Santander Mortgages Reviewed

Home » Best Mortgage Lenders UK » Santander Mortgages Reviewed

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

This comprehensive guide will provide you with an in-depth examination of one the Best Mortgage Lenders in the UK, Santander. Get informed on their variety of mortgages as well as all the advantages they offer customers when selecting them over other providers!

Whether you’re taking your first steps towards homeownership, moving home, or thinking about remortgaging, this could be the lender for you.

We take a closer look at Santander in this guide, with information on the types of mortgage deals that they offer.

For up-to-date information on Santander mortgage products, contact the YesCanDo Money team. We will let you know whether this particular company is the right mortgage lender for you after learning more about your current circumstances.

About Santander

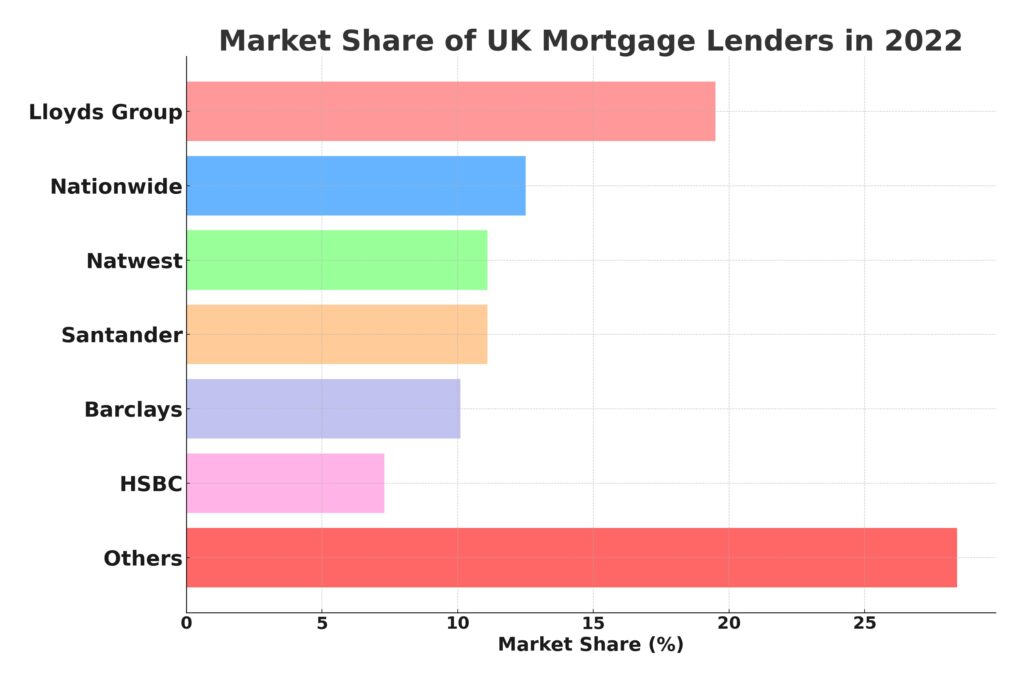

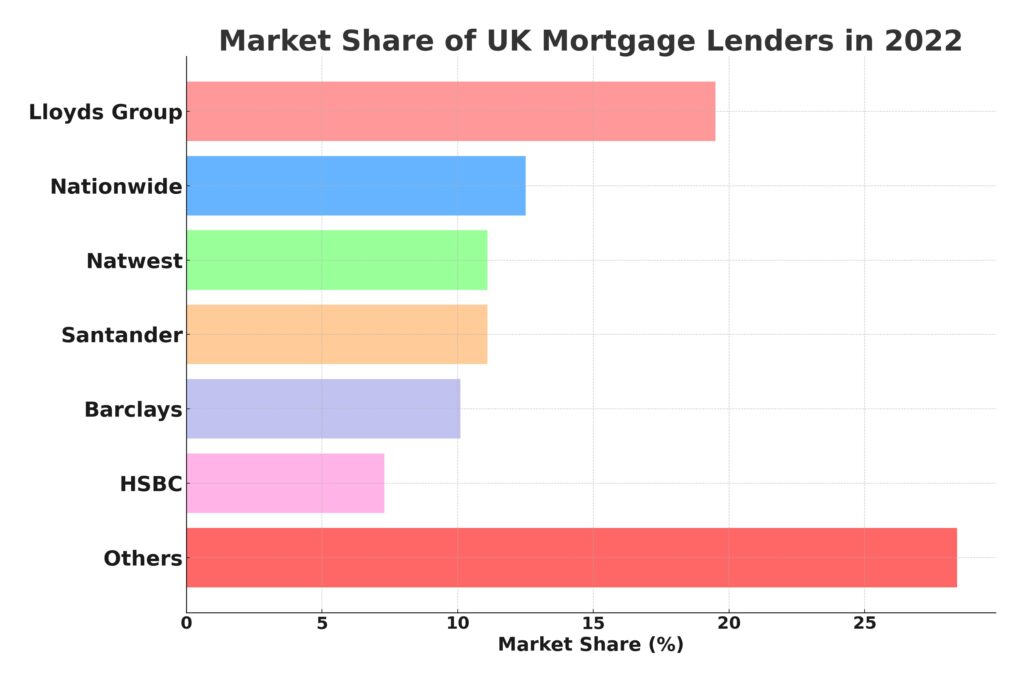

Santander is a major player among UK banks and now has over 400 branches around the country serving around 14 million customers. They are currently the third-largest mortgage lender offering loans on British properties, with a range of mortgage deals for first-time buyers, home movers, and applicants thinking about remortgaging.

If you’re looking for a standard mortgage, you can contact the bank directly. You can do this online, over the phone, or by speaking to them in person at one of their branches.

But if you’re looking for an exclusive deal or if your circumstances could be considered ‘complicated,’ you may need to submit a mortgage application to Santander for Intermediaries via a mortgage broker for the products that aren’t available to the general public.

Compare Santander mortgages

Santander offer a range of mortgage types to both current account customers and newcomers to their service.

Homeowner mortgages

If you’re a first-time buyer, a home mover, or somebody thinking about remortgaging to Santander, you may be eligible for one of the following.

Santander offer:

Fixed-rate mortgages

Santander fixed-rate mortgages are a good option if you can lock yourself into a deal with a low-interest rate and know exactly what you will be paying.

At Santander, you can get a fixed-rate deal for 2, 3, or 5 years, during which time the interest rate won’t change. Once this initial period is over, you will move on to the lender’s Follow on Rate which moves in line with the Bank of England’s base rate.

Tracker rate mortgages

Santander Tracker Mortgage rates are good value when the Bank of England base rate is low. But when the base rate increases, so too will the cost of your loan.

You have the option of a 2-year Tracker deal, after which time you will move onto the lender’s Follow on Rate, or a Lifetime Tracker, where the interest rate tracks the Bank of England’s base rate for the full duration of your loan term.

Interest Only Mortgages at Santander

Santander interest only mortgages work by paying monthly for the cost of the interest without reducing the capital sum. Ideal for buy-to-let investments. These mortgages necessitate a clear strategy for paying off the loan at term’s end. For advice on whether this option suits you, speak with our fee-free advisors.

Cashback mortgages

If you’re a first-time buyer, a customer with a smaller deposit, or somebody looking to remortgage, you may be able to benefit from one of Santander’s cashback products.

At the time of writing, £250 will be given as cashback when an eligible customer takes out a Santander mortgage.

First-Time Buyer Mortgages

Santander offers mortgages designed specifically to support first-time buyers as they make the leap into homeownership. Recognising the difficulty in saving a substantial deposit, Santander provides solutions with lower deposits requirements and competitive interest rates to ease this transition into homeownership. Their approach simplifies the mortgage process while providing supportive guidance when taking their first steps onto the property ladder.

Santander’s Shared Ownership Scheme

Building upon their first-time buyer-friendly mortgages, Santander’s Shared Ownership Mortgages provides an ideal option for those who find full homeownership out of reach. The scheme allows the purchase of between 25%-75% of a property while still paying rent on any remaining portion; particularly beneficial for first-time buyers due to staircasing which allows an increasing share over time leading up to full ownership – ultimately aligning more closely with financial realities of first time purchasers.

Buy-to-let mortgages

Whether you’re an aspiring landlord or an experienced investor, you may be able to get a buy-to-let mortgage with Santander.

You have a choice of 2 or 5-year fixed rate loans or a 2-year tracker rate mortgage. Each of these is capped with a 75% LTV.

To be eligible for a buy-to-let mortgage, you need to meet Santander’s lending criteria, as follows:

The house/flat you’re buying must be at least £75,000 in value

You must be aged between 21 and 70

Your expected rental income must be at least 145% of your monthly payment

You must be a UK resident

If you are making a joint application, one of the applicants must already own a UK residential mortgage

Loan to value ratio

The loan-to-value (LTV) is the ratio of what you borrow from the mortgage lender against how much you put down as a deposit.

Do Santander offer 95% LTV mortgages?

The maximum LTV (loan-to-value) that Santander offer is 95% but if you’re able to put down a higher deposit for a 90% LTV or lower, you will have access to a wider range of deals.

90% LTV mortgages are available to most customers, including self-employed homebuyers who don’t currently have a mortgage with Santander.

The maximum loan size for a 90% LTV mortgage is £570,000.

In the case of a 90% LTV mortgage, Santander will lend you 90% of your chosen property’s value and you pay the remaining 10% with your deposit.

90% LTV example: For a house costing £300,000, Santander will lend you a mortgage worth £270,000 and you will need to cover the remaining £30,000 with your deposit.

Santander also offers 95% LTV mortgages, which could be more affordable if you’re a first-time buyer.

95% LTV example: For a house costing £300,000, Santander will lend you a mortgage worth £285,000 and you will need to cover the remaining £15,000 with your deposit.

If you are a first-time buyer and you’re struggling to raise the money for a deposit, Santander accepts applications from people using a gifted deposit or who are buying a house through such schemes as Shared Ownership.

If you are able to make a larger deposit, such as 20% for an 80% LTV mortgage, more deals will open up to you and your borrowing costs will be lower.

Remortgaging with Santander

Our expert remortgage advisors have written a very helpful guide on the process of a Santander Remortgage.

Find the best deals on mortgage rates

The lower the mortgage interest rates, the less you will have to pay on your mortgage balance.

The Santander Mortgage Rates market has recently seen a reduction in interest rates across their product range. But is Santander offering the best deals at the lowest rates? Or will another lender give you a better offer? To find out, you can either…

Shop around different lenders (this could take up a lot of your time)

Use a comparison website (some may be biased toward certain lenders)

Consult an experienced mortgage broker for advice (your best option)

YesCanDo Money has access to nearly every lender on the market so can search for the best deals on your behalf.

Take advantage of our advice and support by getting in touch with us today using the contact details on our website.

Product Transfer

A Santander Product Transfer allows existing mortgage customers to switch to another loan within Santander’s range more easily and quickly, and benefits those on standard variable rates or those who have expired fixed or discounted rate contracts within six months of expiry. The process involves checking eligibility, submitting a transfer request, and accepting their new deal – with no further income or affordability assessments, wide variety of products offered at competitive rates regardless of direct application versus broker application making the transfer faster, simpler and potentially more beneficial to customers than with competing lenders.

Self Employed Mortgages

As mortgage brokers, we understand self-employed individuals have unique financial situations when seeking home loans. We provide tailored mortgage solutions using Santander’s offerings, which are designed for self-employed borrowers. With competitive rates and expert guidance at no extra cost, we simplify the path to homeownership. To apply, you’ll need standard ID and residency verification, plus specific income docs for the self-employed. Santander requires a minimum 2 years of self-employment and recently upped maximum LTVs to 90% for these borrowers. Our advisors guide you through the Santander mortgage application process, ensuring a smooth experience for self-employed clients seeking our home financing services.

Learn more about Santander Self-Employed Mortgage here >

Santander mortgage reviews: Is Santander a good lender?

Santander offers a good range of mortgages to first-time buyers, home movers, and people remortgaging their properties, but according to research carried out by Which?, they don’t always offer the cheapest deals. This matches up with Which?’s customer satisfaction survey as some customers claim the bank doesn’t always offer good value for money.

That being said, Santander recently lowered their interest rates so their deals may be more attractive now than when they were when Which? surveyed the general public.

For up-to-date information on how ‘good’ the company is, take a look online for recent reviews from the bank’s customers or get in touch with the YesCanDo Money team for a discussion of the pros and cons of choosing this particular lender. If another mortgage provider is better and we believe will offer a more helpful service to you, we will search the market to find a more suitable fit.

How long does a Santander mortgage application take?

The length of time it takes to process an application depends on the busyness of the lender and the applicant’s circumstances.

On average, it can take around 10 days for a residential mortgage and 12 days for a buy-to-let mortgage to be processed by Santander. It’s possible to speed up the process with the help of one of our advisors as we will make sure your application is free of errors to rule out the possibility of any delays.

How much could I afford to borrow from Santander?

Santander uses income multiples when determining what borrowing amount to offer their customers. Typically, the income multiple will be between 4.5 and 5.5, so you can get an idea of what your loan size could be by multiplying your salary by those numbers.

The income multiple (and the borrowing amount) you are offered will depend on a number of factors, including the LTV you are offered.

If you’re a home mover or first-time buyer, you can borrow up to 95% LTV. If you’re remortgaging, you can borrow up to 90% LTV.

Income multiples available on a Santander mortgage

| Income of applicant/s | LTV – 75% or less | LTV – over 75% |

|---|---|---|

| Less than £45,000 | 4.45x | 4.45x |

| £45,000-£99,999 | 5x | 4.45x |

| £100,000 or more | 5.5x | 4.45x |

Why my customers love Santander mortgages

Santander Mortgage Calculator

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Frequently Asked Questions

Is it easy to get a mortgage with Santander?

Santander mortgages are relatively easy to get for customers who meet their eligibility criteria. But for those customers who don’t, they may need to approach another lender.

Santander mortgages may be out of reach to new or existing customers who:

Have certain types of bad credit (such as a recent CCJ)

Are self-employed with declining profits

Exceed the lender’s upper age limits (Santander prefers their customers to be 75 or under at the end of their mortgage term)

Are buying a house or flat made from non-standard construction

Don’t have available funds for a deposit

If you fall into any of the categories listed above, you aren’t automatically ruled out of a mortgage with every lender. The team at YesCanDo Money can make your life easier by searching the market for the lending companies that are more likely to approve you for a loan, despite your personal circumstances.

How long does it take to get a Santander mortgage?

On average, it could take around 2 weeks before you are given a mortgage offer. But this depends on the busyness of the lender and the complexity of your application. If there are any delays, perhaps because there is a holdup with the valuation or the lender needs extra information from you, it could take 6 weeks or even longer before an offer is made.

What credit score do you need for a Santander mortgage?

Santander will carry out a credit check to assess your level of risk. You will be considered a risky borrower if you have a low credit rating, as Santander will have concerns about your ability to make the repayments on your loan balance.

Santander hasn’t indicated the credit rating you need for a mortgage but as they tend to turn down applicants with bad credit, your life will be made easier if you improve your score before you make your application.

You can find out what your credit rating is by signing up to one or more of the main credit reference agencies: Equifax, Experian, and TransUnion. Alternatively, use Checkmyfile, as this is an easy way to check your scores and compare the information each agency holds on you.

Can I make overpayments on my Santander mortgage?

If you have a fixed-rate mortgage, you make a Santander mortgage overpayment by up to 10% of your outstanding balance each year without facing a penalty. If you exceed this limit, you may have to pay an Early Repayment Charge (ERC), depending on the terms of your specific mortgage product.

If you are on Santander’s Follow on Rate or Standard variable rate, you can make unlimited overpayments without a penalty.

Santander’s overpayment guidelines will be found on your mortgage paperwork and your online account. If you struggle to find the information required, pop into your local branch or call their customer service number.

Can I port my Santander mortgage?

Existing customers who are happy with their current mortgage can port (take it with them) to their new property if they meet Santander’s terms and conditions. As such, this could be an option for you if porting your mortgage is more affordable than remortgaging to a new deal.

You won’t have to pay an early repayment charge if you port the same amount as your existing mortgage balance but if you want to transfer less, you might have to pay the charge.

Should you want to port more, you can borrow more money by choosing from the range of Santander mortgages available although you may need to pay a product fee.

Santander Mortgage Advice

We offer FREE dedicated support throughout out the mortgage process, we have full-market access to the best mortgage rates & deals. We do everything for you, for free!

- FREE mortgage support and advice

- We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to 90+ UK mortgage lenders

OR FILL IN OUR FORM

Let us know what the best time is for us to call you. We will get one of our mortgage advisors will be in touch to talk through your situation and available options.

"*" indicates required fields

BM Solutions Mortgage Guide

Reviewing Accord Mortgages

Reviewing Digital Mortgages by Atom Bank

Skipton Mortgages Reviewed

NatWest Mortgages Reviewed

Virgin Money Mortgages Reviewed

Generation Home (Gen H)

Santander Mortgages Reviewed

Barclays Mortgage Review

Nationwide Mortgages Reviewed

Halifax Mortgages Reviewed

HSBC Mortgages Reviewed

Grant Humphries (CeMAP)

Grant Humphries (CeMAP) is a proficient Mortgage & Protection Adviser at YesCanDo Money. With a career spanning since 2001, Grant has honed his expertise in understanding mortgage lenders' criteria, complex financial situations, and the nuances of the mortgage market. His deep knowledge enables him to provide tailored solutions, especially for professionals and those with unique financial profiles. At YesCanDo, Grant's commitment to excellence is evident. He takes pride in guiding clients through their mortgage journey, ensuring they feel confident and informed at every step. From first-time buyers to seasoned investors, Grant's analytical approach and dedication make him a trusted adviser in the financial landscape