As mortgage rates have increased from mid-2022 into early 2023, homeowners are seeking ways to lower their monthly payments. One option that has become more popular is a longer-term mortgage, but buyers need to consider the additional cost that this choice may entail.

Extending mortgage term and the logic behind it

Why remortgage? People remortgage for multiple of reasons and one common goal is to extend the term to lower monthly payments. The typical mortgage term is 25 years, during which the borrower repays the loan. However, mortgage terms can range from five to around 40 years, depending on the mortgage lender. Choosing a longer mortgage term can reduce your monthly repayments by spreading out the loan repayment over a longer period of time. However, it is important to note that a longer mortgage term also means you will accrue more interest over the life of the loan because you are borrowing money for a longer period.

How much lower will my mortgage repayments be?

As interest rates increase, mortgage monthly repayments may also rise. One way to offset this is by extending the mortgage term.

For example, a person purchasing a home for £250,000 with a 10% deposit could lower their monthly payments by £400 by increasing the mortgage term from 20 years to 40 years. Even extending the term by just five years, from 25 to 30 years, can result in a yearly savings of £1,284 in monthly payments. The savings are even greater for larger loan amounts.

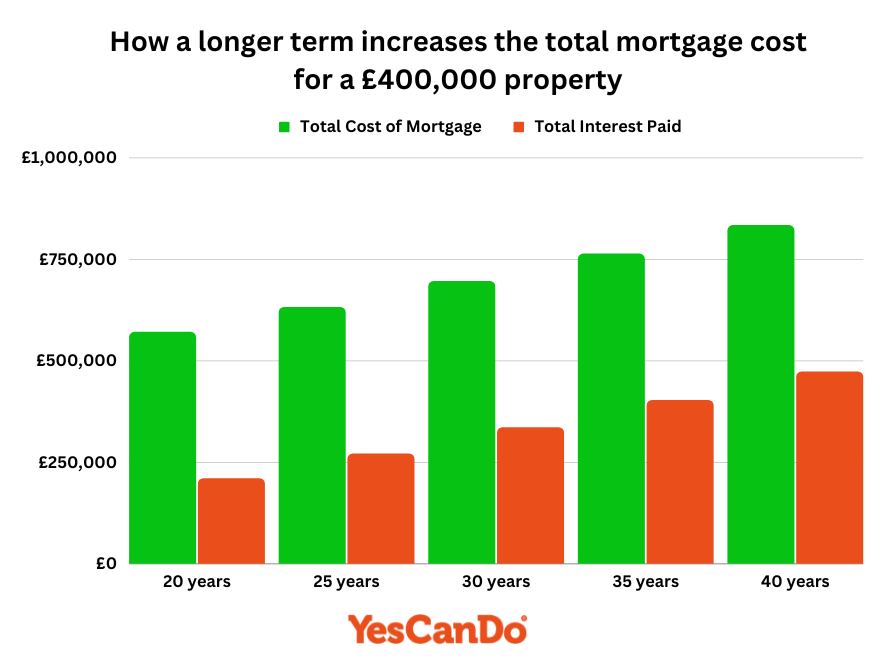

For example, someone purchasing a £400,000 home with a 10% deposit could save £172 per month by extending the mortgage term from 25 years to 30 years, or £228 per month by extending it to 35 years, which is a yearly savings of £3,456 on your monthly mortgage repayments.

How much more will it cost when extending the term of your mortgage?

Anyone extending the term of the mortgage must be aware that although substantial savings can be made on the lower monthly repayments over the term of the mortgage you will end up paying far more interest.

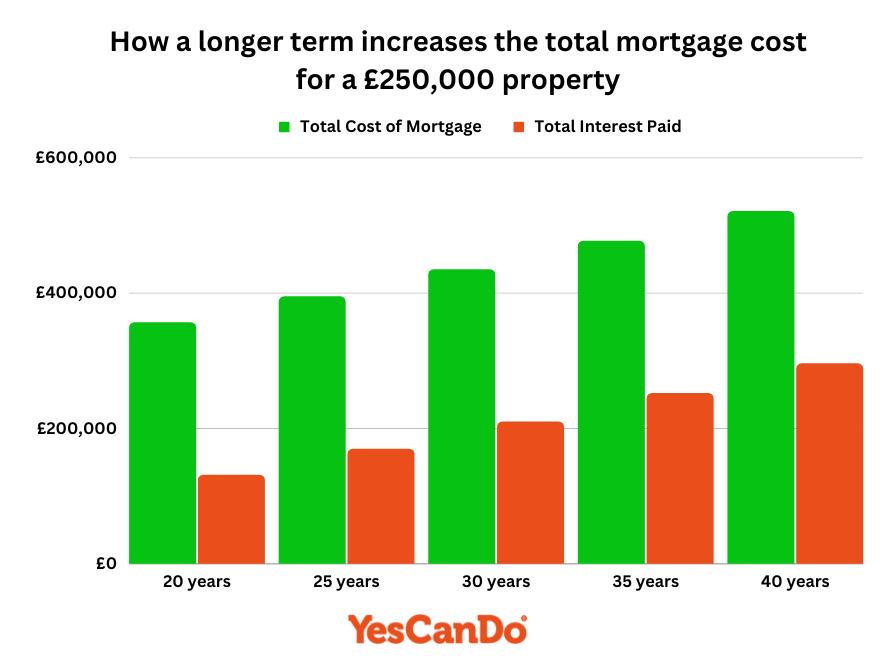

The total cost of borrowing can significantly increase if you extend the term of your loan, especially if you are borrowing a large sum of money. As you lengthen the mortgage term, the total interest charges will accumulate, resulting in you paying more than double the interest at a 40-year term compared to a 20-year term. For example, someone borrowing to purchase a £250,000 property with a 25-year term will pay £169,598 in total interest, but if they extend the term to 35 years, they will be charged an additional £82,332 in interest.

If you are borrowing £360,000, you will pay approximately £210,202 in total interest over a 20-year mortgage term, but if you extend the term to 40 years, you will pay £473,236 in total interest. Even increasing the term from 25 to 30 years can result in an additional £64,364 in interest costs.

What things should I consider before extending my mortgage term?

If your primary goal is to lower monthly mortgage payments as quickly as possible, extending the term of your mortgage may still be a viable option, but it is important to be aware of the additional cost it will incur. Your broker should be able to provide you with an estimate of the total amount you will need to repay over the term of the mortgage based on your specific mortgage deal. If you have not already explored all of your budgeting options, it may be worth considering ways to reduce your spending in other areas for example debt consideration in order to afford a higher monthly mortgage payment and a shorter term.

Total cost of borrowing when buying a £250,000 home

| Mortgage Term | Monthly Repayment | Total Cost of Mortgage | Total Interest Paid |

|---|---|---|---|

| 20 years | £1,485 | £356,376 | £131,376 |

| 25 years | £1,315 | £394,598 | £169,598 |

| 30 years | £1,208 | £434,826 | £209,826 |

| 35 years | £1,136 | £476,930 | £251,930 |

| 40 years | £1,085 | £520,772 | £295,772 |

Figures assume £225,000 of borrowing at a 90% loan-to-value, paying 5% interest for the full duration of the mortgage term.

Total cost of borrowing when buying a £400,000 home

| Mortgage Term | Monthly Repayment | Total Cost of Mortgage | Total Interest Paid |

|---|---|---|---|

| 20 years | £2,376 | £570,202 | £210,202 |

| 25 years | £2,105 | £631,357 | £271,357 |

| 30 years | £1,933 | £695,721 | £335,721 |

| 35 years | £1,817 | £763,088 | £403,088 |

| 40 years | £1,736 | £833,236 | £473,236 |

Figures assume £360,000 of borrowing at a 90% loan-to-value, paying 5% interest for the full duration of the mortgage term.

FAQs

Will I be able to reduce the mortgage term in the future?

We would suggest that extending the term of the mortgage to reduce the monthly repayments is a short-term solution to help reduce overall finances.

If you are extending the mortgage term at the same time as remortgaging to a new mortgage deal we would advise that once the fixed rate or mortgage deal ends that you relook at the mortgage term with a view to reducing the term. If interest rates are falling this means that your monthly payments fall as well. This will be a great time to get a new fixed interest rate that is hopefully lower and choose to keep the monthly repayments the same and reduce the term instead to get you back on track.

First-time buyers often opt for a longer term on their first mortgage with the intention of reducing it later when they refinance, but this is not always possible. As a result, many people end up paying off their mortgage until retirement or may even need to work longer than they had planned in order to afford their mortgage payments.

Could I change to an interest-only mortgage to reduce monthly payments?

A repayment mortgage will always be preferable to an interest-only mortgage however if you need to reduce monthly repayments and reduce living costs drastically this can be worth investigating. It is worth noting that not many mortgage lenders accept Interest only mortgages and the ones that do will need you to be on an above-average income and have a low loan to value.

It is also important to consider the impact on your retirement savings. If you are paying a mortgage until retirement, it may leave you with less disposable income to contribute to a pension.

However, for those with uncertain incomes, a longer term may be a good option to ensure they can consistently make their mortgage payments during leaner months. If they have extra funds available, they can make overpayments to reduce the total cost of their mortgage. Most mortgage lenders allow for overpayments of up to 10% of the remaining balance on the mortgage, but it is recommended to check with your mortgage lender before making any additional payments.

Is it better to overpay mortgage or reduce term?

There are a few factors to consider when deciding whether it’s better to overpay your mortgage or reduce the term.

One important factor is the interest rate on your mortgage. If you have a high interest rate, it may be more beneficial to try to pay off the mortgage as quickly as possible, since this will save you money on interest in the long run. On the other hand, if you have a low interest rate, it may be more beneficial to focus on other financial goals, such as saving for retirement or paying off high-interest debt, rather than overpaying your mortgage.

Another factor to consider is your overall financial situation. If you have other high-interest debt or limited savings, it may be more beneficial to focus on paying off that debt or building up your savings before overpaying your mortgage.

Ultimately, the best approach will depend on your individual circumstances and financial goals. It’s a good idea to review your budget and consider all of your options before making a decision.

We often get asked I own my house outright can I remortgage?

How a mortgage broker can help reduce your monthly mortgage repayments

A mortgage broker such as YesCanDo Money can help you assess your options for reducing or extending the term of your mortgage. They can work with you to understand your financial situation and help you determine the best course of action for your specific needs.

If you are interested in reducing the term of your mortgage, a broker can help you compare different mortgage products and rates to find one that fits your budget and allows you to make lower monthly payments.

If you are considering extending the term of your mortgage, a broker can help you understand the potential impact on the total cost of your borrowing and advise you on the best way to manage your monthly payments. They can also help you explore options for refinancing your mortgage to potentially secure a lower interest rate and reduce your monthly payments.

Contact our fee free mortgage advisors and we can provide valuable guidance and support as you make decisions about your mortgage term, helping you find a solution that meets your financial needs and goals.