In this guide, we look at the impact your age has on getting a mortgage. Being older doesn’t necessarily mean that you won’t be able to get a mortgage.

Mortgage maximum age

Reaching 50 years of age is when your mortgage options start to change. Saying this, it is not impossible to get a mortgage over the age of 50, it is just a little more difficult the older you get past 50. This is why it is definitely worth learning and understanding how age can affect borrowing and what is the maximum age.

Each mortgage lender looks differently at your age and will have their own maximum age they will consider offering a mortgage. Although most providers, however, impose maximum age caps they will vary depending on many factors. These include expected retirement age and projected retirement income.

Does age impact mortgage eligibility?

In short, the answer is yes, your mortgage eligibility is affected by your age.

If you’re a younger borrower (under 50), it shouldn’t be too difficult to get a mortgage, provided you meet the lender’s eligibility criteria and max age for retirement.

But if you’re older and closer to (or within) your retirement years, your options may be limited to shorter-term lengths.

This isn’t always the case, especially if a family member is willing to go down the guarantor mortgage route. There are also those lenders that are more flexible when it comes to term length and max age. However, the older you get, your chances of a more competitive fixed-rate mortgage deal will decrease.

The maximum mortgage age limit varies between lenders. Some will impose a maximum age cap of 65 while others will accept applications from borrowers who are between 70-75. Fewer lenders will accept mortgage applications and have an age limit of 90 or above but that’s not to say it’s impossible.

As whole of market brokers, we have access to a wide range of lenders, including those specialist lenders that cater to older borrowers. Contact us to learn more about the options that may be open to you and how to get a mortgage.

In the meantime, keep reading to learn more about getting a mortgage as an older borrower.

Why does age impact the eligibility of a mortgage?

If you’re under 60, you should have little trouble getting a mortgage. Provided you have a regular salary and a strong credit history, there is a high chance that your mortgage application will be accepted.

Your profession will also be taken into consideration. For example, lenders are more likely to increase the maximum age if you have projected retirement income from a pension.

But borrowers over 60 are sometimes considered “high risk” by lenders. As such, getting a mortgage isn’t always straightforward.

Why are older borrowers seen as high risk?

There are two reasons why you might be seen as high risk if you’re an older borrower.

Your monthly income

Lenders want to make sure you can make your loan repayments before accepting your mortgage application. But if you are no longer in receipt of a salary and not on a sufficient pension, you may find it more difficult to keep up with your mortgage repayments. Monthly repayments that will still need to be paid in retirement will also be taken into consideration. An example would be a personal loan.

Your health and life expectancy

It’s no secret that we become less healthy as we age and it’s because of this that mortgage providers sometimes reject a mortgage application from borrowers who are unlikely to survive a 25-year mortgage term. If you’re between 50-60, this might not be an issue for you, but it will become harder for you to get a mortgage if you’re over 70.

What factors affect mortgage eligibility if you’re retired?

The maximum age is not only the factor that will affect your eligibility for mortgage approval.

As with any applicant applying for a standard residential mortgage, there will be a number of other factors that will affect older borrowers. The three that matter most when you’re retired are…

Affordability

As we suggested earlier, mortgage providers want to make sure you have the ability to make your monthly mortgage repayments.

If you are approaching retirement age, they will want to know more about your predicted retirement income.

If you are a retiree, the lender will want to make sure you are able to afford your repayments with your pension income. As with all applicants, they will also take your outgoings into account to get a better idea of what you can and can’t afford.

Most lenders will allow you a loan of between 3-4 times your annual income. However, there are some who may be willing to lend you more than this, especially if you’re applying for a standard interest-only mortgage.

The Mortgage Term

Your age will correlate with your term length eligibility. If you are past retirement, you might struggle to find a lender who will offer you a standard 25-30 year term.

You might still be eligible for a mortgage at a shorter term but your monthly payments may be higher due to an increase in mortgage rates.

Loan to Value (LTV)

The loan to value is the balance between the loan amount and the value of the property you are thinking about buying. The higher your deposit, the lower the LTV, and the better chance you will have of a mortgage with the most competitive interest rates.

For repayment mortgages, most lenders will accept a deposit of 20% of the property’s value. As such, you will be eligible for an 80% loan-to-value mortgage. Some lenders will accept smaller deposits but it’s important to remember that you will be subject to higher interest rates if your deposit is 15% or smaller than the property’s value.

For younger borrowers, the minimum LTV on standard interest-only plans is usually 15%. But if you’re an older applicant, the LTV will be around 25% minimum.

What is the upper age limit for mainstream mortgages?

We have listed below the upper age limits for mainstream mortgages from 50 – 80 years of age.

Getting a mortgage at 50

If you’re in your 50s, you should have little trouble getting a mortgage. However, the lender might still want to know more about the income you will receive in your retirement.

Getting a mortgage at 60

Your options may be limited to mortgage terms of between 10-20 years when you are within this age bracket. Your monthly repayments will be likely higher as a consequence. You will also need to show evidence of your pension income.

Getting a mortgage at 70

Your mortgage options will be even more limited when you’re within this age bracket. Mortgage terms are likely to span between 5-15 years.

However, building societies and specialist lenders are sometimes more flexible so you may still be eligible for a longer mortgage term, provided you pass their affordability checks.

Getting a mortgage at 80

Very few mortgage providers will consider borrowers within this age bracket however, it’s not impossible as some niche lenders will consider applicants who are in their 80s. As with other applicants, you will need a decent credit rating and have the available income to make your repayments.

Maximum age limits for mortgages

| Age of borrower | Likelihood of acceptance | Lender considerations |

|---|---|---|

| 50 years old | High | Standard lending criteria |

| 55 years old | High | Standard lending criteria |

| 60 years old | High | Standard lending criteria |

| 65 years old | High | Standard lending criteria |

| 70 years old | Fair | Standard lending criteria |

| 75 years old | Moderate | Standard lending criteria (Term length may be restricted) |

| 80 years old | Moderate | Standard lending criteria (Term length may be restricted) |

| 85 years old | Low | Stricter lending criteria / restricted term length |

| 90 years old | Low | Stricter lending criteria / restricted term length |

| 95 years old | Low | Stricter lending criteria / restricted term length |

| No age limit | Low | Stricter lending criteria / restricted term length |

Other factors impacting later life lending eligibility

Your ability to get a mortgage will also depend on…

- Your credit report – Not many lenders offer later-life mortgages to older applicants with bad credit.

- Interest rates – As only a few lenders offer mortgages to those who are later in life, rates are often higher as there is less competition. However, if you opt for a standard mortgage rather than a mortgage that is aimed at older people, you may still be eligible for the best rates.

- Property type – As with any applicant, the type of property you choose will affect your eligibility for a mortgage. Non-standard constructions, such as those that aren’t built with brick, are often looked upon with caution by lenders.

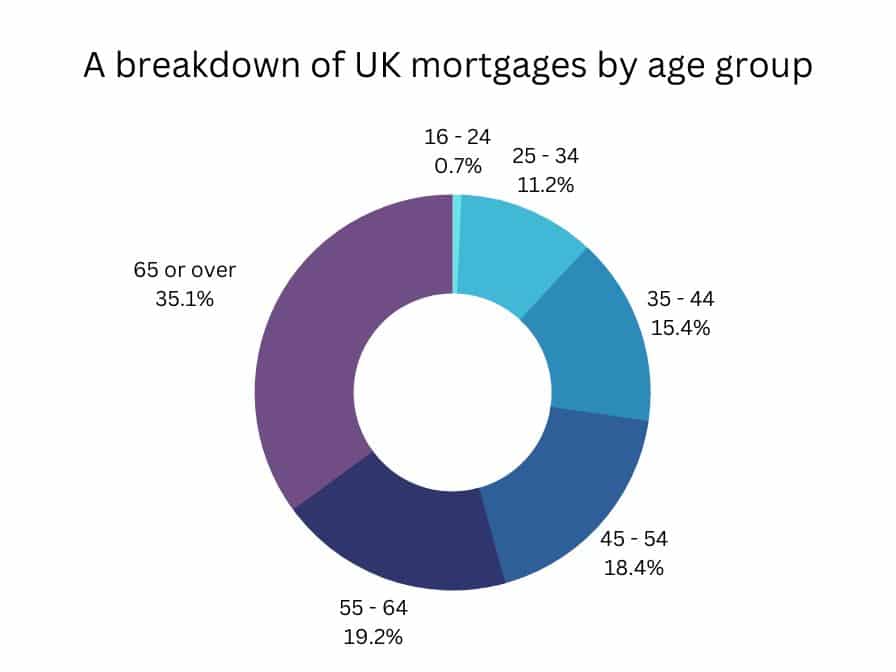

UK mortgages granted by age group in 2021

Many young people in the UK are finding it difficult to get onto the property ladder. This means that for many younger people in the UK owning a home may not be possible until later in their life.

A breakdown of UK mortgages by age group

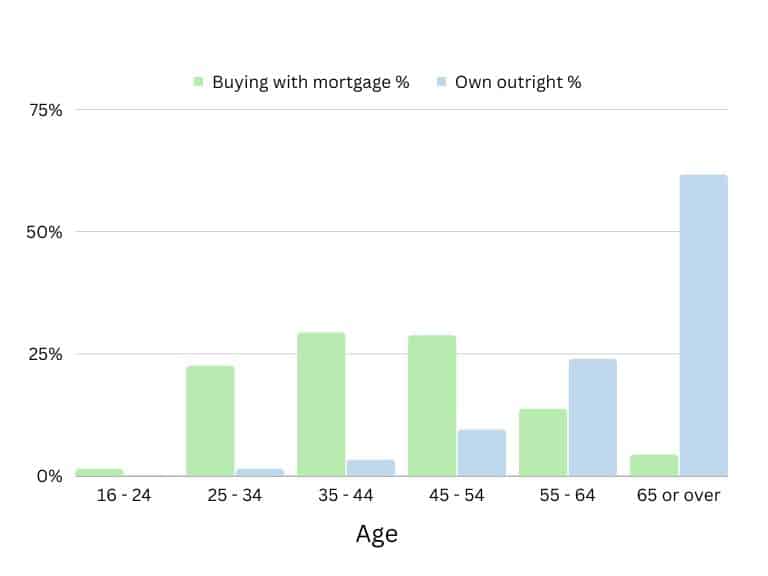

A breakdown of UK homeownership by age group and how they purchased their property

As you can see in the graph bellow, generally speaking as the age group increases, so does the percentage of UK residents who bought their home outright. Only 0.2% of outright owners are in the age group of 16 and 24, compared to 62% of UK residents who are aged 65 or over.

If you aren’t eligible for a standard mortgage as you are above the lenders max age or over the age limit, you could apply for a secured loan. There are also different types of retirement mortgages that may be open to you. These are as follows.

Lifetime mortgage

Lifetime mortgages are a form of equity release mortgages and are open to applicants aged 55 or older. Lifetime mortgages also have an age limit. This time it’s not a maximum age limit however it will be they have a minimum age and therefore suits the older borrower.

The loan is secured against your home and allows you to release tax-free cash, either as a lump sum or a series of lump sums. The loan is repaid (with interest) when you move into care or pass away.

Home reversion

Home reversion is another form of equity release. In this instance, you sell part or all of your home in return for regular payments or a cash lump sum. You can then live in your property rent-free until you die or move into care.

Retirement interest-only mortgage

These are aimed at applicants over the age of 55 and are similar to standard interest-only mortgages. You only pay back the interest each month rather than the loan itself.

Older People’s Shared Ownership

You can benefit from an Older People’s Shared Ownership scheme if you are aged 55 or older. In this instance, you buy a share of the home (usually between 10-75%) and pay rent on the remaining balance.

As a mortgage broker who is whole of market, it is our observation that mortgage lenders’ max age can vary from age 65 up to age 90 depending on your individual circumstances. Our expert mortgage advisors have many years of experience and will now know which lender is best for you. – Stephen Roberts

How a mortgage broker can help

For mortgage advice, you can trust, get in touch with our team of retirement mortgage specialists. Whether you’re looking to get on the property ladder at an older age or looking to move home or remortgage with a new mortgage, we are here to help.

The type of deal on a mortgage varies depending on your personal circumstances but we will search the market on your behalf. While some lenders impose upper-age limits on the deals they offer, there are also those who don’t. We will make sure you get the right mortgage for your financial circumstances and will handle all of the paperwork attached to your mortgage application.

To learn more about our mortgage services, get in touch with our friendly and experienced team today.