Accessing your income information through the UK Government Gateway can be crucial, especially when applying for a mortgage. Mortgage lenders often require proof of income to assess your financial stability and repayment capacity. By obtaining your income statement from the Government Gateway, you provide a reliable and official record of your earnings, which is a key document in the mortgage application process. This step-by-step guide will help you navigate the Government Gateway to view and download the necessary income information for such purposes.

Step 1) Visit: Go to https://www.access.service.gov.uk/login/signin/creds

Step 2) Sign In: Log in with your Goverment Gateway User ID and password if you have an existing account. If you are already registered login and jump to step 4. If your not registered, continue to step 3.

Step 3) Registration Process for New Users:

3.1) Click on “Create sign-in details”.

3.2) Enter and confirm your email.

3.3) Provide your full name and create a password.

3.4) Note down your Gateway ID.

3.5) Choose account type (individual/organisation) and set up access code receipt.

3.6) Prove your identity (name, DOB, National Insurance Number, postcode).

3.7) Confirm identity via app or online details.

3.8) Choose Delivery Method for Tax Letters: Select either online or by post only

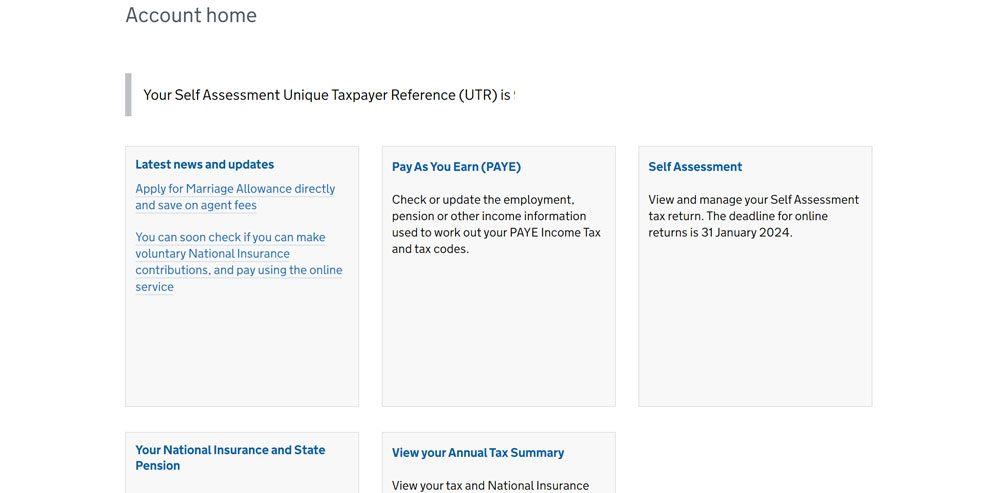

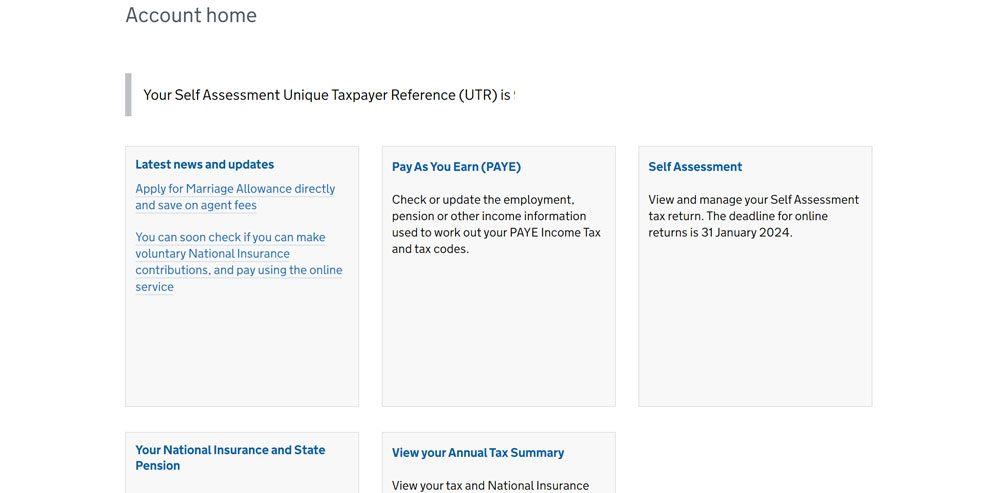

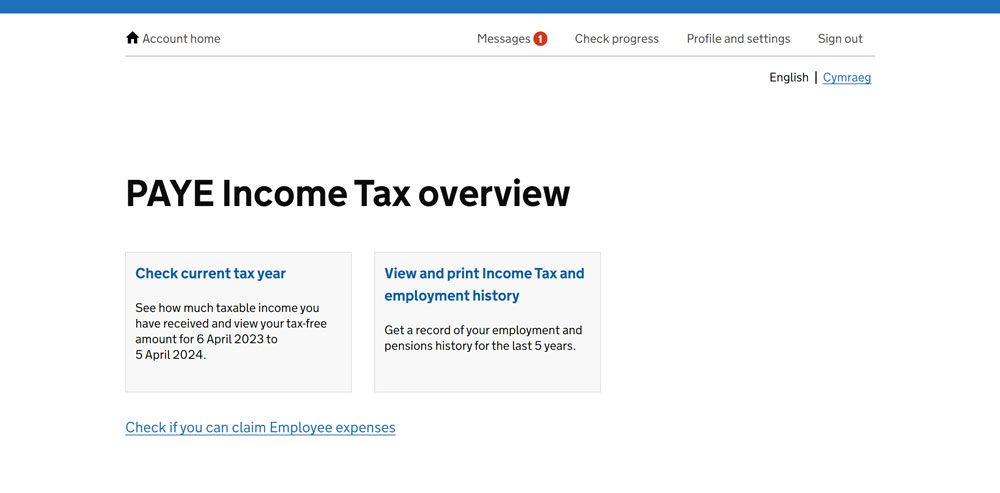

Step 4) PAYE Section: Click on ‘Pay As You Earn’ (PAYE) to manage employment and income information.

Step 5) View Income History: Select ‘View and Print Income Tax and Employment History’ to access records for the past 5 years.

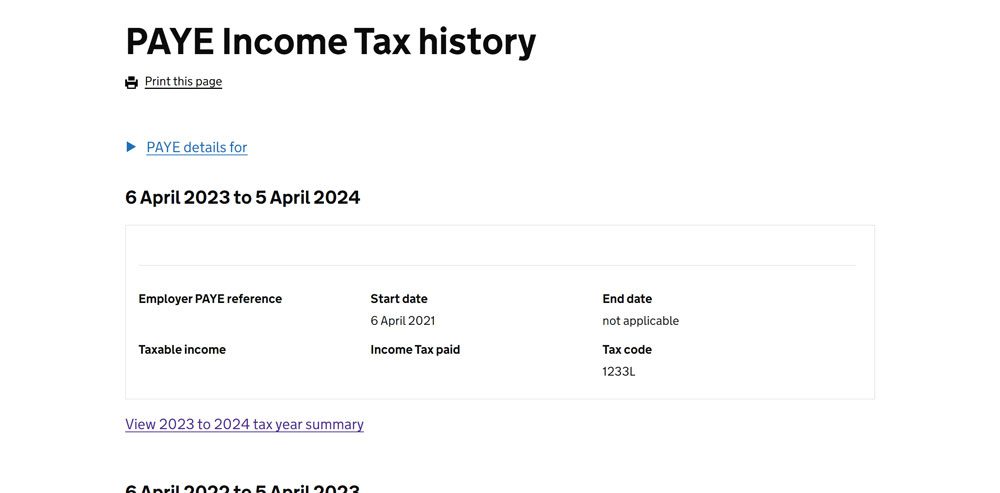

Step 6) Access Specific Tax Year: In the PAYE Income Tax history, click on the relevant year, like “View 2023 to 2024 tax year summary,” for detailed information.

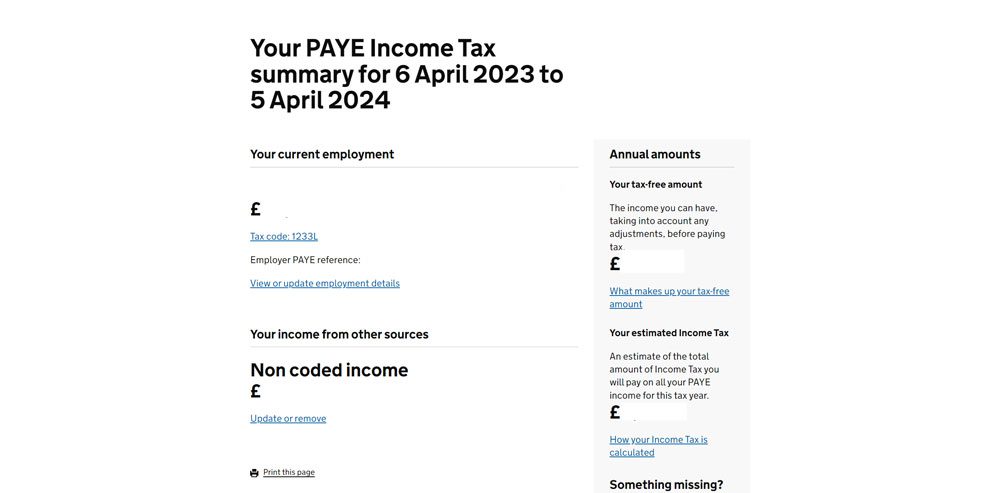

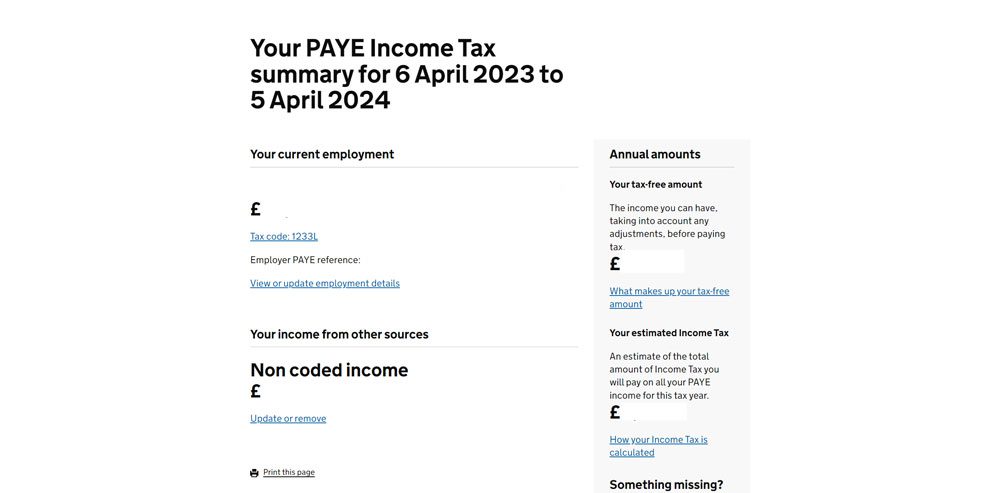

Step 7) Print Your PAYE Income Tax Summary: Once you’re on the “Your PAYE Income Tax summary” page for the selected tax year, scroll down to find the option “print this page”. Click on this to print a hard copy of your income summary, which can be used for various purposes like mortgage applications or personal record-keeping.