Securing a mortgage can be both exciting and daunting. You might be surprised to learn that in some cases, it’s possible to borrow more than the average of four times your annual salary! Mortgage affordability isn’t solely about your income; several factors determine your maximum borrowing limit. In this guide, we’ll explore these elements, discuss how they can increase your borrowing potential, and provide expert advice on this important topic.

We’ll offer a detailed look at securing a mortgage that’s 4 or 4.5 times your income, ensuring you get the most competitive rates available. Let’s start this journey to help you achieve your dream of homeownership.

Is it common for a UK lenders to offer a mortgage 4.5 times salary?

While it’s generally assumed that you can borrow up to 4-4.5 times your salary from high street lenders, this figure is merely an average. Depending on your circumstances and lender criteria, you might secure a mortgage loan for 5 or even 6 times your annual salary!

In some situations and professions, you might acquire a 7 times salary mortgage, but this is rare. These are typically only available to those who can demonstrate significant wealth.

Discover how much you can borrow!

Most mortgage lenders agree that a mortgage based on 4.5 times your salary is ideal. This amount allows you to purchase your dream property and ensures you can comfortably make monthly repayments without financial strain. It’s a great starting point and should give you a good idea of the kind of mortgage available to you.

Take our mortgage calculator for a spin now to estimate how much money you could borrow based on 4.5 times your salary. Just enter a few essential pieces of data, and we’ll show you an estimation of potential results. For comparison, our calculator can also display results based on 5 or 6 times your salary!

Mortgage Affordability Calculator

Want to find out how much you can get approved for a mortgage? Our mortgage borrowing calculator is the answer! Just type in your total household income, and we’ll calculate the kind of loan amount you may qualify for. Ready to start budgeting smarter? Enter your monthly income here:

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Mortgages 4 to 4.5 times salary: Example income multiples table

Your annual salary determines the amount you can borrow for your mortgage. The salary multiple tables below provide an approximation of your borrowing potential.

| Salary | 4x Salary | 4.5x Salary | 5x Salary |

|---|---|---|---|

| £25,000 | £100,000 | £112,500 | £125,000 |

| £30,000 | £120,000 | £135,000 | £150,000 |

| £35,000 | £140,000 | £157,500 | £175,000 |

| £45,000 | £180,000 | £202,500 | £225,000 |

| £55,000 | £220,000 | £247,500 | £275,000 |

| £65,000 | £260,000 | £292,500 | £325,000 |

| £75,000 | £300,000 | £337,500 | £375,000 |

| £85,000 | £340,000 | £382,500 | £425,000 |

| £95,000 | £380,000 | £427,500 | £475,000 |

| £105,000 | £420,000 | £472,500 | £525,000 |

Looking to borrow more than 4.5 times your salary? Here’s how!

If you need a higher income multiple, such as 4.5x or even 5x, to fund your property purchase or remortgage, and are confident that higher monthly payments won’t be an issue, there are a few steps to put you in a prime position.

Use an experienced mortgage broker

When searching for a 5x mortgage income multiple or even 6 times salary mortgage, you may face difficulty. However, contacting a Mortgage broker who specializes in this kind of loan will increase your chances.

Each lender has their own underwriting criteria for higher income multiples mortgages, so it’s important to get advice before starting your mortgage journey.

Your mortgage application is more likely to be approved if you choose a lender that understands your personal financial situation.

Our team of mortgage advisers is experienced with higher income multiple mortgages and has access to the lowest fixed-rate mortgages. Reach out, and we will let you know your maximum mortgage amount and provide you with free advice that requires no commitment on your part.

Even better, did you know there are fee-free mortgage brokers? All brokers get paid by the lender, but some choose to charge their customers an admin fee of £500-£1000. YesCanDo, a fee-free broker, does not charge its customers for its highly-rated service. For over 30 years of mortgage industry experience, our core drive has been to save our customers money and time at every stage of the mortgage process.

Evaluate alternative sources of income to maximize your financial potential.

In addition to your salary from employment, some lenders will consider other sources of household income such as:

- Benefits

- Investments, bonuses, and commissions

- Child maintenance

It’s important to consider all income streams when applying for a mortgage. However, not all mortgage providers value these supplementary incomes equally, so make sure you talk to an experienced mortgage broker about all your income sources. They can help determine which lender is best suited for you and do most of the hard work involved in finding an ideal match!

You will likely get accepted for a larger mortgage amount if you are applying for a joint mortgage.

Check your credit history

Although it doesn’t directly affect your maximum borrowing amount, your credit score report is essential to the mortgage eligibilty process. Make sure you’re familiar with what lenders can see and that all their information about you is accurate! Request a copy of your credit report right away to check for any missing or incorrect details that could limit your options.

The three major credit reference agencies in the UK are:

- Experian

- Equifax

- TransUnion (previously known as Callcredit)

They all offer their own version of a credit history report. Alternatively, you can use a company such as Checkmyfile UK.

Other influencing factors on borrowing caps

Banks consider more than your annual salary when determining their lending limit; other aspects may have an effect. By taking note of such considerations, you can increase the chance that a positive result comes out of applying for a loan larger than 4.5 times your salary.

Deposit amount/loan to value

The loan-to-value ratio (LTV) is the proportion of a property’s total value you wish to borrow and can influence how much you are able to obtain from potential lenders. Also, the mortgage market offers more competitive mortgage deals and interest rates for lower loan to values. Therefore the more money you put down as a deposit the better the interest rate you will be able to get.

The Scottish Building Society, for example, offers up to four times your salary in mortgages with an LTV higher than 80%, but increases that multiple if you have more than 20% deposit.

Profession

Are you in a profession such as medicine, teaching, civil service, or legal services? If so, taking advantage of special mortgages could be the best option for your finances. Professional mortgages are often associated with lower rates and higher loan limits than standard options – if this applies to you then it’s definitely worth exploring further how professional mortgages can benefit you!

Other outgoings

In order to maximise the amount you can get on a mortgage, it’s important to talk with your mortgage broker about reducing costs on your monthly outgoings including credit cards, loans, and other borrowing commitments. Affordability checks on a mortgage take these into account and thus lowering them could have an effect on making sure you’re in the best possible position and mortgage rate when applying for a mortgage.

Which mortgage lenders offer 4-4.5 salary multiples

The majority of lenders set their maximum borrowing limits on mortgages to a standard 4-4.5 salary multiples, such as Leeds Building Society, HSBC, and the Swansea Building Society. While all lenders will assess loan applications based on individual circumstances, there may be cases where the limit can be increased even beyond 4.5 times salary.

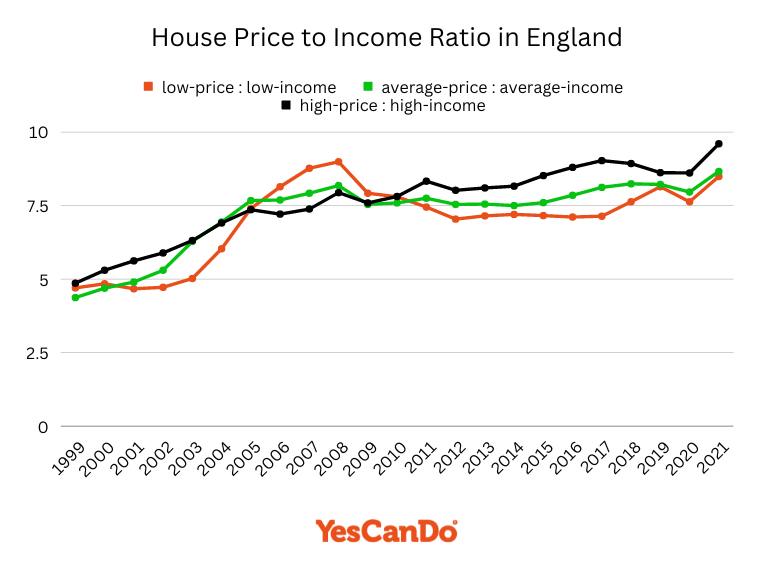

Mortgage affordability in England

The below graph shows affordability in England which is defined by comparing the price range of houses to average household incomes.

This graph was created by YesCanDo | Data Source: Office of National Statistics (ONS)

This graph was created by YesCanDo | Data Source: Office of National Statistics (ONS)

Key points

- As of the financial year ending 2022, the average home cost in England was recorded at 8.4 times the annual disposable household income, a slight decrease from the previous year. In Wales, the ratio increased to 6.4, while in Scotland, it decreased to 5.3. This continues to highlight a significant distinction between these three nations.

- In the North East of England, low-income households would need to dedicate almost 12 years’ worth of earnings to afford a moderately priced home. In contrast, residents in London are expected to sacrifice up to 40 years’ worth of wages.

- In the most cost-efficient region of the country, the North East, homes that are valued at the 10th percentile or lower can be bought for roughly five times a household’s disposable income which is in the tenth percentile range and higher.

- London still offers affordable housing options if you’re one of the top earners in town, with a disposable household income five times that of an average resident (80th percentile or higher).

Use mortgage brokers experienced in higher multiple mortgages

When it comes to securing the perfect mortgage that fits your needs, having guidance from an expert can make all the difference. They will be able to aid you in negotiating for interest rates on common 4.5 times salary mortgages or even discovering lenders who are open to lending 6 times annual income! All of our advisors have access to every lender and plenty of experience finding higher multiple incomes mortgages with the best mortgage deals.

Call us for a chat with a mortgage adviser 033 0088 4407 or send in an inquiry via our online form. Got a question? Feel free to WhatsApp us for free advice also.

FAQs

How do 4.5 times salary mortgages work for joint applicants?

Similarly to single applicants, a joint income mortgage application will add together your incomes in order to calculate the potential loan amount. Notably, if one partner has a particularly high salary as opposed to both partners having average salaries it can cause an elevated income multiple for qualifying applicants.

What salary do I need for a 100k mortgage UK?

To be eligible for a £100,000 mortgage in the UK, your annual income should generally place you at 4-4.5 times that amount; though this can differ depending on external factors such as credit score and monthly expenses. For example, a gross yearly income of £22,222 - £25,000 would likely meet the criteria to secure one of these mortgages. However, it is important to note that requirements may vary according to individual financial circumstances and thus higher or lower salaries could also suffice.

How much mortgage can I get with 40k salary?

With an annual income of £40,000, you can likely borrow between 4-4.5 times your salary for a mortgage - equating to roughly £160,000 - £180,000. Nevertheless, it's important to note that this is just an estimation and the exact amount authorised by lenders will depend on various factors such as credit score and debt-to-income ratio.

Can you get a mortgage 5.5 times my salary?

It is possible to get a 5x, 5.5x or even 6x your income on a mortgage. Each lender has their own limit to the amount of money they'll provide you, known as a 'maximum income multiple', which is typically four or 4.5 times your annual salary. However, if you are among the lucky few whose total yearly income exceeds £60k-£100k (or more), then it's possible for them to give out larger sums - so don't sell yourself short.

If you're a young professional, such as an accountant, doctor, dentist, lawyer, or pilot - you might have the potential to receive even more than 5.5 times your income in mortgage financing! In fact, it's possible for qualified applicants to get up to six times their salary.

Will I need a good credit rating to get a higher income multiple

It is going to be essential that you have a very good credit score to get higher income multiples. You will need to be up to date on all debt repayments, have no bad credit, and also have a good debt-to-income ratio. Although most lenders will need the above you may be able to find a specialist lender that might consider you however it will be with a far worse interest rate.