Moving Home Mortgages

Transfer your mortgage to your new home with YesCanDo Money fee free. YesCanDo mortgage advisors do it all for you! The advice, the application, all the paperwork, the bank and solicitor chasing, and take away the stress.

Home » How To Get A Mortgage » Moving Home Mortgages

Getting your next mortgage for your next home

If you’re moving home, you’re most likely going to need a moving home mortgage. From needing to know how much you could borrow, to finding the best rate and mortgage deal, there will be a lot of things that will be on your to-do list.

We’re here to help. At YesCanDo Money, our mortgage advisers can take away a lot of your stress. We will work with you to understand your individual needs and will advise you on getting the best mortgage deal. Our services are free, so to save yourself both time and money, get a mortgage with us by contacting our friendly team today.

How much you could borrow for your next home?

Banks and building societies have their own mortgage affordability calculators. This means the amount you could borrow might vary from one bank or building to the next.

The lender will ask you a number of questions to assess your affordability. These will be based on your income and outgoings, your credit cards, and any other factors that may affect your credit score. They will enter your details into their affordability calculator and calculate how much they are willing to lend you.

A key factor to how much you could borrow will obviously be based on your salary. Generally speaking, lenders will often offer you a loan that is 4-5 times that of your yearly income. The more you earn, the more the lender is likely to offer you, provided they think you have the ability to keep up with the repayments on your mortgage.

Use the affordability calculator below to get an idea of how much you may be eligible to borrow.

For more detailed information including getting a mortgage agreement in principle, get in touch with a member of our mortgage team and read our guide below.

For more on how much you could borrow, read our guide > How much can I borrow on a mortgage?

Mortgage Calculator

It’s also important to consider how much you can realistically afford to borrow.

To work out how much you may be able to borrow, use the mortgage calculator below. When you’re ready speak to one of our mortgage advisers for free advice, get in touch.

Moving Home: Mortgage options

When looking to get a mortgage, a number of options are open to you, depending on your specific circumstances. Existing home buyers might decide to port their existing loan to their next home, or they might prefer to remortgage (switch from one bank to another to release equity).

No matter your personal situation, a mortgage adviser can help you. Be you an experienced home mover or a first-time house buyer, we are here to help. We go through your available options below, including getting you an agreement in principle, speak to our customer service team today.

Porting your mortgage

When you move home the process of transferring your existing loan to your new home is known as porting.

Porting your existing mortgage is a good idea if:

- You are already on a great interest rate or deal

- You want to stay with your existing lender

- You don’t want to incur exit/early repayment fees by ending your deal early

- You don’t want to go through the entire mortgage application again

Read our guide on How to port your mortgage.

You can sometimes save money when you port your mortgage, especially if you are on a fixed rate. If you took it out when the mortgage rates were lower, it may make sense to stay on the same deal until the fixed-rate period ended.

However, there are disadvantages to porting a mortgage.

- You might miss out on a lower rate elsewhere if you stay with your existing lender

- If your next property is more expensive, the additional money you borrow could be at a higher interest rate.

Knowing whether to port your mortgage or not can be tricky. To help you save time and money, it is always worth speaking to an experienced mortgage broker. Our team can compare your existing rate and deal with others on the market and can help you determine the right way forward.

How does mortgage porting work?

While you will still keep your existing deal, you will have to reapply for the mortgage with your lender. They will assess your income, expenditure, and your personal circumstances, before agreeing on whether to port your mortgage or not. They will also carry out new credit checks, and if your credit score has changed for the worse, this may affect their decision. You will need to get an agreement in principle.

If your new property is more expensive, you will need additional lending. The lender will offer you a deal from their current range. It may not be as competitive as deals from other lenders, so it is still worth comparing deals with a mortgage broker before coming to a decision.

If the lender agrees to port your existing deal and you are happy with that deal, you would normally. transfer to the new mortgage on the day you complete the purchase of the new property.

If the lender doesn’t agree to you porting the mortgage, you have two choices. You can either apply for a new loan with your existing bank or take out a new mortgage with a different bank or building society.

Getting a new mortgage

If your lender doesn’t let you port your mortgage, or if you are a first-time homebuyer then you will need to get a new mortgage.

At YesCanDo Money, we can make the process easier for you. You will be given a dedicated mortgage adviser who will do everything for you! The mortgage application, all the paperwork, the bank and conveyancer chasing, and take away the stress. Plus we’re fee-free.

Our mortgage advisors will search the whole market for you and will give you recommendations based on your personal circumstances.

We will also explain the different types of mortgages available to you, including fixed-rate, variable-rate, and tracker mortgages, to help you make a more informed decision.

Remortgaging your home to move home

If it makes sense for you to do so, you can remortgage to raise money for your next home. To this end, you will be using the equity you have built up in your existing home to help you get another.

Remortgaging when planning to move home is a good idea if you are planning to:

- Buy a second home to use as a buy-to-let

- Buy a second home to live in part-time

If you plan to remortgage, you can stick with your existing lender if they offer you good mortgage rates and deal to stay with them. Alternatively, you can move to a new bank or building society if you are able to get a better mortgage deal elsewhere.

To find out how much you could borrow on a new mortgage, speak to one of our team. We will let you know if we think remortgaging is a good idea for you. We will also use our mortgage calculators to give you an idea of what your new monthly repayments will be.

Check out our remortgaging guide for more information.

Costs of buying your next home

There are a number of costs attributed to buying a new home. You should take these into account before signing on any dotted line. Even if you can afford the monthly repayments, you still need to consider such things as conveyancer fees, estate agent fees, stamp duty, and the other costs related to your mortgage and house move.

These costs should be factored in when deciding where to live. If you cannot keep up repayments because of the various expenses you incur, your home may be repossessed.

Mortgage Broker Fees

Lots of mortgage brokers charge for their service, however, we do not. We get paid commission from the lender and choose not to charge you to help you reduce your overall cost. I’ll mortgage advisers provide you with a highly rated and extremly efficent mortgage service, for FREE!

Early repayment charges

Mortgages, be they fixed or variable-rate, often come with a tie-in that lasts the length of the mortgage term. Written into the clause of your contract will be a statement about early repayment charges. These will be owed to the lender if you decide to end your mortgage contract early. They are charged as a percentage of the outstanding mortgage balance.

Early repayment charges are often tiered. This means they will reduce with each passing year of your mortgage. To give an example, in a five-year fixed deal you might be expected to pay 5% of the balance in year one. Then year two it could drop to 4% and so on, with a 1% charge in year five.

Mortgage lenders are regulated by the Financial Conduct Authority (FCA), and as such, they are required to express early repayment charges within their terms and conditions.

Mortgage costs

It’s usually free to port a mortgage but if you’re getting a new mortgage, there will be a number of costs involved. These are made up of your monthly repayments and the fees and charges required by the lender.

Mortgage fees include:

- The mortgage arrangement (product) fee

- The mortgage booking fee

- The valuation fee for the home report

In some circumstances, lenders will waive some of these fees. But if you are charged, there’s usually the option to add them to your monthly mortgage payment instead of paying them upfront.

In terms of your mortgage payments, you can reduce them if you put down a larger deposit at the outset. A high deposit is usually considered to be 25% and upwards of the total cost. Your mortgage provider might also give you a more favourable rate if you let them know you are willing to pay more at the beginning.

Some mortgage brokers will also charge you to use their services. This is not the case with YesCanDo Money. We are on hand to offer you the best advice for free! We cover the whole of the UK, so wherever you are, this is one mortgage-related cost that you won’t have to worry about. We will help you find the mortgage that you can afford to pay, factoring in the different mortgage-related costs including home insurance that you will need to cover.

Moving costs

You may have moved home before and will therefore know about the costs associated with moving home. If you have never moved home before then we recommend you read our guide on the costs of moving house as this will help educate you on some of the expenses you will incur during the moving process.

Moving costs include:

- Stamp duty

- Conveyancing fees (click here for more on conveyancing and to get a quote)

- Estate agents charges

- Land registry fee

- Storage costs

- Removal costs

- Home insurance, including building and contents insurance

- Life insurance (even if you already have it set up remember to review your protection cover with our life insurance experts)

- The cost of new furnishings and appliances

- New council tax charges

- Mail redirects (Redirect your mail with Royal Mail here)

- Utility costs, including broadband and electricity

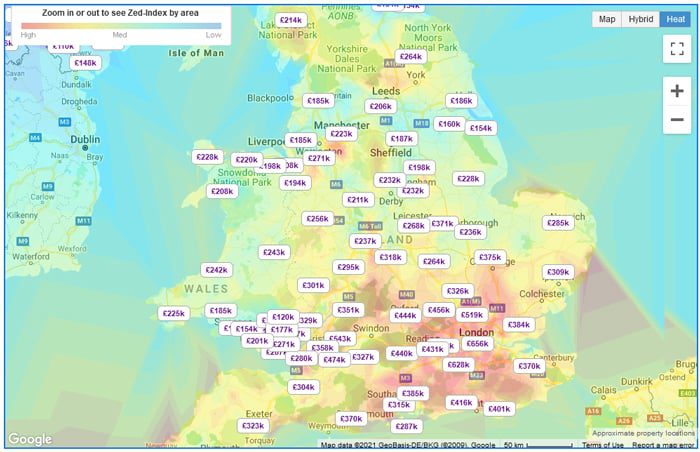

These are all costs that need to be factored into your budget, along with the monthly repayments on your mortgage. In some cases, savings can be made. So, you might use comparison sites when shopping around for home insurance, removal, and storage, for example. And as we suggested earlier, the location of your house move can also be a factor. You can reduce your council tax and stamp duty if you move to a cheaper location.

Check out our guide to moving house for more useful information.

Where to buy your next home

Choosing your next home is the exciting part. But it’s not only the property itself that you need to take into account. You also have to consider the location. Different areas often dictate how much house prices are, and some locations will be more practical for you than others.

To get an understanding of different locations, it’s worth speaking to the local estate agents in your area. They will let you know where the cheapest and most expensive areas are to live, and they will give you information on local amenities too.

You should also visit different areas as getting an up-close and personal look at an area is better than relying on the photos and Google Maps information that you can find online.

When looking at houses in different areas, consider:

- The prices you can afford

- How easy the commute is to your workplace

- Employment opportunities

- The distance from family and friends

- Local parks and other outdoor spaces

- The number of shops, restaurants, and other amenities nearby

- The distance to local schools and colleges

- The availability of leisure centres, gyms, and other exercise facilities

- Local crime statisics

A good website to gather information on an area/street is Street Check.

Frequently Asked Questions when Moving Home

How much is Stamp Duty?

Stamp Duty Land Tax (SDLT) also know as just Stamp Duty must be paid if you buy property or land over a certain price in England and Northern Ireland. The tax differs for property or land in Scotland or Wales.

Tax is paid when you:

- purchase a freehold property

- purchase either a new or existing leasehold

- purchase a property through a shared ownership scheme

- are given ownership of either property or land in exchange for payment. Usual examples of this are taking on a mortgage or buying a share in a house.

Stamp Duty Thresholds

Stamp Duty only applies from the amount past the stated threshold. If your purchase price is lower than the threshold then great news, you will have to pay no stamp duty.

The current stamp duty threshold for residential properties is £250,000. This will change to £125,000 from the 1st October 2021.

What information will I need to get a mortgage?

Maybe you are worried about what information you will need to get together before you can get the mortgage underway. The information you need varies depending on which bank or building society you are getting a mortgage from however here is a list of information that will always be required from you as a starting point: –

- Passport

- Driving licence

- Proof of name & address

- Proof of income

- Proof of deposit

- Latest 3 months bank statements

Read more on what information you will need before applying for a mortgage here »

How do we find you the best mortgage?

There are so many options out there that it can be very confusing. Here at YesCanDo Money, we give honest straightforward and easy to understand financial advice.

We take care of all the mortgage administration and liaise with estate agents, mortgage lenders and solicitors to make sure the process is as smooth and hassle-free for you as possible. Our mortgage brokers will find the best deal for YOU!

Being an independent business, we provide a service based on how we would like to be treated ourselves by offering appointments at a time and place most convenient for you – call us today to book a daytime or evening appointment at either our office or your home. We don’t think that is an offer you will see many other places!

How can I make sure I have a good credit rating?

When it comes to getting a mortgage, it’s best to have a clean slate but we understand that this isn’t always the case. Most mortgage lenders look back at your past 6 years of credit history therefore you want to make your credit file look as clean and strong as possible. You can achieve this by ensuring/having/areas to focus on/focusing on these areas:

- NO Defaults and late payments

- NO to Pay Day Loans

- NO to Gambling

- Your Overall Credit Score and Debt

Read more on things that should be avoided if you are looking to get a mortgage soon »

How much life insurance do I need?

As well as home insurance, it is good practice to have the right amount of life cover when you purchase a new property and move home.

If you have someone who will financially suffer if you were to die or be diagnosed with a critical illness then it should be in place. Even if you already have life insurance in place, you will need to review your policy when moving home. This way you can make sure you are fully covered and for the best available price.

Mortgage protection is very important! Read more about life and critical illness insurance here »

What is the current base rate?

The Bank of England base interest rate is currently (2021) at 0.1%. In March 2020 it was lowered from 0.75% to help stabilise the economic instability due to COVID-19 coronavirus pandemic.

This gave birth to low-interest rate deals but also stricter lending criteria.

FREE Mortgage Specialists

-

100% FREE mortgage support and advice - We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to the whole mortgage market

Our expert advisers will sort your mortgage for your next home

Let us know what the best time is for us to call you. We will get one of our mortgage advisors will be in touch to talk through your situation and available options.

OR FILL IN OUR FORM

"*" indicates required fields

UK Mortgage Advisers

- Free Advice and Support

- Mortgage Specialists

- Online Mortgage Advice (UK)

- Fast Mortgages

- Independent Mortgage Broker

- Support Through The Whole Process

- Life Insurance