Are you thinking about changing your residential mortgage to a buy to let mortgage?

Change to a buy to let mortgage

This might be something to consider if you want to purchase another property to live in but still keep your existing house for the purposes of a rental income.

You might also consider the option if you intend to be away from your property for a long period of time, perhaps because you are travelling or staying with other family members for an extended period.

If you want to move into your partner’s property, this is another reason why you might want to swap your existing mortgage into a buy to let mortgage. You might also want to take this step if you want to release equity for a new property.

But will a mortgage lender approve a change of mortgage?

Yes, you can change your existing mortgage to a buy-to-let mortgage. However, there are a few things you need to know first.

In this guide, we will let you know the ins and outs of changing a normal mortgage to a buy to let mortgage, with some other useful information that we think will be helpful to you.

Changing a residential mortgage to buy to let

As we suggested, you should be able to change your current residential mortgage into a buy to let mortgage. This will be good news for you if you need to move for practical reasons or if you’re looking to make a living from a rental income.

However, as was the case with your current mortgage, you will need to meet the lender’s eligibility criteria before you make the switch.

Lender criteria for a buy to let mortgage

When it comes to a mortgage provider’s lending criteria for a buy-to-let, their requirements are usually the same as those for a residential mortgage.

However, there is one key difference.

To be eligible for a buy to let mortgage, you usually need to have had your current mortgage for at least six months before you make the switch. There may be a few mortgage providers lending to customers who have lived in their homes for a shorter period but these are usually specialist lenders who don’t always offer the best deals. You could consider these at your own risk but it may be better to wait until you have lived in your home for a longer fixed period.

You then need to meet the other aspects of the lender’s eligibility criteria, which include the following.

Affordability

As with a residential mortgage, you need to provide evidence of your income to the lender. You also need to show them your projected rental income. While you won’t be able to look into the future to get a guaranteed income figure, you can get an estimate by looking at the rent other landlords charge for properties similar to yours. Most lenders will want to see that your approximate rental income is at least 125% of your mortgage payments before letting you make the switch.

Credit history

If there are any negative changes on your credit file, your application may be turned down. Therefore, it is in your best interests to improve your credit rating before you remortgage to a buy to let as your application will have a better chance of success and you may be eligible for a better buy to let mortgage deal.

All hope isn’t lost if you do have a bad credit history as you may still be able to get a new buy to let mortgage from a specialist lender. This is no guarantee that you will get the best deal, however, so it’s still worth checking your credit file and making a few positive changes before you approach a lender.

Deposit

You don’t necessarily need to save up for a deposit if you’re turning your residential property into a buy to let rental property. This is because the equity released from your home can be used as a deposit although you will need at least 20-25% equity in your property to qualify for this.

Landlord experience

Not all lenders will turn you down if you have no prior landlord experience. However, some buy to let mortgage providers will insist that you have had some experience before changing your residential agreement to a buy to let agreement.

To find out which lenders cater to first time landlords, it is recommended that you speak to a mortgage broker such as ourselves.

Property type

If you live in an HMO (House In Multiple Occupation) property or a high-rise apartment, you might have difficulty converting a normal mortgage into a buy to let mortgage. This is because many lenders prefer traditional property types, such as terraced or semi-detached houses that are the sole property of their applicants.

If your current lender or any other mortgage providers turn you down because of your property type, you may still be able to get a mortgage from a buy to let specialist lender, so establish online mortgage advisor help at YesCanDo Money for advice and support.

When it comes to buy to let mortgages, these are just a few of the things lenders will take into account. If you are unsure at all about changing mortgage and want some of your questions answered, get in touch with our team who will be happy to help.

Do I Need To Change To A Buy-To-Let Mortgage?

You don’t necessarily need to change your current mortgage to a buy to let mortgage. If you only want to rent out your property for a temporary period, perhaps because you are going to be away from your home for a short while, your current mortgage provider might give you ‘consent to let.’ This is where they let you keep your current mortgage while you rent out your home.

‘Consent to let’ explained

‘Consent to let’ is often given to ‘accidental landlords.’ i.e those people who decide they need to rent out a property for a temporary period due to a change in personal circumstances. They might need to move to a new town for work purposes, for example, or they might inherit a property that wasn’t previously their own.

So, if you have no plans to rent out your property long-term, it might be that ‘consent to let’ is the right answer for you.

There is no guarantee that you will be granted ‘consent to let,’ however. If the period for which you want to rent out your property is too long or if the lender isn’t satisfied you will make enough rental income, you may be turned down. You might also be turned down if they don’t believe your change in circumstances is genuine and you want an investment mortgage

If ‘consent to let’ is granted, you would still be able to keep your current mortgage. However, you may have to pay an admin fee (usually £7) and you may see a rise in the interest rate on your mortgage.

What do I do if ‘consent to let’ is refused?

If your current lender refuses ‘consent to let,’ they will let you know the reasons why. It might be because of the reasons we stated earlier or it might be because your mortgage is in arrears.

If you are turned down, you shouldn’t decide to turn your residential accommodation into rented accommodation anyway, as you would be in breach of your mortgage conditions. Your lender might then subject you to financial penalties or they might repossess your property. As such, you should stick by their decision so as to avoid the financially painful consequences that would otherwise ensue. It makes sense you investigate if a buy to let mortgage will work best for you.

Why Would I Need to Change from a Residential Mortgage to a Buy-to-Let Mortgage?

If you needed to or wanted to leave your current property outright, you have the choice of selling it or renting it out to others. If you decided to rent out your property, you would need a buy to let mortgage.

You would also need a buy to let mortgage if the lender refused ‘consent to let.’

How to change to a buy to let mortgage

At YesCanDo our experience is you need to have an expert mortgage advisor when changing a mortgage to a buy-to-let. Mortgage lenders have very different attitudes to switching to a buy-to let and our observation is that it needs to be handled in an accurate and professional way.

Before changing to a buy to let mortgage, there are a few things you should know beforehand.

For starters, your interest rate is likely to rise as mortgage rates for a buy to let property are typically higher than on a residential property. As such, you should expect higher monthly mortgage payments on your new mortgage. In some cases, you may need to pay early repayment fees if you’re still within the fixed-term period of your mortgage. Depending on where you live in the UK, you might also have to register as a landlord before you take on any tenants.

If you still wanted to change to a buy to let mortgage, despite these ‘inconveniences,’ the steps are as follows.

1. Speak to your current mortgage lender

Let your lender know of your intentions to rent out your property long term. Ask them about the early repayment charges you may be subjected to and ask them about the deals they are offering on buy to let mortgages. If they are able to make you a deal, don’t switch to them just yet. It’s wise to get professional advice from a mortgage advisor before you continue, as switching to a new lender may be worth your while.

2. Get a rental income forecast

As is the case when applying for a standard residential mortgage, lenders want to make sure that you have the financial means to make your monthly payments. As such, they will want to know how much rent you are likely to get on your buy to let property, as this will give them an idea of your approximate annual income. To get a rental forecast, speak to an estate agent or look at rental property listing sites to find out more about rental prices in your area.

3. Get in touch with a mortgage broker

When you are ready to change your residential mortgage to buy to let, it is in your best interest to get tailored advice from a mortgage broker. Most mortgage brokers have experience in helping customers transition from a residential mortgages to buy to let mortgages, and they can give provide mortgage advice related to your new property too.

All the advisors at YesCanDo Money have the specialist finance and mortgage experience to help customers change their residential mortgages to buy to let mortgages, so no matter your circumstances, give us a call today to get the ball rolling.

Educate yourself further on buy-to-let mortgages:

- Buy-To-Let Costs

- What is the lowest deposit buy to let mortgage?

- Buy-To-Let vs Residential Mortgage

- Can you remortgage a buy to let property?

- Buy-To-Let Mortgage Tips: Things you need to know

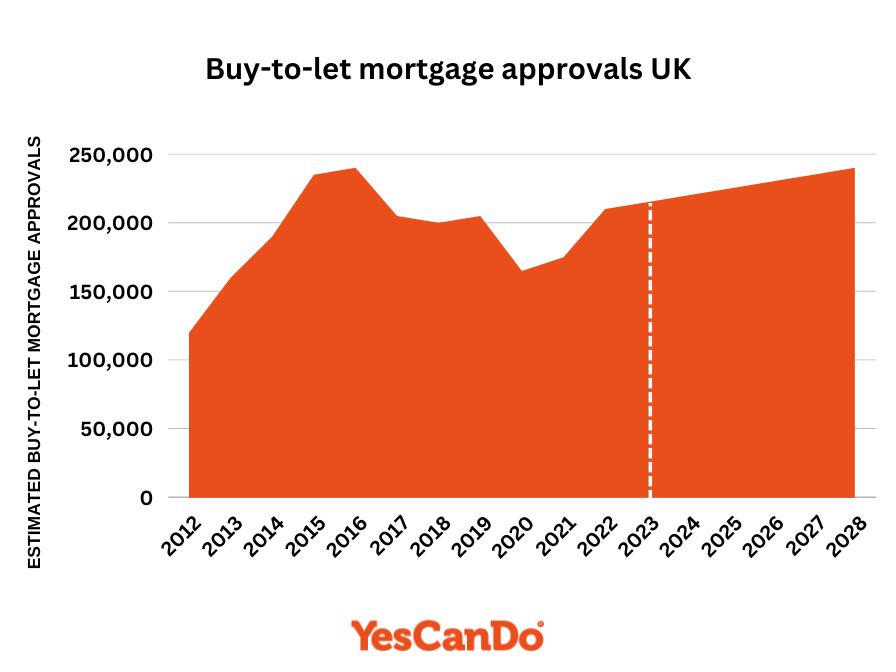

How many people have a buy-to-let mortgage UK?

Switch to a buy to let mortgage with help from expert mortgage advisors YesCanDo Money

If you would like to change your residential mortgage to buy to let, get in touch with an online mortgage advisor at YesCanDo Money today. We will search the entire market to find you an affordable mortgage deal, at a loan to value that is right for your financial situation.

Get in touch about your mortgage online or by calling us for a no-obligation chat and we will book you an appointment with an experienced mortgage advisor.

Your advisor will talk to you about your existing mortgage, give you advice on changing your residential mortgage to buy to let, and will compare the deal being offered by your current mortgage provider with the deals that are being offered by mortgage lenders elsewhere.

After searching the market for mortgages with the most attractive mortgage interest rate, your exclusive mortgage expert will explain the range of deals being offered. They will then take you through the next steps of your buy to let remortgage if you decide to move away from your current mortgage provider.

If you are happy with the mortgage terms on the deal your advisor has found and you still want to change your residential mortgage to buy to let, they will help you throughout the application process until the new deal has been finalised.

Your advisor can also give you advice related to mortgages for your new property with a discussion of the financial implications involved when you have two mortgages to pay for.

As we are a fee-free mortgage broker, your advisor will do all of this and more for FREE!

So, if you want to convert your residential mortgage to buy-to-let, either because of necessity or as an investment, get in touch with our team of mortgage experts today to see how we can help you.

This guide has been written to help and give you an idea of options open to you and does constitute financial advice.