Can You Remortgage to Pay Off Debt?

Remortgaging to settle debts is not only feasible but can also serve as a strategic method of managing your finances. This process allows you to leverage the equity in your home, thereby freeing up funds which can be redirected towards faster repayment of existing loans. In doing so, you may be able to reduce your monthly payments and save money in the long run. To know how to remortgage to consolidate debts effectively it is essential to understand how remortgaging works.

In this guide, we will provide you with the necessary insights and an overview of the remortgaging process, equipping you with the knowledge to make informed decisions that can lead to financial stability and peace of mind. Additionally, we offer you the opportunity to consult with one of our expert advisors, who are available for fee-free mortgage consultations, ensuring you receive professional advice tailored to your unique financial situation.

The Process of Remortgaging to Consolidate Debt

Remortgaging to consolidate debt involves switching your existing mortgage for one that pays off your outstanding debt. The aim is to find a mortgage with lower interest rates that could reduce your monthly outgoings and save significant sums over time.

Steps to Remortgage to Debt Consolidation

- Assess Your Current Financial Position: Begin by becoming acquainted with all aspects of your current financial landscape, from outstanding debts and home equity evaluation, to repayment capabilities and your ability to meet monthly obligations. This initial audit forms the foundation of any remortgaging decision you may consider making.

- Consult a Mortgage Advisor: Meet with a specialised advisor who can tailor advice specifically tailored to your unique financial circumstances. A mortgage adviser can explain all the potential advantages and drawbacks of each mortgage option available to you, providing invaluable insights. Their expertise can save both time and money during the remortgaging process.

- Apply for Remortgage: This step involves going through an affordability evaluation from potential lenders, which involves both passing both a credit check and an affordability test. This process helps determine your eligibility for remortgaging as well as finding out your best options.

- Pay-Off Debts: Once your remortgage application is approved, its funds can be put to use to pay off other existing debts such as personal or secured loans. This move can streamline your financial obligations while setting the stage for greater financial security.

- Once Your Remortgage Is Secure: Finally, once your new mortgage is in place, your responsibility is to make regular payments on it. Keep in mind that this new loan now encompasses any unsecured debt, creating a more manageable financial landscape for yourself and your family.

The Risks and Benefits of Remortgaging to Pay Off Debts

Remortgaging to pay off debts may help lower monthly payments and make them more manageable, yet there are certain risks involved with doing so. Your home could become collateral should you fail to repay your debt – therefore it is imperative that all options and advice from a mortgage advisor before you start a debt consolidation remortgage.

Benefits of Remortgaging to Pay Off Debt

- Reduce monthly repayments: Consolidating debt into one monthly payment may help to lower overall monthly payments and may allow you to significantly decrease them overall.

- Simplifying finances: Instead of dealing with multiple creditors individually, all payments need only to go to one place – your existing lender.

- Reduced Interest Payments: Mortgages often feature lower interest rates than unsecured debt, providing an opportunity to save on interest payments and save some cash over time.

Risks of Remortgaging to Pay Off Debt

- Your Home Is at Risk: If you fail to make mortgage payments on time, lenders could repossess it and sell it at auction.

- Longer term costs could be higher: Though your monthly payments might be less, due to extended repayment terms you could end up spending more overall.

- Potential Costs: Remortgaging may involve fees such as early repayment charges or arrangement costs that must be considered when planning.

How I help my customer consolidate debts with her remortgage

Debt Consolidation Mortgage Alternatives

Remortgaging may be one of the best options available to consolidate debt, but you shouldn’t rely on it alone as there may be other viable choices depending on your unique circumstances.

Secured Loan

Secured loans (commonly referred to as homeowner or second-charge mortgage loans) provide an attractive alternative to remortgaging when poor credit makes refinancing impossible or you’re stuck in an existing fixed-rate mortgage with costly early repayment charges. Like with any form of borrowing, however, your home remains at stake should you fail to keep up the repayments on such an arrangement.

Further Advance

A further advance involves borrowing more money from your current mortgage lender. This option may be the right option if your lender offers competitive interest rates or you wish to avoid the fees and charges associated with refinancing, though you’ll need to demonstrate to them that you can afford their higher repayments.

Personal Loans

If the amount of debt you need to consolidate is relatively small, a personal loan might be an ideal solution. Unsecured loans do not tie your home up, which makes this form of financing suitable if your credit score is strong and payments can be met on time each month; however, interest rates tend to be higher compared with secured loans like mortgages.

Credit Card Balance Transfers

If your debt consists largely of credit card debt, a balance transfer could provide some respite and help accelerate repayment of it faster. By moving the debt from cards with higher rates to those offering 0% for set periods (known as zero balance transfer rates) this can give you breathing room while helping pay down your debt more rapidly. However, you’ll need to be disciplined and aim to pay off your balance before the 0% period ends, as the interest rate will likely jump up afterwards.

Each of these options has its own benefits and drawbacks, and which option best meets your circumstances will depend on that individual situation. Seek professional advice prior to making any major decisions.

Understanding Equity and How It Affects Your Ability to Remortgage

Equity refers to the portion of your property that is actually yours – it’s the difference between its market value and what is still owed on your mortgage loan. As your equity increases, so will your borrowing power when refinancing.

However, it’s important to keep in mind that when refinancing to pay off debts, you are effectively borrowing against your home as collateral. If property prices decline rapidly enough, negative equity could occur – meaning owing more on your mortgage than its actual worth – making it hard to sell or switch to a new mortgage deal in the future.

The Role of Credit Scores in Debt Consolidation Mortgages

As with any form of borrowing, your credit score plays an integral part when it comes to remortgaging. Mortgage lenders use your score to evaluate your creditworthiness and decide the interest rate they offer you; those with high scores could get more advantageous terms; those with poorer ones could face higher rates that reduce its benefits.

Improving Your Credit Score

If your credit score is low, there are steps that you can take to increase it before applying for a remortgage:

- Pay your bills on time: Late and missed payments can have serious repercussions for your credit score.

- Reducing Debt: Your credit utilisation ratio has an impactful influence on your score; aim to decrease it as much as possible before applying for a remortgage loan.

- Make an effort not to apply for new credit: Applying for any form of loan could temporarily lower your credit score – to protect it, try not applying in the months leading up to the remortgage application.

- Check Your Credit Report Annually: Errors in your credit report could have serious repercussions for your score and it is in your rights to review it for free once every year in order to report any discrepancies that you find.

Mortgage Advisor's Advice

FAQs

Is it possible to remortgage to pay off debt?

Yes, remortgaging can help pay off debts. This involves taking out a larger mortgage than what's needed to cover both existing payments as well as any outstanding liabilities, with any funds from this remortgage used directly for debt repayment.

Is remortgaging to consolidate debt a good idea?

Remortgaging to consolidate debt could prove beneficial if it reduces monthly payments, and interest rates and helps manage debt more effectively. Before making this decision, however, it's essential that you carefully weigh any risks involved and seek professional advice before proceeding with this strategy.

Can you remortgage to consolidate debt?

Yes, remortgaging can help consolidate debt. This involves replacing your current mortgage with one that includes all your other debts - potentially streamlining payments and decreasing monthly outgoings.

Can I remortgage with bad credit to pay off debt?

While it can be more challenging, it is possible to remortgage with bad credit. However, you may face higher interest rates or stricter lending criteria. It's advisable to speak to a mortgage advisor to explore your options.

Is it a good idea to remortgage to clear debt?

Remortgaging to clear existing debts may be advantageous if it reduces monthly payments and interest rate; however, it's essential to take into account potential risks such as higher long-term costs and the threat to your home if repayments become unmanageable.

What stops you getting a remortgage?

Many factors could prevent you from refinancing, such as having insufficient equity in your home, unstable income, or changes to your financial circumstances. Therefore it's essential that you speak to an experienced mortgage advisor in order to fully comprehend all available options and potential obstacles to refinancing.

Conclusion: Should I Remortgage to Consolidate Debt?

Remortgaging to pay off debts can be an effective tool in managing and reducing debts, but it isn’t necessarily suitable for every situation – so it is wise to carefully consider your personal circumstances before making the decision to remortgage.

How a Mortgage Broker Can Help

Mortgage brokers can be invaluable resources when considering refinancing to repay debts. They can help you understand potential benefits and risks, assist with application procedures, and identify suitable remortgage deals tailored specifically to your circumstances. At YesCanDo Money’s fee-free service, we offer expert advice at no additional charge so make the right financial decisions.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

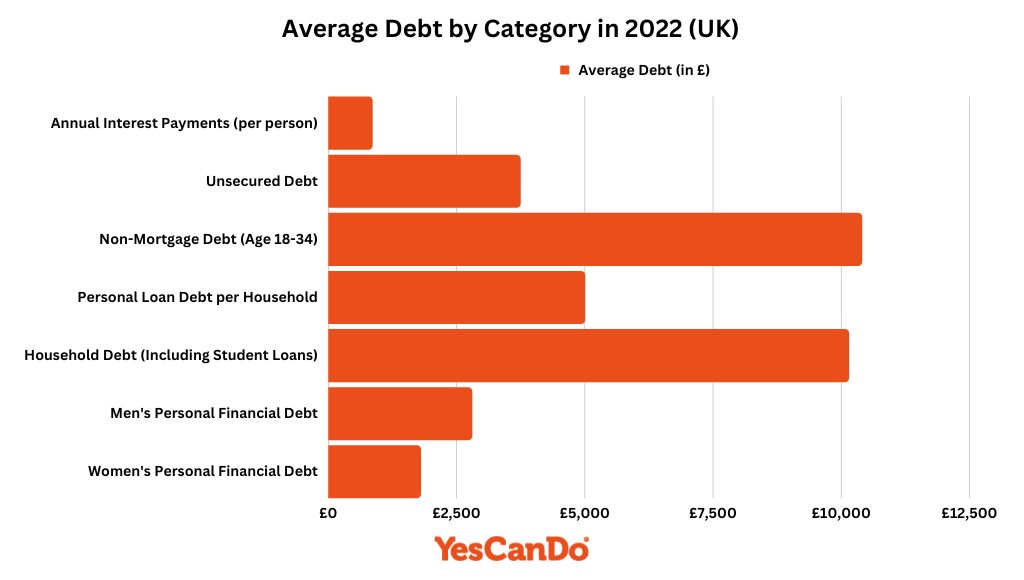

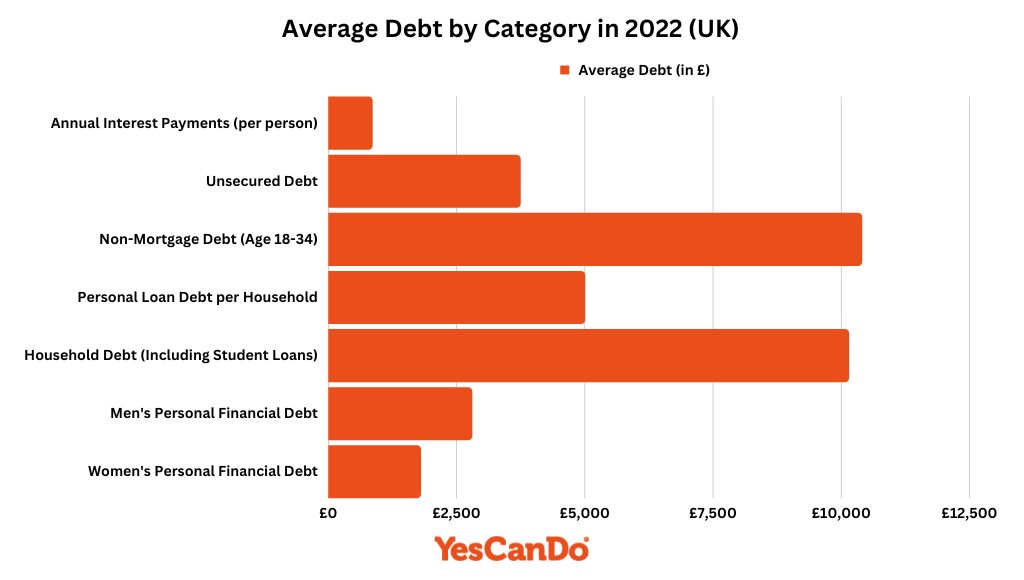

UK Average Debt Statistics