be the income multiple they use when calculating the amount they are willing to offer.

Keep reading to learn more about income multiples and then get in touch with our friendly team of mortgage experts if you have any questions after reading this guide.

What are mortgage income multiples?

In simple terms, a mortgage income multiple is a multiple of your annual income.

As mentioned, mortgage lenders will use income multiples when working out what you could potentially borrow for a mortgage.

Most mortgage lenders offer a 4.5 times salary mortgage using a multiple of 4 or 4.5 however there are those who offer higher income multiples in the right circumstances.

Example: If you earn £30,000 a year and the lender uses a multiple of 4, you may be able to borrow up to £120,000. This is because the lender multiplies your annual income by 4.

Should you gain access to a mortgage provider willing to offer you 5 times your income, you may be able to borrow more money, up to a maximum of £150,000 using the same calculation method.

What income multiples can you get for a mortgage?

Different mortgage lenders offer different income multiples so whereas one lender might be willing to calculate your mortgage size using 4.5 x your income, another mortgage lender might choose to calculate your mortgage using a higher or lower multiple.

As such, there isn’t always a hard and fast rule when it comes to finding a maximum income multiple, although your personal circumstances can sometimes dictate what income multiple a mortgage lender will use.

Many lenders cap income multiples at 4.5 but if you’re a high earner, you may be eligible for a mortgage size calculated with a multiple of 5 or 6 with the right mortgage lender.

In rare cases, some customers are able to get a mortgage with a multiple of 7 but to be eligible, you would need to use the services of a private lender and be a high net-worth individual.

Calculating your mortgage affordability

If you want to know what size mortgage you could potentially borrow for a home, the best thing to do is speak to one of our mortgage advisers.

But in the meantime, you can get an estimate of the mortgage size you may be offered by using the mortgage repayment calculator below.

Mortgage Affordability Calculator

To get an estimate of how much you could borrow from a mortgage lender, enter your household income into the box below.

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Example calculations

The table below can give you an idea of how much you may be able to borrow from a mortgage lender, based on different income sizes and income multiples. If you’re applying for a joint mortgage, be sure to factor in the other applicant’s earnings when looking for the relevant income bracket.

| Salary | 4x Salary | 4.5x Salary | 5x Salary | 6x Salary |

|---|---|---|---|---|

| £25,000 | £100,000 | £112,500 | £125,000 | £150,000 |

| £30,000 | £120,000 | £135,000 | £150,000 | £180,000 |

| £35,000 | £140,000 | £157,500 | £175,000 | £210,000 |

| £45,000 | £180,000 | £202,500 | £225,000 | £270,000 |

| £55,000 | £220,000 | £247,500 | £275,000 | £330,000 |

| £65,000 | £260,000 | £292,500 | £325,000 | £390,000 |

| £75,000 | £300,000 | £337,500 | £375,000 | £450,000 |

| £85,000 | £340,000 | £382,500 | £425,000 | £510,000 |

| £95,000 | £380,000 | £427,500 | £475,000 | £570,000 |

| £105,000 | £420,000 | £472,500 | £525,000 | £630,000 |

How a broker can help secure a higher mortgage income multiplier

If you need a higher income multiple to secure your dream property, get in touch with YesCanDo Money’s mortgage experts for qualified advice and support.

We will consider your income, including both your salary and any additional earnings you receive, and then look for ways to maximise your borrowing potential.

We will also advise you on the steps you need to take to be eligible for higher multiples before searching the market for the best deal available for somebody in your situation.

5 factors that affect what income multiple you can get

A number of factors can affect the multiple you will be offered and they are all based on the level of financial risk you pose to the lender. The less risk you are, the more you will be able to borrow as you should be eligible for higher multiples.

1) Deposit

To be eligible for a mortgage, you need to put down a deposit. The more money you can raise for your down payment the better, as larger deposits equate to lower loan-to-value mortgages.

Higher-income multiples are offered to people with bigger deposits so if you can raise at least 15% of a property price for a lower loan-to-value mortgage, you may be eligible for a mortgage amount that is equivalent to 5 times your income or higher.

2) Annual Income

Before you’re offered a mortgage, the lender will go to great lengths to make sure you can afford your monthly payments, not just now but also in the future should interest rates rise.

Your income will be considered when they assess your affordability and if it’s enough to qualify for a mortgage, your chances of approval will be improved.

Higher salary multiples are often offered to higher earners so your borrowing ability could be increased.

If you’re applying for a joint mortgage, the combined income of the joint applicants could be enough to qualify for a higher income multiple. As such, you don’t necessarily need to be a high earner if you are adding another person to the mortgage application.

3) Employment type

The higher your income, the higher the salary multiple you are likely to be offered.

But how your income is worked out will depend on whether you’re employed or self-employed.

This is straightforward if you’re in a full-time employed role as mortgage lenders will make calculations based on your annual salary.

But if you’re self-employed, most lenders will apply the income multiple to an average of the earnings you have made over the last 2-3 years. You will need to evidence your earnings with your SA302 tax calculations and account statements.

If you’re a limited company director, most lenders will include your dividend income when calculating your earnings, so the multiple you are offered won’t only be based on your salary. The mortgage process is sometimes complicated for limited company directors but with the help of an expert mortgage broker, such as ourselves, getting a mortgage can be made easier.

4) Property type

If you’re planning on buying a property made from non-standard construction materials, or if you need a mortgage for an unusual property type, your mortgage may be worked out with a lower income multiple.

This is because non-standard properties are considered a risk by some lenders so lending criteria can be much stricter. Such properties include:

- Houses with thatched rooves

- Houses with glass, concrete, wooden, or metal walls

- Flats in high-rise buildings

- Flats above shops

- Prefabs

- Listed buildings

5) Mortgage term

Most mortgage terms are 25 years but if you opt for a shorter term, your monthly repayments could go up, and for some lenders, this will mean you’re a higher risk. Consequently, the income multiple you’re offered may be lower.

The reverse may be true if you choose a longer mortgage term. As your mortgage payments will usually be lower, you may be eligible for a higher income multiple.

Lenders’ mortgage income multiples

As you can see, there are a number of factors that come into play when it comes to the salary multiples offered by different lenders.

How much you can borrow for a mortgage will also depend on the lender you choose and whether or not they accept supplemental income. We go into a little more detail below.

Which mortgage lenders offer the highest income multiples?

A number of lenders offer mortgages of 5.5 x income, including Barclays, Santander, and Halifax, but these are usually reserved for higher earners.

Santander, for example, requires a combined income of £100,000 or more and an LTV of 75% or less. Barclays set the same income requirements but with a maximum LTV of 85% or less.

If you’re interested in high-income multiple mortgages, get in touch with our team for up-to-date information on the lenders that are willing to offer these.

What supplemental income will lenders accept?

Your annual salary isn’t the only form of income lenders will accept so you may be able to improve your mortgage affordability with the supplemental income you receive. This can include:

- Pension income

- State benefits

- Investment dividends

- Rental income

- Bonuses

- Commission

- Overtime pay

Do lenders take all of your outgoings into account?

Your outgoings can impact your mortgage affordability but not everything will be taken into account. You don’t have to worry too much about your supermarket shopping, for example, or loans that only have a few months left to run.

But if you have a lot of debts that are eating into your finances or if your spending is likely to impact your ability to make your mortgage repayments, then questions will be raised about your expenses.

Before making your mortgage application, it’s wise to reduce your spending where you can. This will improve your mortgage affordability and your chances of getting a higher income multiple.

Housing affordability trends across the countries of Great Britain

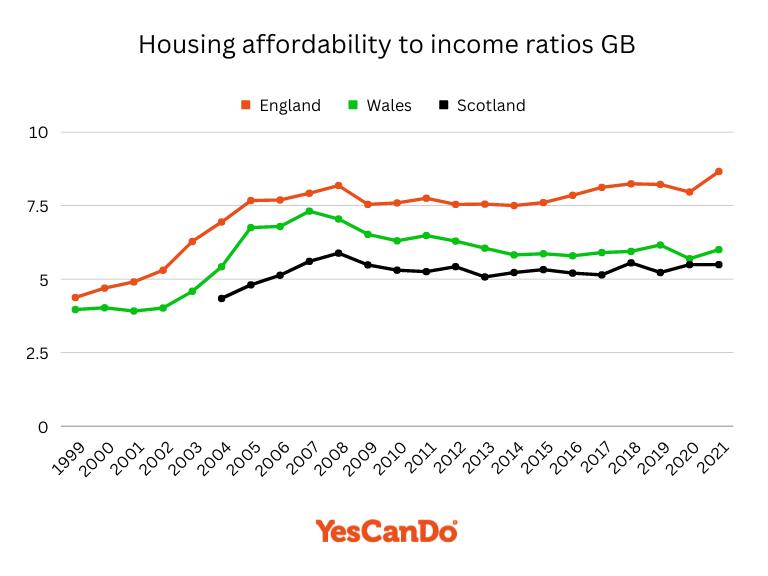

The below graph shows the ratio of housing affordability for median household income compared with median house prices for England, Wales, and Scotland from 1999 to 2021.

Graph created by YesCanDo | Data sourced from the Office of National Statistics (ONS)

Graph created by YesCanDo | Data sourced from the Office of National Statistics (ONS)

How an experienced mortgage broker can help you achieve higher income multiple mortgages

Due to the steep rise in property prices over the last few years, many people are in need of higher-income multiple mortgages, but finding the lenders that offer these is sometimes tough.

Fear not, however, as YesCanDo Money can help. Our mortgage brokers know which lenders on the mortgage market are prepared to offer higher income multiples so we can put you in touch with the right lender for your particular situation.

We can also advise you on the steps you need to take to qualify for higher multiple mortgages.

To learn more, get in touch with our experienced team using WhatsApp, phone, or our contact form below and we will give you all the support and advice you need on your mortgage journey.

FAQs

What is the highest income multiple for a mortgage?

Many lenders cap their multiples at 4.5 but there are some who will stretch to 5 or 6 for high earners and those applying for a lower loan-to-value mortgage.

There are even lenders who will offer a multiple of 7 but to qualify, you would need to be a high net worth individual with an annual income of £300,000 or assets worth at least £3 million.

What income multiple will I get if I’m a first-time buyer?

Your case will be assessed on the same basis as any other mortgage customer, so you won't be excluded from favourable salary multiples as a first-time buyer. Your income, credit score, deposit for your house purchase, and other factors will be taken into consideration when deciding which multiple you will be offered.