If you’re considering applying for a self employed mortgage soon, it’s wise to pull together all the paperwork needed before you make your application. This will speed the process up so if you are accepted for a mortgage, you will be able to go ahead with your property plans sooner.

Is this something you will need to provide when making your mortgage application? Let’s take a closer look.

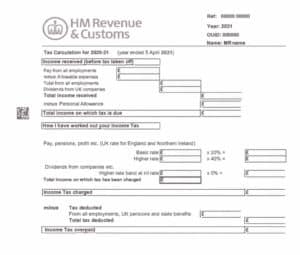

What is an SA302?

An SA302 is a document that is created by the HMRC when you have completed your annual self-assessment tax return. The document details your tax calculations and all of your taxable income streams.

The SA302 form is one method of proving income to a mortgage lender. The mortgage lender will take the information from the form and calculate your affordability for a mortgage.

An SA302 form document includes:

- A tax calculation with a summary of earnings

- Details of your tax allowance

- An overview of the given tax year, including the current status of tax payments

You can see an example of an SA302 below.

SA302 Example

Who needs an SA302 Tax Calculation for a mortgage?

Not everybody needs to provide an SA302 Tax Calculation form when making a mortgage application.

If you are employed and receive pay slips and a P60 as proof of your income, you won’t necessarily need an SA302 Tax Calculation form. This is because you pay income tax through the PAYE system which automatically comes out of your wages.

The exception is if you are employed but also earning money from another source. If this is the case then you will need to declare the earnings outside of your employment on a self-assessment tax return. This is because the HMRC will need to know about your other income streams when considering your tax year overview. You will then receive an SA302 that can act as proof of income for your mortgage lender.

Income streams outside of employment can include:

- Rental income

- Investments

- Dividends

- Foreign Income

- Money earned from side hustles

If you are self-employed, you will need an SA302 form for a mortgage. Most lenders will ask for 3 years’ worth of SA302s for evidence of a sustained income.

You will know you are self-employed if you own your business and are responsible for completing your own tax returns. People in self-employment include:

- Sole traders (also known as sole proprietors)

- Freelancers

- Independent contractors

- Business partners

If you’re unsure about whether you need an SA302, contact the HMRC or visit their website for further details.

How can I obtain an SA302?

The easiest way to get your SA302 form is to:

- Log into your HMRC online account,

- go to the ‘self-assessment’ section,

- click on ‘more self-assessment details’,

- download your form by clicking the tab which reads ‘print your full calculation’.

This is a simple process but if you get stuck, try phoning HMRC or use their webchat for advice and support.

If you or your accountant have submitted your tax return through commercial accounting software, you can also use that to print your official tax calculation.

On the commercial software, there should be a section called ‘tax computation’ or something similar where you can print your tax calculation.

An SA302 form displays your tax calculation and breakdown along with evidence of earnings that are based on your most recent Self Assessment tax return.

You can also request a copy from the HMRC by calling or writing to them. But as it can take up to two weeks to receive the SA302 in the mail, you might prefer to use the ‘go to self-assessment’ section on the HMRC website if you need your calculated tax overview in a hurry.

HMRC self-assessment contact details

For your convenience, we have provided the contact details for HMRC’s self assessment and tax calculation below.

HMRC Postal Address:

- HM Revenue and CustomsSelf Assessment and Tax Calculation

BX9 1AS

United Kingdom

HMRC Phone

- Self Assessment General Enquiries – Tel: 0300 200 3310

The HMRC representative will request your National Insurance number and Self Assessment Unique Taxpayer Reference when you call so be sure to have those ready.

Is it possible to get a mortgage without an SA302?

If you’re in self-employment or earning an income outside of your normal job, the SA302 is often the best way for a lender to assess your total income as it acts as an indication of what you can afford in mortgage repayments.

But if your tax return isn’t ready or if you haven’t submitted your tax return because the tax year hasn’t ended, you can give the mortgage lender a complete set of your accounts as evidence of your income instead. These will need to be certified by an accountant.

Our experience as a mortgage broker is that a mortgage progresses far quicker and easier if you have your SA302 to hand as evidence of your income. If you need help ask as we can help you with this.

Your mortgage lender will usually ask for other documents too, such as your bank statements, when asking you to prove your declared income. We can advise you on the other paperwork that is needed when applying for mortgages so get in touch with our team if you need any guidance.

What if I haven’t been self-employed for very long?

Many lenders will want to see SA302 forms from the last three years before approving you for a mortgage product. There are even lenders who will want you to prove your income from the last four years.

Related reading: Is it possible to get a mortgage being Self Employed Mortgages with 1 years accounts?

If you haven’t been self-employed for 3-4 years, will you still be able to get a mortgage?

Fear not!

If you don’t have SA302 forms (or a set of accounts) that show your income for that period of time, it is still possible to get a mortgage.

Lenders that specialise in self-employed mortgages will have a more flexible approach so providing you have some evidence of your earnings, such as two years’ worth of SA302s or a year’s worth of accounts certified by an accountant, they should consider your mortgage application.

The best way to access mortgages from specialist lenders is to speak to a mortgage broker, such as ourselves. We will search the mortgage market for niche lenders that will consider you for a self-employed mortgage, even if you haven’t been able to get your SA302 tax return.

Get in touch

If you’re self-employed or earning an income outside of your regular employment and you are looking to buy a property soon, we can give you further advice regarding your SA302 form.

We will also let you know which other documents you will need to provide alongside your tax year overview as part of your mortgage application.

If you aren’t able to get your SA302 tax form, perhaps because you are newly self-employed, we can advise you on the mortgage lenders that may still be willing to consider your situation.

Get in touch if you have any questions and we will give you all the advice and support you need on your mortgage journey.