HSBC Mortgages Reviewed

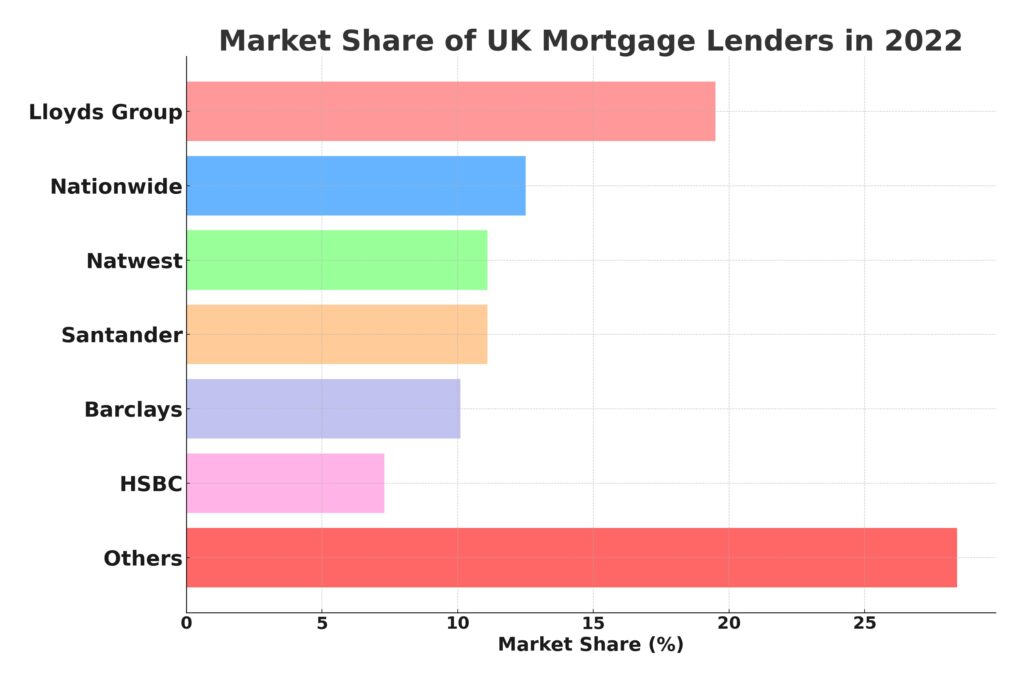

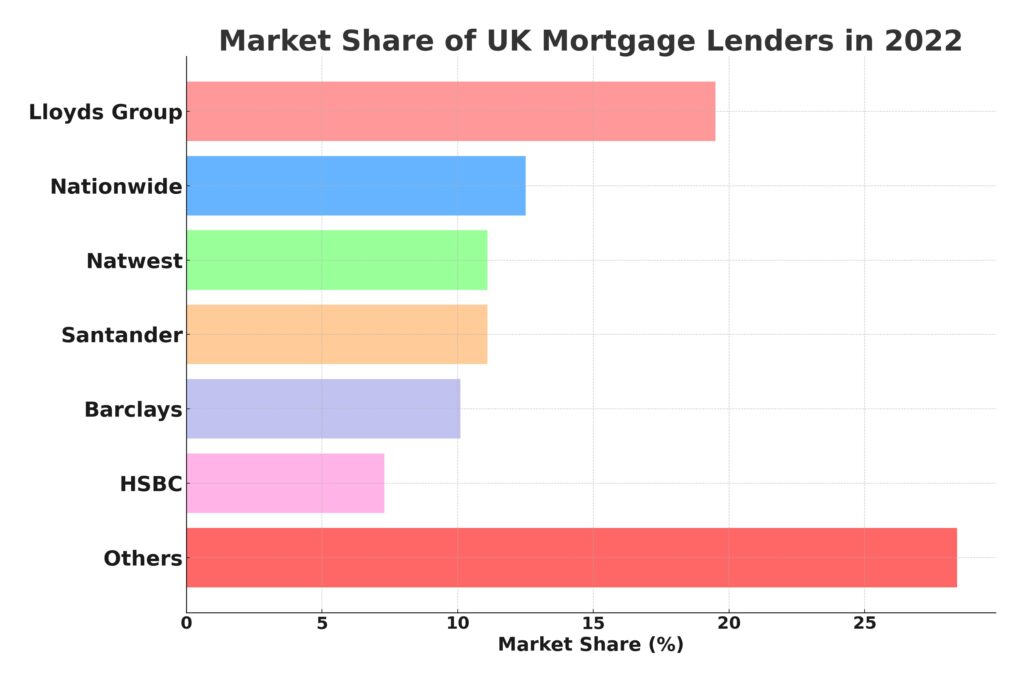

Getting a mortgage with HSBC (The sixth biggest UK mortgage lender)

There are over 100 mortgage lenders operating in the UK, including HSBC. Read more to learn if HSBC are a good fit for your mortgage needs.

Home » Best Mortgage Lenders UK » HSBC Mortgages Reviewed

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

HSBC is one of the best mortgage lenders in the UK so they may well be worth considering if you’re currently browsing the property market or thinking about a remortgage.

We will take a closer look at HSBC in this guide, with information on the types of mortgage deals that this mortgage lender offers.

Could HSBC be the right lender for you?

Quite possibly, however as there are over 100 lenders on the mortgage market, let’s dig a little deeper into HSBC and what they have to offer before securing a deal as there could be another lender that is better for your particular set of circumstances.

About HSBC

HSBC is one of the largest banking institutions in the world. It first opened its doors in Hong Kong in 1865 and quickly expanded into other countries across Asia, North America, and Europe.

Today, HSBC serves around 39 million customers worldwide. They offer a range of mortgage deals to many people, including first-time buyers looking to get on the property ladder, home movers, property owners wanting to get a remortgage, and investors wanting to make money from a rental income.

Compare HSBC Mortgages

HSBC offers a range of mortgage types to…

Homeowners looking to move home or switch to a better rate

Home buyers wanting to purchase their first property

Prospective landlords wishing to buy one or more properties

Homeowner mortgages

HSBC has a wide range of fixed-rate and tracker-rate mortgages they offer to customers wanting to buy a new home or remortgage for a better deal.

Fixed-rate mortgages

With a fixed-rate mortgage, you have the security of fixed monthly mortgage payments for a period of 2 or 5 years.

You won’t be affected by any rise in interest rates, so this can give you financial security and the means to better budget your finances.

But if interest rates fall, you won’t benefit from any savings as you will still be locked into a fixed-rate deal.

At the end of the fixed-rate period, your mortgage will revert to HSBC’s standard variable rate, which will typically be higher than the rate you were on.

You can avoid this higher rate by applying for a new mortgage product. It’s best to do this near the end of your mortgage term to avoid the Early Repayment Charge (ERC) that you would be liable for if you exited your fixed deal early.

Tracker rate mortgages

The interest you pay on a tracker mortgage is variable so your monthly repayments could go up or down at any time.

HSBC’s tracker mortgages follow the Bank of England base rate for a fixed period of 2 years. After this time, they revert to HSBC’s standard variable rate.

You can avoid the higher rate by switching mortgages before the deal period ends.

Buy-to-let mortgages

If you want to buy an additional property to make extra income from rent, you will probably need to borrow money from a mortgage lender.

You may be able to get an HSBC buy-to-let mortgage (fixed or tracker rate) if…

You have lived in your current home for at least 6 months

You have a minimum 25% deposit

Your annual income is £25,000 or more

The property you’re intending to buy is in the UK

The property is not an HMO (House in Multiple Occupancy).

Other eligibility requirements will also apply.

Loan to value ratio

You’ll notice the term ‘loan to value’ (or LTV) when looking at mortgage deals. It is always described as a percentage and it refers to the ratio between two figures, namely the size of the loan and the property value.

If you borrowed £180,000 for a house with a property value of £200,000, the LTV would be 90%. The remaining £20,000 would be covered by your deposit.

HSBC offers mortgages up to a maximum of 95%, Their best interest rates start at 60% LTV and they have different rates at 5% increments up to the 95%LTV

If you’re applying for a buy-to-let mortgage with HSBC, the maximum LTV is 75%.

LTV example:

In the case of an 80% loan-to-value mortgage, HSBC will lend you 80% of the property value if you can pay the remaining 20% with your deposit.

If the property you want to buy costs £300,000, 80% would equate to £240,000. This would be the size of your mortgage loan. You would need to pay the 20% deposit, which in this case would be £60,000.

Remortgaging with HSBC

Our expert remortgage advisors have written a very helpful guide on the process of a HSBC Remortgage.

Find the best deals on mortgage rates

You need to think carefully before securing a home loan with any lender as your home may be repossessed if you aren’t able to keep up repayments on your mortgage.

As such, it’s wise to seek the services of a mortgage broker, such as ourselves. We will…

Let you know about the mortgage rate options being offered by different lenders

Check your annual income to discover your borrowing ability

Give you advice on ways to lower the cost of your mortgage repayments

Help you save money by finding you the best deal for your set of circumstances

To get an idea of the best mortgage deals currently available and to find out how much you could borrow from a lender, get in touch with our expert team today.

HSBC Mortgage Reviews: Is HSBC a Good Lender?

According to Which?, HSBC consistently offer some of the cheapest mortgage deals on the market so if you’re looking to save money when buying a property, the bank could be considered a ‘good lender.’

HSBC can also be commended on the high number of mortgage awards they have won, including ‘Best Remortgage Lender’ by Your Mortgage.

However, HSBC isn’t the right lender for everybody. The bank doesn’t participate in the Help To Buy scheme, so you may need to go elsewhere if you’re a first-time buyer and unable to raise a deposit on your own.

Property buyers with bad credit and self-employed people without a lot of income proof might also need to consider another lender, as HSBC tends to reject applicants in these situations.

For a wider discussion on HSBC and how they compare to other mortgage lenders, contact our team who will let you know if this lender is the best fit for you. If not, your appointed mortgage advisor will consider your other options to ensure you…

Get a great mortgage deal

Have a better chance of being approved for a loan during the mortgage application process.

How Long Does an HSBC Mortgage Application Take?

On average, most lenders take around 21 days to process mortgage applications.

However, HSBC has a good track record of processing applications faster, with an 11-14 day wait time between application and mortgage offer for some customers.

How much can I borrow mortgage HSBC

As is the case with most lenders, HSBC will use income multiples when deciding how much you could borrow for a mortgage.

The minimum income multiple used by HSBC is 4.49 x annual income. You may be able to lend more money if you’re eligible for a higher income multiple, up to a maximum of 5.5 x your salary, if you meet the lender’s earning requirements.

Your income isn’t the deciding factor on whether or not HSBC will lend you money. The lender will also consider…

Your credit history

The size of your deposit

Your regular expenses

Your age

Any debts you still have left to pay

Please note: If you fail to keep up repayments, your home may be repossessed. So regardless of how much you may be able to borrow, don’t take out any loan that you think you will have difficulty paying back in the future.

How much would my monthly mortgage payments be?

The total amount you pay each month will depend on a number of factors, including the size and term of your mortgage, and the added interest rate.

Typically, the longer your loan term, the lower your mortgage repayments will be.

If you’re able to make a larger deposit, you may get access to deals with the lowest interest rates to make your monthly repayments more manageable.

HSBC Mortgage repayments

When you know how much you could borrow from a lender, you will have a better idea of what your payments may be. We can do the calculations for you, so get in touch with our team if you would like to benefit from our FEE-FREE mortgage services.

HSBC Mortgage Calculator

To get an idea of how much you could borrow from HSBC, use the mortgage calculator below.

Please note: As a number of factors can affect your mortgage repayments and the total amount of your mortgage, this figure is an estimate only. Contact our team for a more accurate calculation.

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Frequently Asked Questions

What is a good HSBC interest rate

At the time of writing (March 2023), the lowest interest rate on an HSBC mortgage is 5.74%. You may be eligible for this rate if you borrow money on a 2-year fixed-term loan with a 60% LTV. If you want a longer fixed-term loan, the cheapest interest rate is 6.99% on a 5-year fixed standard mortgage with a 60% LTV. These are some of the lowest interest rates currently offered by the HSBC.

Is HSBC hard to get a mortgage with?

Getting a mortgage with HSBC isn’t difficult if you meet their eligibility criteria.

There is a chance that you won’t be able to borrow money from this lender if you…

Have a bad credit history

Are self-employed and don’t have enough proof of income

Don’t earn enough to qualify for a mortgage

Need a guarantor

Have other debts against your home

You might also be turned down for a mortgage if any issues are found within your chosen property when HSBC carries out its Standard Valuation.

What evidence do I need to provide with my mortgage application?

As part of the application process, you will need to provide certain documents. These will include:

Proof of identity, such as a driving licence and passport

Evidence of income, such as payslips if you’re employed and tax year overviews if you’re self-employed

Evidence of your spending, such as 3 months worth of bank statements

Depending on your circumstances, other documents may be required during the application process.

How do I contact HSBC UK mortgage?

If you’re applying for a mortgage, you can complete the application online or apply with a mortgage advisor by calling 0800 169 6333.

You can also get in touch with HSBC by visiting your local branch or by using Live Chat on the bank’s website.

What happens if I fail to make my mortgage payments?

After finding out how much you could borrow for a mortgage, consider your future situation. If your annual income is likely to drop for any particular reason, such as a change of job role, you might need to reconsider your mortgage plans by looking at cheaper properties. This is better than taking out a loan you can’t afford.

If you don’t keep up repayments on your mortgage…

HSBC may charge you a fee

Your home may be repossessed

Your credit file will be impacted and this could affect your ability to borrow money in the future.

As such, you should think carefully before securing debts against your home.

If you do take out a mortgage with HSBC and you are worried about missing your payments, it’s better to contact them rather than bury your head in the sand when you’re in financial difficulty.

You can call their team of specialists on 0345 850 0633. They will ask you to complete an income and expenditure form so they can offer you tailored support to help you manage your finances. In some circumstances, they may allow you to reduce the size of your mortgage payments to make your life a little easier.

Toggle Title

The maximum age for a HSBC mortgage depends on the type of mortgage and your personal circumstances.

- For capital repayment loans, the maximum age is 75, and for interest-only loans, the maximum age is 65.

However, HSBC may consider extensions beyond these limits if you can provide evidence of how you intend to repay the mortgage in retirement. For later life mortgages, there is no maximum age limit.

HSBC Mortgage Advisors

-

100% FREE mortgage support and advice - We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to 90+ UK mortgage lenders

OR FILL IN OUR FORM

Let us know what the best time is for us to call you. We will get one of our mortgage advisors will be in touch to talk through your situation and available options.

"*" indicates required fields

HSBC Mortgages Reviewed

Barclays Mortgage Review

Virgin Money Mortgages Reviewed

Nationwide Mortgages Reviewed

Halifax Mortgages Reviewed

Skipton Mortgages Reviewed

Generation Home (Gen H)

Santander Mortgages Reviewed

NatWest Mortgages Reviewed

Reviewing Digital Mortgages by Atom Bank

BM Solutions Mortgage Guide

Reviewing Accord Mortgages

Grant Humphries (CeMAP)

Grant Humphries (CeMAP) is a proficient Mortgage & Protection Adviser at YesCanDo Money. With a career spanning since 2001, Grant has honed his expertise in understanding mortgage lenders' criteria, complex financial situations, and the nuances of the mortgage market. His deep knowledge enables him to provide tailored solutions, especially for professionals and those with unique financial profiles. At YesCanDo, Grant's commitment to excellence is evident. He takes pride in guiding clients through their mortgage journey, ensuring they feel confident and informed at every step. From first-time buyers to seasoned investors, Grant's analytical approach and dedication make him a trusted adviser in the financial landscape