If you’re a foreign national who has moved to the UK, you might be wondering about your rights to get a mortgage on tier 2 skilled worker visa (or any other type of visa) that has granted you entry into the country.

Will lenders reject your application because you’re not from the UK?

It’s our experience, that your chances of getting a mortgage may be the same as any other mortgage applicant, provided you can pass the lender’s checks during the mortgage application process.

Keep reading to learn more and get in touch with our team if you have any questions after reading our guide.

Can you get a mortgage in the UK with a visa?

It’s a misconception that non-UK citizens can’t obtain a mortgage due to their visa status. If you would like to buy a home in the UK, you may be able to do so.

Before approving your mortgage application, lenders will want to know how long you have been in the UK and how long you have left on your visa. They will also check external credit reference agencies to obtain information about your credit history.

If you meet their requirements for a mortgage loan, your chances of mortgage approval will be improved, whether you’re looking for a tier 2 visa mortgage or a mortgage with another type of visa.

What if you don’t have indefinite leave to remain?

If you have indefinite leave to remain, you have the right to live, study, and work in the UK for as long as you like.

But what if you don’t have indefinite leave to remain? Can you still get a mortgage? The answer is yes but you will have fewer mortgage options open to you.

Don’t worry though, as with the right help from a mortgage broker with extensive knowledge of the mortgage industry, it’s still possible to get an affordable mortgage loan. At YesCanDo Money, our specialist team has experience with skilled worker visa mortgages (and all other types of mortgages), so get in touch with us for expert advice and support.

Are the lending requirements different?

Every UK mortgage applicant needs to meet the mortgage provider’s lending criteria but as these criteria are a little stricter for foreign nationals, getting a mortgage can sometimes be a little tricky.

This doesn’t mean it’s impossible, however, as a mortgage broker with experience of foreign national mortgages (such as ourselves) can advise you on the things you need to do to ensure mortgage approval.

Lending requirements

– You will need to have a minimum of 12 months left on your tier 2 visa unless your employer can confirm your work permit will be renewed.

– Most lenders will expect you to have been in the UK for at least two years. This isn’t the case for every lender, as some will accept your mortgage application if you have been in the UK for less time while others will want you to have lived in the UK for longer.

– When assessing your mortgage application, the lender will carry out their usual credit checks. If you have a poor credit history, your application may be rejected or you may be ruled out of the best mortgage deals. There are specialist lenders who accept applicants with a bad credit history but your mortgage chances will be improved with a good credit score.

– Most lenders will expect you to have a permanent employment contract in place, with several months’ payslips to prove your income.

– You may need to pay a higher deposit with money that comes from your own resources (i.e. a deposit that hasn’t been gifted).

– Affordability criteria can be stricter as some mortgage lenders have higher minimum income requirements for foreign nationals working in the UK. In some cases, the minimum income required could be as high as £75, 000.

How to get a UK mortgage as a visa holder

Regardless of the type of visa you hold, you are still eligible for a normal mortgage, so provided you meet the lender’s requirements, you can be on your way to home ownership.

To get a mortgage the following steps are advised.

- Get all of your documents together. You will need to evidence your visa status, employment, ID, and affordability, so make sure you have all of the necessary documents to hand, such as the appropriate work permit, utility bills, and bank statements, before you make your mortgage application.

- Check your credit score. As we mentioned, lenders will check their applicant’s credit history before granting mortgage approval. If you notice you have a bad credit score after checking your credit report, it’s wise to improve your score before you apply for a mortgage.

- Speak to an expert fee free mortgage broker. You could go directly to a mortgage lender but as it can be tricky to get a mortgage as a foreign national, it’s wiser to speak to an experienced mortgage broker such as ourselves as we have access to the mortgage lenders that are likely to offer you the best deals.

Types of visa acceptable to lenders

You may be eligible for a mortgage if you hold one of the following visas.

Mortgage on Tier 1 visa

Tier 1 visas were granted to foreign nationals who had a credible business idea that has been endorsed by the Department of International Trade or a UK higher education institution before coming into the country. They were also granted to people with investment funds of £2,000,000 or more to invest within the UK.

It’s no longer possible to apply for a tier 1 visa but if you already have one, you should have no trouble getting a mortgage provided you have been in the UK for at least two years and you have a good credit history.

You will need to pass the lender’s affordability checks but as most people with this type of visa have a well-paid income through their business earnings and investments, these checks may not be a problem for you. If you do have a large amount of capital, there will be a wider range of lenders open to you, including private banks and specialist lending companies that offer the most favourable deals.

Mortgage on Tier 2 visa

As we have established, it is possible to get a mortgage on tier 2 visa (skilled worker visa) but you will need to meet similar requirements to those who have a tier 1 visa. To be eligible for tier 2 visa mortgages, you will need to have a UK-based current account. Some lenders might also require you to have a savings account before approving your application for a skilled worker visa mortgage.

Mortgage on Spousal visa

Spousal visas are granted to those who are married to UK nationals. Getting a mortgage shouldn’t be too difficult if you have a spousal visa as you will have the right to live and work in the UK. Provided your partner is a UK national with a permanent right to remain, you may also be eligible for a joint mortgage.

Ancestry visa

Ancestry visas are granted to Commonwealth citizens who have at least one grandparent that has been born in the UK. It’s possible to get a mortgage with an Ancestry visa but you may need to put down a larger deposit when you make your mortgage application.

Student visa

There are only a few lenders that offer mortgages to applicants with a student visa (tier 4 visa). To be approved, you will need to have lived in the UK for at least two years and you may need to raise money for a larger deposit. Getting a mortgage may be made easier if you have family members willing to gift you a deposit or if you apply for a joint mortgage with a UK national.

British National Overseas (BNO) visa

If you’re a Hong Kong national with a BNO visa, you will be eligible for a foreign national mortgage if you are in full-time employment, have a mortgage deposit of at least 25%, have lived in the UK for more than one year, and have a minimum of one-two years left on your visa.

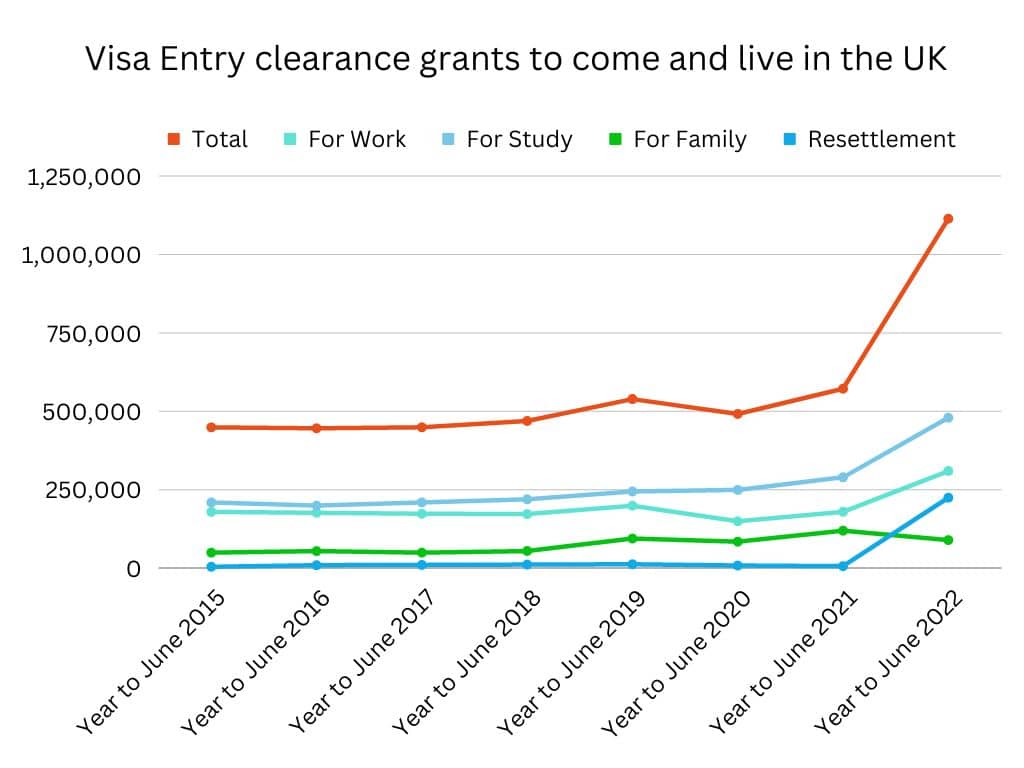

Visa types granted in the UK from 2015 to 2022

2022 has seen the biggest rise in people migrating to the UK since the end of the second world war. Mortgage lenders have been changing their mortgage criteria to accommodate the different types of Visas as well as making the mortgage process easier for Visa holders. Our team of fee-free expert mortgage advisors specialise in advice for Visa mortgages as well as completing the paperwork, submitting the mortgage application and supporting foreign nationals throughout the mortgage process.

Over recent years we introduced WhatsApp to allow our clients including foreign national customers a more efficient line of communication. At YesCanDo we understand the importance of our clients being able to ask questions and to fully understand their mortgage journey. Some of our customers that do not speak fluent English have found WhatsApp and their chosen translation app allows them to communicate better than speaking on the phone. Since 2021 we have organised mortgages for foreign nationals from 51 different countries. – Steve Roberts

Which visas aren’t acceptable with mortgage lenders?

You are unlikely to be approved for a mortgage if you have a tier 5 visa as these are for temporary workers who are only living in the UK for a short amount of time.

If you’re a refugee, you are also unlikely to be accepted for a mortgage unless a permanent right to reside is granted to you.

Which lenders will accept visa mortgage applications?

There are quite a lot of lenders that accept applications from visa applicants, including some of the bigger banks on the high street. They will accept visa applicants with a minimum deposit of 25% or 75% loan to value.

There are some other lenders that accept visa applicants but their criteria is slightly different. These lenders include:

Accord Mortgages

Accord Mortgages has updated its criteria for foreign nationals, increasing inclusivity in its lending practices. For joint mortgage applications where one applicant does not have indefinite leave to remain, the maximum Loan-to-Value (LTV) has been raised to 95% if the other applicant is a British citizen or has indefinite leave to remain. This enhancement significantly benefits a range of borrowers, from first-time buyers to those remortgaging, making Accord a competitive choice for foreign nationals seeking higher LTV mortgages in the UK.

NatWest

Foreign nationals can apply for a mortgage with NatWest but with a loan-to-value (LTV) of 75%. If one of the mortgage applicants has a British passport or indefinite leave to remain then they are eligible for a maximum of 95% loan to value mortgage.

Halifax

It’s possible to get a mortgage as a foreign national with Halifax higher than a 75% LTV. If you don’t have a permanent right to remain and you earn more than £100,000 or have been in the UK for at least five years then you will be eligible for a 95% loan to value.

Barclays

Barclays accepts applications from visa applicants and they are a good choice for those only able to make a lower deposit. This is because Barclays has set a higher LTV limit (90%) than the norm, as long as you have resided in the UK for 2 years.

These are just some of the lenders that accept mortgage applications from foreign nationals looking for a mortgage in the UK, but there are others. If you’re looking for a tier 2 visa mortgage (or any other type of mortgage), get in touch with our team and we will point you in the direction of those mortgage providers that are suited to your personal circumstances.

YesCanDo Money – Visa Mortgage Experts

If you’re looking to get a mortgage in the UK, be that with a skilled workers visa or tier 1 or tier 2 visa, or any other type of visa that has granted you entry into the country, our expert mortgage brokers can help.

Get in touch with us today to learn more about the mortgage options open to you and benefit from the expert support we can offer you.

At YesCanDo we have found WhatApp and have found this makes communication far easier for our clients when wanting a home loan. In 2022 we have helped 32 different nationalities to get a mortgage so have lots of experience in helping and making getting a mortgage as smooth and clear as possible.

Frequently Asked Questions: Getting a mortgage with a Visa

Our advisors have answered some of the most frequently asked questions on getting a mortgage with a visa.

Can I get a buy-to-let mortgage on a visa?

It is possible to get a buy-to-let mortgage but mortgage eligibility is strict and not many lenders offer these types of mortgages to foreign nationals. Your chances will be increased if you’re a tier 1 or tier 2 visa applicant or if you are looking to purchase a buy-to-let property using a joint mortgage where one applicant is a UK resident.

To be eligible, you will need to:

Raise funds for a larger deposit

Prove you can attract tenants to your property

Prove the rent you are charging will cover the mortgage repayments

Show that you can make the mortgage payments if your rental property sits empty for a while

How much can I borrow on a mortgage as a non-UK citizen?

Mortgage lenders have different lending criteria but generally speaking, the amount you will be eligible to borrow will be based on:

The amount of deposit you have saved up (the more money you can raise, the better)

Whether or not you have past credit issues (lenders are less willing to lend to applicants with a bad credit history)

How long you have lived in the UK

Your annual income (lenders offer multiples between 4.5 – 6 x your annual income)

The stability of your income

The lender wants to make sure that you won’t get into financial difficulties after they lend to you, and they want to reduce risk to themselves, so the amount you are eligible to borrow may be affected as a result. We can give you tailored advice based on your personal circumstances, so if you would like to know how much you may be able to borrow, get in touch with our specialist team.

How can I improve my chances of getting a mortgage?

Be it a tier 2 visa mortgage (skilled worker visa mortgage) or a mortgage with any other type of visa, you will improve your mortgage chances if you:

Establish a reliable credit history when you’re in the UK

Open a UK bank account

Provide a larger deposit at the time of your mortgage application

Apply for a mortgage when you have at least a year left on your visa

Minimise the debt on your credit cards and personal loans

Seek mortgage advice from mortgage brokers with experience of skilled worker visas

If your credit score has been affected by County Court Judgements, bankruptcy, defaults, and Individual Voluntary Arrangements, it may be wise to wait until these have dropped off your credit report before applying for a mortgage.

Related reading: