Having proof of deposit is important for a successful mortgage application. This is why our mortgage client support managers have written a helpful guide to follow when proving funds for your mortgage. Learn what mortgage lenders accept as a legitimate source of deposit, and put the odds in your favour by getting your mortgage application off to a sound start.

Trying to confirm the source of your deposit for a mortgage application can often prove difficult, especially if you’re unsure of how to provide evidence that meets the lenders’ criteria. Don’t worry though – even non-standard deposits have ways and means of being verified. In this guide, we’ll show you how to demonstrate various types of deposits and explain what assistance a mortgage broker provides in these scenarios. Learn more about proving your deposit today!

How to provide proof of funds for mortgage approval

Proof of deposit isn’t just about proving you have the money, it is about proving where the money originated from.

On a daily basis at YesCanDo we see deposits coming from several sources including an ISA, bank account, and savings account. As well as these more common deposit sources we also see deposits coming from overseas savings and gifted deposits from a family member.

Lenders need a paper trail such as bank statements

A paper trail of where the money started out from is required to satisfy the mortgage lender and solicitors requirements to ensure the deposit is from a legal and legitimate source. Just because you have the money in your bank or savings account does not necessarily mean that it is classed as savings and as such, more evidence can be required.

When it comes to conventional deposit sources such as personal savings, mortgage lenders prefer to witness the funds accumulating in your bank account for an extended period of time – typically at least six months.

To simplify the process of making deposits, please find a comprehensive list below outlining all necessary evidence to provide based on your deposit type.

Personal savings

Most lenders and solicitors require a minimum of 3 months’ bank statements to show the build-up of your savings.

Is your deposit true savings?

By that we mean, have you saved the money yourself, month in, month out from your earnings, if so, then that is true savings and a lender requires to see 3 months of each bank statement of the multiple accounts that has the savings in. If you have moved the money around then a paper trail may be needed You will need to see the statements for the account it was once in, showing any transfers and the statement to which you transferred it to

Selling property or other assets

You might advise us that your deposit is coming from savings when in actual fact, it has come from the sale of a previous property, if this is the case, the documents we need to see are:

- a completion statement from your solicitor,

- a bank statement from an established bank account showing the funds being transferred to you from your solicitor and then if you have transferred that to another account,

- we will also need to see the bank statements from which the money has been transferred to and from.

Equity released from a property

If your deposit is coming from the sale of your current property, a memorandum of sale will be required.

As well as providing the proof of deposit to us, as initially stated, your solicitor and possibly your estate agent may ask you for additional documents over and above what is requested from you.

Inheritance

If you have received an inheritance payment and are using this as your deposit, you will be required to provide a certificate of deposit inheritance letter from the solicitor confirming details of the inheritance to evidence this. This document must clearly state the amount of your inheritance and you should provide a copy of your bank statement that confirms the sum has been moved from the executor or solicitor’s account into yours.

If you then transfer the money into a savings account, we will need to see the bank statements from the accounts to which the money has been transferred from and to.

Gifted deposits

If your deposit is being gifted to you by a family member, the person gifting this to you will need to complete a gifted deposit letter. You may also be required to provide a copy of their ID and a bank statement to show they have the funds ready to gift to you. If the deposit is coming from outside of the UK, there will be additional documents required. Each mortgage lender has their own specific criteria for this. Please see our separate guide on gifted deposits for more information.

Help to Buy ISA or ISA

We will need an up-to-date statement showing the available funds however because the majority of ISA statements do not show your name, address, account details, etc you may also need the annual ISA statement which does show those details.

Savings in an overseas bank account

Conveyancing solicitors can easily determine if any illegitimate activity is transpiring with funds from an established, overseas checking account. This eliminates the need for extensive tracing of where the cash originated, lending a certain peace of mind to all parties involved.

In the UK, proof of savings can be demonstrated similarly to personal savings by providing copies of bank or saving accounts statements that show regular in-payments that are traceable.

Cash

Although only a handful of solicitors accept any cash at all, they usually have an upper limit to the amount taken (typically no greater than £300).

If your bank statement shows a large amount of cash that cannot be attributed to any previously mentioned sources, you may wish to consult with either a solicitor or mortgage broker.

Lottery Winnings

If you are fortunate enough to be able to use lottery winnings for your mortgage deposit, then a receipt confirming the sum of money won from the lottery company and its corresponding bank statement must be provided. This will ensure that you can move forward with using your winning funds for your mortgage deposit.

Gambling winnings

Lenders prefer to lend to customers that do not gamble on a regular basis. If you were to win a large sum of money from gambling, it would be considered. The issue lies in how often you gamble and what your bank statements show for the amount paid in and out of your established bank account to gambling. If you went on a holiday to Vegas for example and won a jackpot prize, it would be looked at more favourably than if you had accumulated a deposit with regular betting over several months or years. But ultimately, each applicant is considered on a case-by-case basis.

Regular gambling is known to cause massive issues when applying for a mortgage, learn more about what stops you getting a mortgage?

Don’t feel discouraged if you are uncertain of how to show proof of your deposit or think that you lack adequate evidence for the mortgage lender; our experienced fee-free team is here to help. We will assist with constructing the appropriate paperwork and connecting you with a lender who is willing to be flexible on types of deposits while still granting approval. – Suzanne (Client Support Manager)

How likely a mortgage lender is to accept your deposit source

If you are applying for a mortgage, the tables below show how likely your deposit will be approved based on its source. We have divided each type of deposit into categories in order to indicate their level of acceptance…

Mortgage deposit sources that are widely accepted by lenders

| Deposit Source | Mortgage Lenders’ Stance |

|---|---|

| Gifted deposits from close family | Lenders generally view gifted deposits from near family members as standard. Legal security for all parties involved in the transaction is ensured with a gifted deposit letter. |

| Personal Savings | Lenders prefer deposit funded by personal savings. Evidence, such as bank statement or savings account statement, is required to demonstrate the growing balance over time. |

| Proceeds from the sale of a property | Lenders require a completion document from a solicitor or conveyancer and bank account demonstrating the funds from the sale. |

| Inheritance | Most lenders will accept an inheritance-funded deposit with satisfaction, requiring only a letter from the executor outlining the amount obtained and proof of funds from a bank account statement. |

| Equity released from a property | Lenders will require evidence of ability to sustain payments for an increased or second mortgage if purchasing another home while releasing equity from one. |

| Sale of other assets | Lenders often allow securing deposits through the sale of legally obtained assets, such as cars, memorabilia, or artwork, with legitimate proof. |

If your mortgage deposit is sourced from any of the choices mentioned above, you can be sure to have a wide selection of rates and deals, depending on your type of deposit. Though having an adequate amount of money saved up and a commendable credit history are two significant factors that lenders consider when making their decision. So it is advised to speak with an experienced mortgage broker beforehand so as to guarantee yourself the best possible deal based on all these components combined.

Deposit sources that are sometimes accepted by lenders

| Deposit Source | Mortgage Lenders’ Stance |

|---|---|

| Gifts from distant relatives | Lenders are cautious about gifts from distant relatives as they have to ensure that it is a true gift and not a loan under the money laundering act. A legal agreement is needed to prove it’s a gift if a lender is willing to accept it. |

| Overseas savings | Lenders may find it difficult to trace and confirm overseas savings, but funds originating from a reliable bank account with legitimate tracking information may be easier to accommodate by some lenders. |

| Gambling winnings | Lenders are very wary of gambling winnings as a deposit source. They will inspect bank statements and deduct any gambling-related proceeds from income before determining the amount of loan accessible. Lenders do not generally like gambling and gambling-related payments or winnings can result in loan rejection. |

If your mortgage deposit originates from any of these sources, you may have to deal with a higher probability of being rejected or obtaining an unfavourable offer. To counter this risk, speaking to a professional mortgage broker could be ideal – they will match you with the lender best suited for your needs. This can benefit you in various ways; not only does it save time and money due to potentially lower interest rates but also guards against negative reports on your credit report by reducing unnecessary hard footprints on your credit file.

Deposit Sources that rarely accepted by lenders

| Deposit Source | Mortgage Lenders’ Stance |

|---|---|

| Cash | Many lenders frown upon cash deposits as these are difficult to track and trace. They can even make the entire account ineligible for a property purchase, meaning that no money from it could be used regardless. |

| Gift from friends | Mortgage deposits from anyone other than a close family member are typically perceived as riskier, hence why so few lenders will accept them. However, there may be some special cases in which your loan is approved if you contribute additional funds to prove that you’re invested in the venture. If friends or family offer to gift you money for your mortgage deposit, it’s wise to chip in part of your own cash too- this can increase your chances of success and make lenders feel more secure about their investment. |

| Gift from an employer | To protect against money laundering and fraud, most lenders will not accept a gift from a third party, such as an employer. However, some may consider it under certain conditions – but be prepared for extensive due diligence checks. These procedures carefully examine the origin of funds and could include identity verification on the donor’s behalf. |

| Personal loans | Most lenders do not accept deposits from personal loans, credit cards, and overdrafts because borrowing money to borrow more money does not give them confidence in your financial situation. However, depending on your circumstances there are a few mortgage providers who may still consider it as an option for you. |

If you are using one of the above-mentioned deposit sources, it is essential that you consult a mortgage broker in order to maximize your chances for mortgage approval. Without professional advice, there is an increased likelihood of being denied a mortgage or forced to settle for unfavourable rates.

Why do you need to evidence your mortgage deposit?

In the United Kingdom, all mortgage borrowers are required to divulge where their deposit was sourced. Mortgage lenders and solicitors strictly abide by anti-money laundering regulations and guidelines in order to ensure that each mortgage deposit is legally procured from authorized sources.

Provide accurate information

Submitting accurate deposit source information is essential to having your mortgage application approved. To avoid any issues, it’s crucial that you are honest on your mortgage application from the beginning. Otherwise, there’s a risk of potentially having your mortgage application declined due to non-approved sources. Making sure everything is correct and complete will guarantee an efficient process for everyone involved!

Bank statements provide a paper trail

You must provide evidence of the origin of your mortgage deposit; lenders and solicitors will conduct extensive investigations to validate your statements about its provenance. The most common way of proving mortgage deposits is bank account statements from your bank or even multiple bank accounts.

Obtaining proof of the origin of your mortgage deposit can take various forms, such as a review of saving and bank account statements, signed contracts, and certificates.

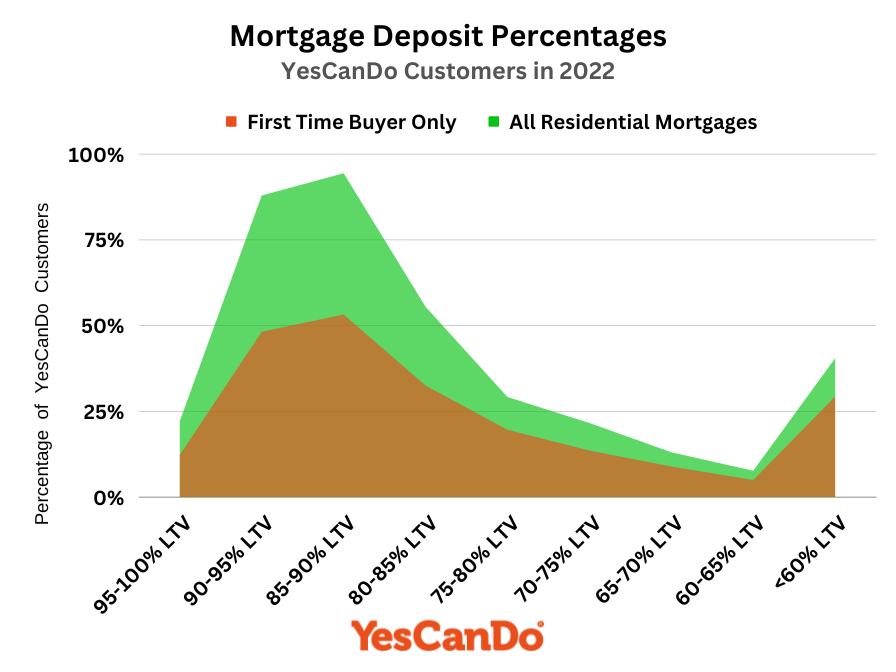

This graph was created by YesCanDo | Data from YesCanDo Money

This graph was created by YesCanDo | Data from YesCanDo Money

3 main points to consider when proving your deposit

Below we have summarised and highlighted 3 main points you should take away from this proof of mortgage deposit guide.

1) Keep in mind that some deposit sources are more desirable than others.

If you don’t have a traditional source for your mortgage deposit, it can be more difficult to get approved and secure the best possible deal.

2) A mortgage broker can help you verify the source of your deposit.

If you’re not sure how to prove your deposit or think that you’ll be denied due to an “uncommon” deposit source, reach out to a fee free mortgage broker. They can assist you with the appropriate paperwork and refer you to a lender who is willing to accept rarer types of deposits.

3) We are an experienced fee-free independent mortgage broker

Our expert team is on hand to help verify proof of your mortgage deposit. If you’re looking for a mortgage with an unconventional deposit type, the key to success is finding experts who specialise in this area. Our team is knowledgeable about the whole mortgage market and will connect you with the perfect lender suited to your needs and financial situation as well as your unique deposit type. Don’t hesitate – to get in touch with our team today via 033 0088 4407, our online form or WhatsApp.

To learn more about the information needed and how to prepare for a mortgage we recommended reading:

- What information will I need to get a mortgage?

- How to prepare for a mortgage application

- Proof of income for mortgage

FAQs

Why do solicitors ask for proof of funds?

When purchasing a property in the UK, solicitors and also estate agents may ask for proof of funds due to an assortment of reasons.

- To guarantee that the buyer is financially capable of successfully completing their purchase: Before a solicitor can move ahead with the transaction, they must affirm that the purchaser has sufficient funds to cover their deposit, any associated fees and stamp duty, and other expenses which may arise during the process.

- To comply with anti-money laundering regulations: To ensure all funds are sourced properly and that no money laundering is taking place, it is essential to provide proof of the funds.

- To ensure a smooth and efficient conveyancing process: Presenting evidence of funds from the beginning can avert any issues or delays down the line. This is especially crucial when buying a house in a chain, as this will ensure that everything runs smoothly and to schedule for all involved.

Proof of funds safeguards a seamless property purchasing process and confirms that the buyer has sufficient financial resources to conclude the deal.

What’s the difference between an exchange deposit and a mortgage deposit?

An exchange deposit is part of the total amount that must be paid when exchanging contracts and this adds up to 10% of the property's purchase price - it will not be refunded if something goes wrong with the transaction. To put it into context, let us say that you are paying a 15% deposit; initially, 10% (the exchange deposit) should come out from your pockets while the remaining 5%, will be needed at completion time. However, there is an exemption here: if you obtained a 95% mortgage then all 5% needs to go as soon as exchanging contracts happen.

Do I need proof of deposit to get an agreement in principle?

You do not need to prove you have a deposit to get a mortgage agreement in principle however you will not able to proceed to a full mortgage application without proving you have a deposit. All you will need is a bank statement showing the deposit. Quite often this will be from a savings account or ISA.