Unfortunately, you have to pay interest on every type of mortgage. It’s the price you pay for borrowing the funds you need to secure your home. However, did you know that there is something called an interest-only mortgage, and this choice can have a big impact on your life financially?

There are many options available to people who want to find the right mortgage for their current situation, and this can be very confusing, mainly when one reads something like “interest-only mortgages”. Though they may not be as widespread as other repayment mortgages, there are still some cases where these loans can prove useful for individuals who want to purchase property in the UK. Our ultimate guide will look at everything you need about an interest-only mortgage.

What is an Interest-Only Mortgage?

It is an interest-only mortgage that involves some form of borrowing in which the customer must pay only for the interest of capital for a given period. This ensures that the monthly payments are lower than those of ordinary repayment mortgages, thus allowing the borrower to keep more money in their pockets. However, once this mortgage term ends, the debtor has to repay the total amount of the original loan. Remortgaging, property sale or conversion to a repayment mortgage where capital and interest are paid together could be the most common repayment strategies.

Key Components of Interest-Only Mortgages

- Interest Payments: During the interest-only period, monthly payments exclusively cover the interest, leaving the capital untouched.

- Capital Repayment: The capital borrowed remains intact throughout the interest-only phase. Repayment is necessitated at term’s end, achievable through a lump sum, refinancing, or transitioning to a repayment mortgage that addresses both capital and interest.

While offering flexibility and lower initial payments, this tailored mortgage option underscores the importance of forward-looking financial planning and strategy.

The Pros and Cons of Interest-Only Mortgages

Interest-only mortgages have pros and cons, which can help you decide whether or not this type of loan is suitable for you.

Advantages

- Reduced Monthly Payments: Such payments are lower than those that would be made to a repayment mortgage because only the interest has to be settled monthly, which could be particularly useful if you have other financial commitments or expect your income to increase in the future.

- Flexibility: Interest-only mortgage loans provide some flexibility. An additional amount of cash within reach could encourage overpayment, thus lowering the overall cost of borrowing.

Disadvantages

- Total Cost: Even though an interest-only mortgage may have lower monthly instalments, it will eventually cost more since the capital balance will remain unchanged.

- Repayment Vehicle: Any applicant must have a plan to repay the entire sum borrowed at the end of the mortgage term—this may involve savings, investments, or even selling property.

Interest-Only Mortgages vs Repayment Mortgages

Knowing the disparities between interest-only and repayment mortgages is essential before selecting the best mortgage option for yourself. Choosing the option that suits your situation will determine your path.

What Is Repayment Mortgage Lending?

Repayment mortgages (alternatively called capital and interest mortgages) have become the most common way of financing homes today. Both interest and the capital balance of your loan are settled through monthly instalments, which ensures that by the time your mortgage is completed, you will have paid off everything, leaving you with full ownership of that home.

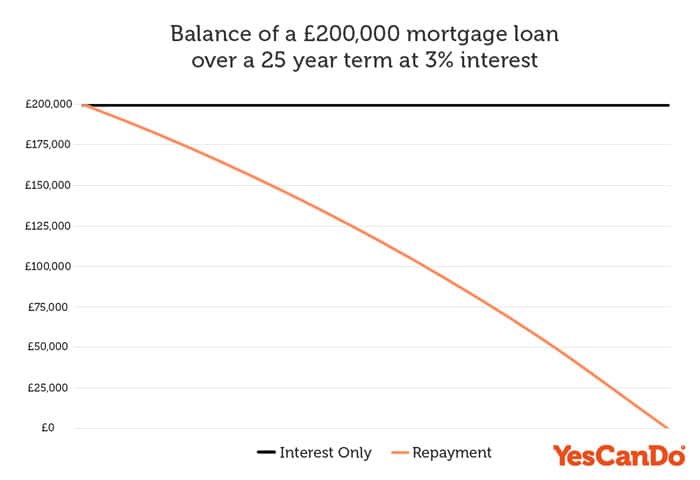

Interest only mortgage vs repayment mortgage graph

Key Differences

Monthly Payments

- Interest-Only Mortgage: Your monthly payments only cover the interest on the loan, resulting in lower monthly repayments than a repayment mortgage.

- Repayment Mortgage: With this type of mortgage loan, your monthly payments include both interest and capital loan amount owed compared to an interest-only mortgage, resulting in higher monthly repayments than would otherwise be necessary.

Total Cost

- Interest-Only Mortgage: While monthly payments may be lower, their total cost can be higher as the capital balance does not reduce over the term of the loan.Repayment Mortgage: While monthly repayments will likely be higher, the total costs could actually be less as you gradually reduce the capital balance.

Repayment of capital

- Interest-Only Mortgage: At the end of each term, it is your responsibility to repay in full the entire loan amount owing. A solid repayment strategy should include savings or investments as well as selling off property as part of this repayment strategy.Repayment Mortgage: With this type of loan, capital amounts are gradually paid back over its term. By its conclusion, all of your debt will have been satisfied.

Example: Interest-Only vs Repayment Mortgage

An interest-only mortgage with 5% interest over 25 years would cost monthly mortgage payments of £1041.67; totaling to £312,501 over time. However, you would still owe back your original deposit when your deal ends.

Compared with a £250,000 repayment mortgage with the same rate and term, your repayments would be £1,461 a month. You would also clear the capital over the 25 year term. You would pay £188,443 in interest over the full term – which makes it £124,058 cheaper than choosing an interest-only mortgage.

To ensure you benefit from lower repayments, speak to our team and we will search the market for the lowest mortgage rates currently available on both interest-only and repayment mortgages.

Learn more: The Different Types of Mortgage Explained

Which is Right for You?

Your choice between an interest-only mortgage and a repayment loan depends on your current and future financial situation. With the latter, you’ll pay a portion of the original debt plus interest each month, while with an interest-only mortgage, you’d only repay the interest cost. If you’re looking for more flexibility regarding your cash flow, the former might be best for you, as you won’t have to pay back any of what you borrowed until the end of your loan term. However, if you want to own your property once your agreement ends completely, having a mortgage repayment plan or paying off lump sums during the mortgage term will be important. Consider sitting down with a professional — like a mortgage advisor or broker — to help iron out what’s most important when making such an impactful decision.

You can always start with a repayment mortgage and then switch later, for more read or guide on Can I Switch to Interest Only Mortgage?

Introducing part and part mortgages

Part Repayment, Part Interest Only Mortgages combine interest-only and repayment methods. One portion requires you to pay both the interest and capital, gradually paying down the mortgage; for the other, only interest is payable, keeping monthly costs down while repaying the capital at the end of the term. While this mortgage type offers flexibility, careful planning may be required as not everyone may find this suitable.

What is an interest free mortgage?

Interest-free mortgages do not really exist in the mainstream mortgage market. The products sometimes marketed as interest-free mortgages are more accurately described as:

- Low or fixed rate mortgages – They have interest rates of 0% or close to 0% for a set period of time, after which regular interest rates apply. The interest is just deferred.

- Offset mortgages – Borrower deposits are held in a savings account offsetting the mortgage balance, reducing interest costs but not eliminating them.

- Islamic/Sharia-compliant mortgages – They avoid interest through cost-plus financing but still have monthly fees.

- Deferred interest schemes – Interest accrues but payments are deferred until the end of the term.

The mortgage industry works by charging interest over the long run, so a product with zero interest wouldn’t line up with how lenders make money. Sometimes, marketing language can make certain mortgages sound interest-free when they’re not. But the bottom line is that true interest-free home loans aren’t practical or on the market. However, don’t get too caught up in the terminology – feel free to WhatsApp one of our knowledgeable mortgage advisors. We’re happy to provide straightforward explanations and help clarify any confusion around interest rates. Our team looks forward to assisting you in understanding your options.

How much you could borrow?

Mortgage providers will allow you to borrow a loan amount of up to 75% of a buy to let property however an interest-only mortgage on a residential mortgage can be higher.

The exact amount you will be eligible to borrow will depend on whether you’re buying a residential or a buy-to-let property, as well as several other factors, the most prominent of which will be your monthly income.

Mortgage Affordability Calculator

Each mortgage lender has its own calculator to determine how much you can borrow for a home loan. However, we have access to a tool that looks at the affordability calculations of over 90 different lenders. This lets us give you a more precise figure for your situation. To get an accurate estimate, reach out to our team, and we will help you calculate the amount you can borrow.

Use our free Mortgage Affordability Calculator here

Interest only mortgage calculator

You can compare the monthly cost of a capital repayment mortgage vs an interest-only mortgage using the mortgage repayment calculator below.

Who is Eligible for Interest-Only Mortgages?

Interest-only mortgages aren’t suitable for everyone, and mortgage lenders typically have stricter eligibility criteria compared to repayment mortgages. Here are some of the key requirements:

- Income and Affordability: In order to meet a lender’s minimum income threshold, you need to demonstrate that your repayments can be afforded and meet their minimum income threshold requirements.

- Credit History: While your credit rating may be less impactful than it would be for a capital repayment mortgage, serious credit issues could still pose a problem.

- Age: Most lenders have minimum and maximum age thresholds.

- Experience: If you’re purchasing for investment purposes, some lenders prefer that you have prior landlord experience.

- Deposit: The loan-to-value (LTV) amount offered on a mortgage that is interest-only is typically lower than for mortgages that are repayment, meaning the deposit requirement is greater.

Repayment Vehicles for Interest-Only Mortgages

As mentioned earlier, having a reliable repayment vehicle in place is crucial for an interest-only mortgage. Here are some of the acceptable repayment vehicles:

- Sale of the Property: This is a popular option, especially for investment properties. You might choose to sell a residential property at the end of a longer interest-only mortgage term by downsizing to a smaller dwelling and using the equity to repay the original loan.

- Investments: There are a number of investment options that may be deemed acceptable repayment vehicles, including ISAs, stocks and/or shares, bonds, unit trusts, and endowment policies.

- Cash Repayment or Pension Lump Sum: You could choose to use personal savings, an inheritance, or the tax-free lump sum taken from your pension pot to repay the loan.

How to Secure an Interest-Only Mortgage

Securing an interest-only mortgage for buy-to-let or residential properties can be done directly with lenders; however, to access the most cost-effective deals it’s advisable to consult a mortgage broker first. Brokers have access to every lender offering interest-only loans and can search them all on your behalf to find one with lower interest-only payments.

Which Lenders Offer These Mortgages?

Although an increasing number of lenders are implementing strict criteria around minimum income and deposit requirements, these institutions are beginning to re-introduce interest-only mortgages. However, there is a silver lining, as some providers are much more flexible. Getting advice from a mortgage advisor is definitely worth it to find the one that best suits your circumstances.

Here are some examples of three popular UK lenders offering interest-only mortgages to qualifying customers:

| Lender | Minimum Income (Single) | Minimum Income (Joint) | Deposit | Minimum Equity | Important Notes |

|---|---|---|---|---|---|

| Barclays | £75,000 | £100,000 or one applicant earning £75,000 | On application | No | Cannot rely on property sale to repay loan |

| Nationwide | £75,000 | £100,000 | 40% | Varies by region: £300,000 – Greater London £250,000 – Outer South East £200,000 – all other UK regions | New purchase and remortgage only maximum term of 25 years (or retirement if sooner) maximum loan amount of £2 million. Not available to first time buyers |

| Halifax | £100,000 | £150,000 or one applicant earning £100,000 | 50% (for sale of mortgaged property as a possible repayment strategy) | £200,000 (for sale of mortgaged property as a possible repayment strategy) | Sale of mortgaged property as a possible repayment strategy only for a maximum loan of 50% loan-to-value on interest only |

The table gives you a good idea of lending criteria as of May 2023 but shouldn’t be used as financial advice. The 2023 mortgage market is seeing lenders change their lending criteria on a monthly basis. However, as with any financial decision, I recommend reaching out to these lenders directly or speaking with one of our mortgage advisors to get the most accurate and personalised information.

How Long Can You Have One?

Interest-only mortgage terms can range from 5 to 25 years, depending on the borrower’s individual situation. In some cases, lenders may offer longer mortgage terms of up to 40 years for individuals deemed suitable by them. If you can demonstrate your ability to pay off the mortgage within two years or less, loan providers might approve your request for a shorter-term mortgage option.

What Rates to Expect

Interest-only mortgages come with both variable and fixed-term interest rates; due to rising interest rates, fixed-term rates currently offer greater stability. Your rate depends on a range of factors, including the type of loan taken out, deposit size, total length, and amount financed over a specified timeframe.

Discover The Best Interest-only Mortgage Rates

Interest-Only Mortgages in the current UK Market

Interest-only mortgages have experienced a comeback in the UK market in recent years. Though many lenders withdrew their interest-only offerings following 2008’s financial crisis, an increasing number are offering this type of deal again – though with stringent criteria imposed for interest-only lending, such as minimum income requirements and equity deposits/deposit requirements.

Our Mortgage Advisers’ Thoughts on Interest-Only Mortgages

People attracted to a mortgage that is interest-only are usually drawn in by the prospect of lower monthly payments; however, most are unaware of its stringent criteria and requirements. Typically interest-only mortgages are most accessible for individuals with high incomes, considerable savings accounts or significant equity in their property.

Generally, you would need to have savings or investments equivalent to the amount you’re borrowing. Alternatively, the sale of your property could serve as a repayment vehicle, but usually, you can only borrow up to 50% of the property’s value. Additionally, after taking out a mortgage on a property you should ideally maintain at least £250,000 of equity in it.

While lower monthly payments may seem appealing, securing such a mortgage may not always be practical due to its stringent requirements. As always, it’s wise to carefully evaluate your personal financial circumstances and consult a qualified mortgage adviser in order to identify whether an interest-only mortgage could be a suitable option for you.

Conclusion

Interest-only mortgages can be an attractive option for certain homebuyers in the UK, but it’s essential that they fully comprehend all their pros and cons before making a decision. While lower monthly payments might tempt buyers, remember to create a solid repayment plan and consider potential higher overall costs before choosing. For best results, it is always advisable to seek advice to understand how interest-only mortgages work and how to get a mortgage. Speak to an experienced mortgage broker before making such decisions on your own.

Frequently Asked Questions

Is it worth getting an interest-only mortgage?

An interest-only mortgage depends on your current financial circumstances and goals. It may be ideal for those seeking lower monthly payments with a solid repayment plan for the outstanding mortgage at the end of their term; however, it can be risky without an established repayment strategy.

What are the requirements for an interest-only mortgage?

Attracting lenders who offer a mortgage that is based on interest-only requires showing proof of income and meeting certain credit history standards; additionally, they may request larger deposits as well as age criteria that need to be fulfilled before being approved for one.

What is a disadvantage of an interest-only mortgage?

An interest-only mortgage has one key drawback—having to repay the full loan amount at the end of its term, even though monthly mortgage payments may be lower as capital remains constant during repayment. This could result in higher total costs as interest payments don't reduce during the loan's lifespan.

How much is a 100k interest-only mortgage per month UK?

A 4.5% £100,000 interest-only mortgage will cost approximately £250 each month depending on its interest rate and term; at 4.5% over 25 years, this would translate to approximately £250 as monthly interest payments.

How does an interest-only mortgage work?

With an interest-only mortgage, you only pay the interest on the loan each month. The capital amount remains the same throughout the mortgage term. At the end of the term, you must repay the full loan amount.

How risky are interest-only mortgages?

An interest-only mortgage can be risky without an effective repayment plan or strategy to repay the capital at the end of the mortgage term. If investments or property sales fall short, you will leave with a significant debt that must be addressed quickly.

Can you get interest-only mortgages anymore?

Yes, interest-only mortgages are still available, although not as frequently. Lending criteria tend to be stricter for these mortgages, and some lenders only provide them to high-net-worth individuals.

Do any banks offer interest-only mortgages?

Yes, some banks and mortgage lenders in the UK still offer interest-only mortgages. However, they often have stricter eligibility criteria and may require a larger deposit than mortgages based on a repayment basis.