Are you considering applying for a mortgage and wondering how much mortgage can I get? If so, it’s important to understand how lenders calculate affordability—what is taken into account and what criteria are used. To help make this process easy to comprehend, we’ve put together this guide with an overview of the components involved in a mortgage affordability test, determining your eligibility, and tips on securing the best mortgage rate. Read on to learn more!

Lenders’ mortgage affordability checks

In the United Kingdom, a mortgage affordability test can help potential borrowers determine what amount of money they are likely to qualify for from a mortgage lender. During this assessment process, lenders evaluate applicants’ financial standing based on their income, debts, and credit score to ascertain how much is suitable for lending. This procedure allows purchasers to understand better their borrowing capacity when seeking out a new mortgage or wanting to look at new fixed interest rates or lower monthly mortgage payments.

To ensure that the borrower can comfortably manage the monthly mortgage repayments, lenders conduct a thorough mortgage affordability check. They evaluate various elements such as income and expenses, credit score, plus any existing assets or savings to assess eligibility and affordability of a loan.

Mortgage lenders rely on mortgage affordability checks to shield both sides from agreeing to an unmanageable mortgage loan. When supplying the details for a mortgage affordability check, it is essential that borrowers are honest and precise; any inconsistencies may lead to either their application being rejected or approved but with a loan not fitting into their budget.

How do mortgage lenders work out affordability?

For over 10 years the UK financial system has made sure that everyone entering into a mortgage will be able to afford the monthly repayments. It was decided that a mortgage affordability test would be needed and therefore each lender started to use their mortgage affordability calculator.

It is very possible to achieve the average UK mortgage, however, it will depend on which lender you select based on your financial circumstances. Some lenders may be more inclined to lend a greater amount if you are employed, whereas others might favour lending larger amounts when no other loans or credit cards exist.

Banks and building societies use a variety of information to determine a borrower’s affordability when considering a mortgage application and the interest rate. Some of the main factors that lenders will consider include the following:

- The borrower’s credit score and credit history

- The size of the deposit and the loan-to-value ratio

- The borrower’s income and employment status

- The borrower’s current and future outgoings, such as existing debts and living expenses

- The value and condition of the property being purchased

- The length of the mortgage term and the type of mortgage product being applied for

Two of the leading variables that can determine affordability are income alongside deposit and loan size.

Income multiples

UK mortgage affordability rules have changed over the last couple of decades, with different methods being used to determine a borrower’s affordability. One common approach that has been used as an affordability rule of thumb is income multiples. This involves calculating the borrower’s mortgage repayments as a percentage of their income, which gives lenders a sense of how much the borrower may be able to afford. However, this is meant to act as a general guide as modern affordability tests typically take into consideration debt-to-income ratios.

The income multiple used can vary widely among lenders when accessing mortgage affordability checks. Some may use an average multiple of 4-4.5 times the borrower’s salary, while others may use a lower multiple of 3 times salary. There are also lenders who will use higher multiples of 5 or even 6 times salary.

However, gross salary alone may not provide a complete picture of a borrower’s financial situation. Lenders may also consider a borrower’s major expenses and disposable income to get a more accurate idea of their ability to afford a mortgage.

Deposit & loan to value

When applying for a mortgage, each lender will ask to know how much money you have saved up as the deposit of your property purchase. This helps them calculate the loan-to-value (LTV) ratio which is the relation between your loan amount and value of your home. The LTV ratios allows banks to measure their risk by giving you this loan, therefore it also can influence what kind of interest rate they would be willing to give you.

Your deposit and the loan-to-value ratio will be taken into account as part of the lender’s affordability test. This assessment is intended to make sure that you are able to pay back your mortgage repayments, and could involve analysing your income, expenses, plus credit history.

If you have a bigger deposit, not only can it result in a lower Loan-to-Value (LTV) ratio but also makes you more qualified for the mortgage. The lower the loan-to value the lower the interest rate will be. This is because mortgage lenders are likely to be assured that when they see someone with enough funds to invest a considerable amount of money into purchasing the property, then there must be financial stability and security. Furthermore, such an act could potentially lead to an even lesser interest rate on your loan!

When it comes to their individual policies for calculating a loan-to-value (LTV) ratio and affordability assessment, lenders vary greatly. To ensure the most accurate information is obtained, reach out directly to them.

Can you include additional income on your application?

If you receive income from multiple sources, like commissions, bonuses, overtime pay, freelance, or investment properties; it is beneficial to work with a mortgage lender who will consider all these avenues of revenue when evaluating your application. By doing so you could potentially increase the likelihood of obtaining pre-approval and taking one step closer towards owning a home.

How eligibility criteria can affect your application

Although affordability assessments help lenders determine how much you can borrow for a mortgage, they are not the only elements that will have an effect on your application. Every lender has its own internal eligibility requirements, which could potentially diminish or strengthen your chances of getting a successful outcome from your mortgage application.

Some key factors that may be considered include:

- Type of employment: When evaluating applicants, lenders take into account your employment status and income stability. Certain lenders may have stricter standards for self-employed borrowers or other alternatives to consider.

- Source of income: Lenders often have rigorous standards for what constitutes acceptable income, but some are more flexible and willing to accept commissions, bonuses, or overtime pay when others would not.

- Credit scores: Your credit score is a comprehensive view of your financial past, and it can determine whether or not you will be approved for an essential mortgage. It may be helpful to review your credit reports before applying for a mortgage to identify any errors or opportunities to improve your credit score.

- Outgoings: Lenders may review your bank statements to assess your monthly expenses and ensure that you have enough income to cover your debts and other obligations. If you spend as much as you earn, lenders may be able to lend you less.

What outgoings are considered when applying for a mortgage?

Affordability assessments offer lenders an initial overview to calculate how much you can potentially borrow for a mortgage, however, they do not guarantee your application will be successful. Each lender has their own internal criteria which may influence whether or not you acquire the loan of your desire.

Each lender will look at your application individually and take future outgoings into consideration including:

- Rent or mortgage repayments on any other properties

- Credit card payments

- Car loan or lease payments

- Childcare expenses

- Insurance premiums (e.g. health, life, car)

- Taxes (e.g. property, income)

- Utilities (e.g. electricity, gas, water)

- Phone and internet bills

- Groceries and household expenses

- Entertainment and leisure expenses

- Travel expenses

- Health and wellness expenses (e.g. gym memberships, medical bills)

- Debt repayment plans (e.g. student loans, personal loans)

- Child support payments (if applicable)

Debt-to-income ratio (DTI)

Lenders employ debt-to-income ratio (DTI) to measure a borrower’s financial situation, dividing their total monthly debt payments by gross income. Different common debts might be included in the calculation such as credit card or store card payments, loans, rent or mortgage expenses, student loan obligations, and car finance instalments. If you’re looking for that next loan approval then DTI could just be your saving grace!

Aiming for a loan-to-income ratio of 20 to 30% is typically the best way to guarantee the lowest possible mortgage interest rates. Nevertheless, certain lenders may still provide competitive rate offers for individuals with higher debt-to-income ratios.

If your loan-to-income ratio is over 50%, you should consider paying off some of your debt to secure better mortgage rates. Doing this will increase the probability of procuring desirable interest rates for a loan.

By taking into account all of these expenses, lenders can gain a better understanding of the borrower’s fiscal situation and determine whether or not they are eligible for a mortgage. It is extremely important that borrowers reveal accurate information about their outgoings; any discrepancy could lead to rejection for the said loan–or approval for something too costly in regards to their financial circumstances.

Debt to Income Ratio Calculator

Regular monthly costs

When a lender is reviewing your application for your mortgage, they will take into consideration more than just the costs of housing. Other expenses that you may have each month are referred to as outgoings and can include:

- Mobile phone contracts and utility bills

- Streaming services

- Gym memberships

- Regular investment contributions

When taking on a mortgage, it is essential to include all of your typical outgoings in the affordability assessment process. To make sure you are fully prepared ahead of beginning the application procedure, take a look at an example questionnaire and review each expense before continuing.

Do affordability checks cover gambling?

If you’re an occasional gambler, taking part in sports betting or any other type of online gambling can act as a red flag for lenders when evaluating your mortgage application. It could result in your assessment being adversely affected. To ensure that this doesn’t happen, it’s recommended to abstain from gambling altogether before applying for a loan, or alternatively find a broker who knows which creditors are open to considering applications from people with some history of wagering.

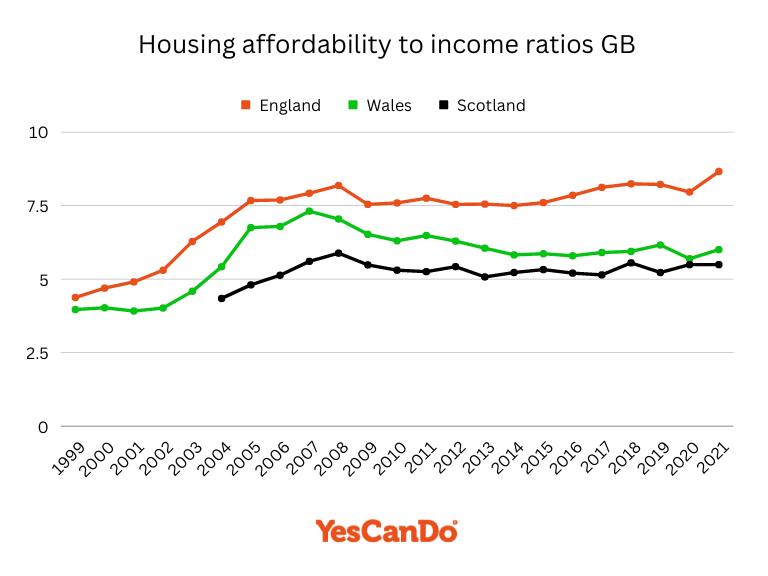

Housing affordability to income ratios in England, Wales, and Scotland

Below is a graph that shows the affordability-to-income ratios in England, Wales, and Scotland from 1999 to 2021.

Mortgage affordability calculator

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Why a lender might decline your mortgage application

There are several reasons why an application for a mortgage may be declined based on affordability. Some common reasons include:

- insufficient income

- income from sources that are not accepted by the lender

- low disposable income after accounting for monthly expenses

- high levels of regular debt or a high debt-to-income ratio

- and poor credit.

Working with a mortgage broker can be an invaluable resource when it comes to making sure you don’t get rejected or have any negative marks on your credit file. Brokers are experts in the field and they know exactly which lender is most likely to approve your loan application, increasing your chances of success.

How affordability checks differ between types of mortgages

Depending on the type of mortgage you seek, lenders may evaluate your affordability in various ways. To illustrate this, here are several examples of how each loan option might be assessed:

First time buyer affordability checks

For those looking to take that first step into homeownership, lenders will evaluate your capability for mortgage repayment by taking into account income, debt, and other expenses. As part of the mortgage affordability checks lenders will also review the borrower’s credit score in order to ascertain their financial background as well as the value of the property they plan on purchasing. With this information in hand, mortgage lenders can make an informed decision regarding whether or not you are able to afford a mortgage loan. A favourable credit score and an affordable property can improve your likelihood of being accepted for a mortgage. First-time buyers should be fully aware of how good their current credit report is and take measures to strengthen it if needed, as this can significantly influence whether they qualify or not.

Buy to let affordability checks

When obtaining a buy-to-let mortgage, the borrower’s annual income is not as crucial as it would be for residential mortgages; instead, lenders focus on the likely rental revenue of said property. Most require that expected rent cover 25-30% more than payments required by the loan. Additionally, borrowers will typically need to make a bigger down payment for this specific type of home purchase.

Affordability checks if you’re self-employed

Self-employed borrowers or business owners seeking a Self Employed Mortgage must recognize their mortgage affordability check may be structured differently in comparison to traditional employees. Some areas of focus that will have greater importance during the calculation process include:

- Business structure: When lenders evaluate an application, they may take into account if you are a sole proprietor, company owner, or independent contractor.

- Trading history: Lenders may review your trading history and accounts for the past 2-3 years.

- Profit or dividends: Your share of net profit or dividends may be considered.

- Pension contributions: Lenders may review how much you contribute to a pension or self-invested personal pension (SIPP).

- Business and personal expenses: Lenders may consider both business and personal expenses when evaluating your affordability.

For self-employed borrowers, or business owners looking for a mortgage, it is essential to be prepared with comprehensive financial documentation and full disclosure of their finances. This will heighten the probability of acceptance from lenders.

Remortgage affordability checks

Upon researching a remortgage, you must consider both your current lender and any new ones since mortgage providers will assess several additional elements beyond the usual criteria.

- Interest rate stress tests: Lenders may conduct an in-depth analysis of your finances to ensure you can cover the mortgage payments, even when the interest rates rise. That way, they can guarantee that you are able to comfortably afford this loan for years into the future.

- Remortgage Property valuation: Lenders may order a property valuation to determine the current value of your home.

- Remortgage Fees: Lenders may review your ability to cover the fees involved in the remortgage process, including application, valuation, and solicitor’s fees.

- Credit scores: Mortgage providers may review any changes to your credit scores since you took out your current mortgage.

- Early repayment charges: Banks and building societies may consider whether there are any early repayment charges associated with your existing mortgage that would need to be paid in order to complete the remortgage.

Speak to an expert broker to prepare you for affordability checks

Consulting an experienced mortgage broker like ourselves is a sound decision when preparing for the affordability evaluations. Our specialist mortgage advisors can offer you significant guidance and assistance to make navigating this process simple, as well as enhance your chances of procuring the loan you are looking for. Working with our expert team guarantees that you will have no worries while being fully prepared. This in turn will allow you to get the lowest mortgage payment each month with the lowest mortgage interest rate possible.

FAQs for Mortgage Affordability Checks

Has the affordability test been scrapped?

The Bank of England has announced the discontinuation of their mortgage affordability test as of August 1, 2022. Initially implemented in 2014 to guarantee that borrowers are not taking on more debt than they can handle and uphold underwriting standards, these checks necessitated individuals to demonstrate they could pay back their mortgages even if interest rates rose above 3%, which is the lender’s average rate. Consequently, this move worked towards both protecting lenders from soaring levels of debt and ensuring responsible borrowing practices among consumers.

To better safeguard against growing household debt, the Bank of England changed their approach to affordability tests by introducing a loan-to-income limit. They believe that this method is more effective in preventing rising debt levels than relying solely on mortgage affordability assessments.

Are all mortgages based solely on affordability?

In the UK, banks and building societies are mandated to conduct an affordability assessment as part of mortgage applications. This helps lenders evaluate if borrowers would be able to afford their mortgage based on income, debt levels and other expenses. Despite this being a major element in the evaluation process that determines whether or not they accept a borrower’s application for financing, it is only one factor taken into consideration along with credit rating, condition of property bought and deposit amount contributed by the applicant.

Is an affordability check the same as a credit check?

When it comes to mortgages, a lender will conduct an affordability test and credit check for each borrower. An affordability assessment takes into account factors such as income, debt load, current expenses and capabilities if interest rates increase in the future. On the other hand, a credit check evaluates the individual’s history of handling debt including accounts opened or closed; payment patterns observed; and overall standing with their score.

When seeking a mortgage, all lenders will use credit checks to assess your financial history and stability. These assessments are carried out not only by lenders but also landlords, and businesses that lend money or extend credit. Make sure you’re aware of your credit score and take steps to improve it if need be; having an excellent rating can give you the edge when applying for loans!