With the economy in constant flux, homeowners want stability and certainty with their mortgages. For the last 20 years, the vast majority have opted for either 2-year or 5-year fixed rates. The 2-year offered flexibility but not security, while the 5-year gave peace of mind over a longer term. With the consensus that interest rates will hit their maximum in late 2023 or early 2024 a new option is now gaining popularity – the 3-year fixed-rate mortgage. This halfway point between short and long-term provides the best of both worlds. The 3-year fixed gives stability by locking in a rate while allowing flexibility to take advantage of dips in rates after 3 years. This balanced approach is appealing to many in uncertain times.

Threefold Surge in 3-Year Fixed Rates for YesCanDo Money

At YesCanDo Money, we have found that the popularity of 3-year fixed-rate mortgages has grown noticeably in recent months. From January to April 2023, these medium-term fixed mortgages accounted for a modest share of new mortgages. But from May to August, we saw a 360% increase in demand for 3-year fixed-rate mortgage products. This significant increase shows that homeowners are turning to the stability and flexibility these mortgages provide. With economic uncertainty on the rise, the 3-year fixed rate strikes the balance between the very short 2-year and the long 5-year.

Since interest rates started increasing in December 2021 the vast majority of our clients at YesCanDo Money have been choosing 5-year fixed rates. As we have progressed through 2023 we have seen a massive uptake in clients choosing a 3-year fixed-rate mortgage.

The feedback our clients are giving us is that they feel worried about locking themselves into a high-interest-rate mortgage for 5 years but also want more peace of mind than a 2 year fixed rate gives them. The 3-year fixed rate seems to hit the sweet spot for people needing a mortgage as we move nearer to the end of 2023 and hopefully, the end of interest rate increases.

Homeowners seem to appreciate locking in a consistent rate for a few years while retaining the option to refinance if rates drop. The noticeable spike in interest indicates that the 3-year fixed rate mortgage is becoming a popular choice for those seeking security and flexibility. – Steve Roberts (Founder of YesCanDo Money)

This guide explores fixed rate mortgages, focusing on the emerging popularity of 3-year fixed rate loans. These provide consistent repayments over a set timeframe, balancing the stability of a 5-year and flexibility of a 2-year fixed rate. Read on to learn why a 3-year fixed could bring certainty to your financial decisions.

What is fixed rate mortgage?

A fixed rate mortgage is a type of mortgage loan where the interest rate remains the same for the entire term of the loan. This means your monthly mortgage payments will be the same amount for the length of the fixed rate period, which is usually 2, 3, 5, 7, or 10 years.

The interest rate is locked in at the time you take out the mortgage, so even if market interest rates rise or fall, your rate will remain unchanged. This gives you stability in knowing exactly what your payment will be each month for the fixed period.

The advantage of a fixed rate is you are protected from rising interest rates. The tradeoff is that you lose the ability to take advantage of falling rates, since you are locked into your set rate until the fixed period ends.

Fixed rate mortgages are a good choice for budgeting and peace of mind. However, an adjustable rate mortgage may make sense if you think rates will fall and you plan to refinance before your fixed period ends.

What is a 3-Year Fixed Rate Mortgage?

A 3-year fixed rate is a type of home loan wherein the interest rate remains the same for its first three years – regardless of changes to England’s base rate or lender standard variable rate. This provides greater predictability and budgeting ease.

Why Choose a 3-Year Fixed Rate Mortgage?

Choosing a 3-year fixed rate product comes with several benefits. Here are some reasons why you might consider this type of mortgage.

- Stability of Repayments – With a 3-year fixed rate, both your interest rate and monthly repayments are set for three years – making this loan an especially good solution if rates may rise in the near future.

- Short-Term Commitment – A 3-year fixed rate offers a shorter commitment compared to longer-term deals such as five year deals, which could be especially helpful if your long-term plans remain unclear or your personal circumstances change quickly.

- Competitive Interest Rates – As of 2023, many mortgage lenders offer competitive rates on 3-year fixed rate deals. It’s always worth comparing mortgage deals to find the best deal for your situation.

Which mortgage lenders released a 3 year fixed rate in 2023?

Here are some of the UK mortgage lenders that have released a 3-year fixed rate mortgage product this year:

- Nationwide Building Society: 3 Years Fixed, 4.99% fixed for 3 years, 7.99% variable.

- Monmouthshire Building Society: 3 Years Fixed, 5% fixed for 3 years, 7.49% variable.

- Yorkshire Building Society: Fixed until 28/02/2027, 5.03% fixed, 6.05% variable.

- The Co-operative Bank: Fixed until 28/02/2027, 5.09% fixed, 8.12% variable.

- HSBC 3 year fixed mortgage rate: Fixed until 31/12/2026, 5.09% fixed, 6.99% variable.

- Santander: Fixed until 02/03/2027, 5.18% fixed, 8.5% variable.

- TSB: Fixed until 31/12/2026, 5.19% fixed, 8.74% variable.

Please be aware that these rates were correct as of 3rd November 2023 but aren’t live updated rates. As they may change at any time, for the latest and up-to-date rates please speak directly with one of our mortgage advisors, or visit our page on Best Mortgage Rates UK here > for the top best current rates. Eligibility will depend on individual circumstances.

Other Fixed Rate Periods

Though this guide primarily focuses on three-year fixed-rate mortgages, a tracker mortgage or other fixed-rate periods might better suit your circumstances. Let’s briefly review these alternatives.

2-Year Fixed Rate Mortgages

A two-year fixed rate mortgage offers the shortest fixed rates. It may be ideal if you anticipate changes to your financial situation in the near future or are uncertain about longer-term commitments. The main advantage is the lower rates compared to longer fixed periods. However, keep in mind that you’ll need to reassess your mortgage situation sooner, which could lead to additional arrangement fees.

5-Year Fixed Rate Mortgages

A 5-year fixed rate provides a longer period of stability with your mortgage repayments. This can be beneficial if you prefer the certainty of knowing exactly what your mortgage costs will be for a significant period. It’s particularly appealing in an environment of rising interest rates. However, the trade-off is typically a slightly higher interest rate compared to shorter fixed periods. Also, early repayment fees may be higher if you need to exit the mortgage deal early.

10-Year Fixed Rate Mortgages

For those in search of long-term financial security, a 10-year fixed rate mortgage could be the perfect choice. This loan allows you to lock in an interest rate for 10 years at once – offering peace of mind regarding mortgage repayments and eliminating uncertainty about changes to financial circumstances during that period. Unfortunately, interest rates tend to be higher; early repayment charges can also be quite substantial should you need to switch loans within 10 years.

Pros and Cons of a 3-Year Fixed Rate Mortgage

As with any financial product, 3-year fixed rate mortgages come with their own set of advantages and disadvantages; understanding them will help you decide whether it is the right decision for you.

Pros

- Stable Repayments: Your monthly repayments will remain consistent for three years, making budgeting simpler.

- Protection from Interest Rate Rises: Even if interest rates rise, your repayments will remain the same.

- Short-term Commitment: Ideal if your long-term plans remain unclear or you expect that your financial circumstances could change significantly over time.

Cons

- Early Repayment Charges: These charges may apply if you want to repay your mortgage early or exceed its agreed limit during its fixed rate period.

- Higher rates if interest rates fall: If rates fall, you won’t benefit from the decrease.

- Potential rate increase after the fixed period: When the fixed rate period ends, your mortgage will usually switch to the lender’s standard variable rate, which could be higher.

Comparison with Other Types of Mortgages

A 3-year fixed rate mortgage is one of many different mortgage products available today, here’s how it stacks up against others:

Variable Rate Mortgages

Variable rate mortgages offer greater flexibility over fixed rate loans. Your monthly mortgage payments could change as interest rates fluctuate; this makes variable rate mortgage an appealing option if rates decline; if they rise instead, however, they could cause your repayments to go up significantly.

Tracker Mortgages

Tracker mortgages follow the Bank of England base rate plus a set percentage. This means your repayments can go up or down. If you want certainty about your repayments, a fixed rate could be a better choice.

Longer-Term Fixed Rate Mortgages

Longer-term fixed rate mortgages, such as five-year deals, offer the certainty of fixed repayments for a longer period. However, they often come with higher interest rates and early repayment charges.

If you are unsure about whether to choose a fixed-rate product or a variable one read our guide on Tracker vs Fixed Mortgage: Should I Fix My Mortgage or Get a Tracker?

Case Studies

To help you understand how a 3-year fixed rate mortgage works in practice, let’s look at a few hypothetical scenarios.

Case Study 1: First-Time Buyer

John, a first time buyer with an LTV of 80% and a deposit of £40,000 is looking to purchase a property worth £200,000 with an LTV of 80%. After researching several mortgage deals and selecting one with an interest rate of 5.1% for three years he decided on a three-year fixed-rate mortgage at approximately £960 per month over that timeframe.

Case Study 2: Remortgaging

Sarah needed to remortgage her property, valued at £300,000. With £200,000 remaining on her current mortgage loan and an SVR rate of 7% after falling onto her lender’s standard variable rate, Sarah decided to seek advice from a broker for further advice about remortgaging.

After consulting with her broker and discussing various mortgage products available to her, Sarah made the decision to switch to a 3-year fixed rate mortgage with an interest rate of 5.1% and significantly reduce her monthly repayments compared with her current 7% SVR rate (approx. £1,330 mortgage payments were reduced to around £1080 each month resulting in savings of roughly £250 each month). Sarah felt that a 3-year fixed rate gave enough time for the market to settle and interest rates to come down and felt uncomfortable with fixing her rate for 5 years.

Frequently Asked Questions

Can you get a 3-year fixed-rate mortgage?

Yes, many lenders offer 3-year fixed-rate mortgages which offer the security of fixed repayments over three years of your loan's term.

What are current 3-year ARM mortgage rates?

As of 2023, 3-year Adjustable Rate Mortgage (ARM) rates can differ widely depending on your lender and personal circumstances. To get the most accurate and up-to-date rates it is wise to compare multiple lenders.

What is a 3-year fixed-rate?

A 3-year fixed-rate mortgage refers to a loan amount wherein the interest rate remains constant during its first three years regardless of fluctuations in market rates.

What will happen to fixed-rate mortgages in 2023?

Predicting exact mortgage rates can be difficult due to various economic influences; however, mortgage rates generally follow inflation trends and the Bank of England base rate.

What is the difference between a 3 and 5-year fixed mortgage?

The primary difference lies in how long an interest rate remains fixed: with a 3-year fixed mortgage, this period lasts three years while five-year fixed mortgages typically cover five.

What are the current best fixed-rate mortgages?

A "best" fixed-rate mortgage depends on a range of personal factors, including credit score, deposit size and income. It's recommended to compare offers from multiple lenders to find the most competitive deals.

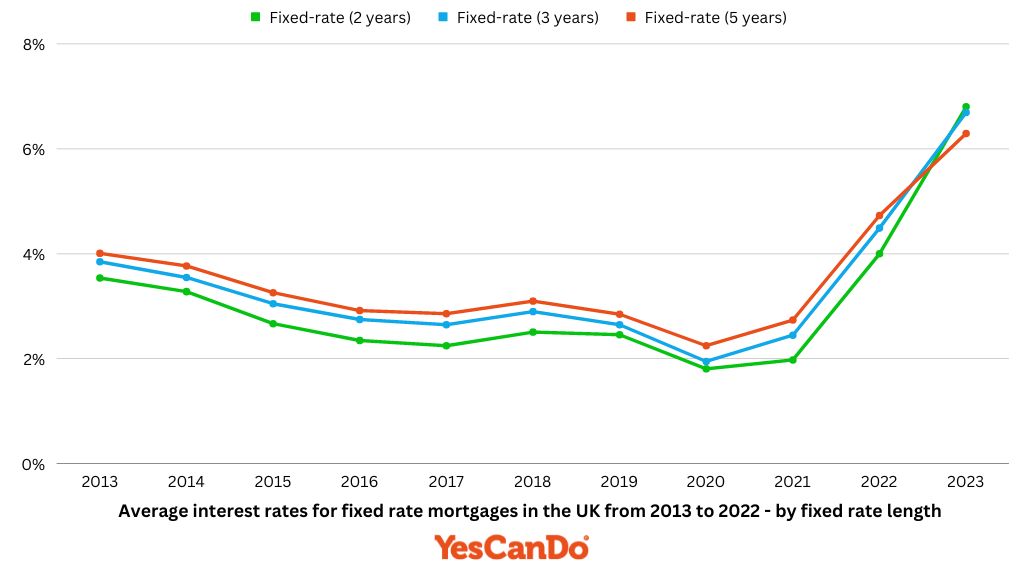

Compare 3 year fixed rate mortgages over the last 10 years

Below is a table and graph the shows what the average UK mortgage rates were for 3 year fixed rate mortgages from 2013 to 2023.

| Mortgage Rates by Type and Year | |||

|---|---|---|---|

| Year | Fixed-rate (2 years) | Fixed-rate (3 years) | Fixed-rate (5 years) |

| 2023 | 6.80% | 6.69% | 6.29% |

| 2022 | 4.00% | 4.49% | 4.73% |

| 2021 | 1.98% | 2.45% | 2.74% |

| 2020 | 1.81% | 1.95% | 2.25% |

| 2019 | 2.46% | 2.65% | 2.85% |

| 2018 | 2.51% | 2.90% | 3.10% |

| 2017 | 2.25% | 2.65% | 2.86% |

| 2016 | 2.35% | 2.75% | 2.92% |

| 2015 | 2.67% | 3.05% | 3.26% |

| 2014 | 3.28% | 3.55% | 3.77% |

| 2013 | 3.54% | 5.85% | 4.01% |

How to Apply for a 3-Year Fixed Rate Mortgage

Applying for a 3-year fixed rate mortgage involves several steps. Here’s a guide to help you through the process.

1) Check Your Credit Rating

Before applying for a mortgage loan, it’s wise to perform a credit rating check. A solid score can increase your odds of approval and ensure a more affordable interest rate.

2) Determine Your Loan-to-Value Ratio (LTV)

Your Loan to Value (LTV) ratio represents the percentage of property value that you wish to borrow against. A lower LTV increases your odds of qualifying for a lower interest rate.

3) Compare Mortgage Deals

Use a comparison service to compare every 3-year fixed rate deal from different lenders. Consider the interest rate, overall cost for comparison, and any arrangement fees.

4) Submit a Mortgage Application

Once you’ve selected the ideal mortgage deal for you, the next step is submitting an application. A fee free broker could assist with this process.

Working With a Mortgage Broker

Mortgage brokers are an invaluable source for finding the perfect mortgage solution, with access to an array of products tailored specifically for you and tailored advice that meets your individual circumstances. Some brokers even operate fee-free; instead, they receive commission from lenders instead of charging an upfront fee from you directly. Here are some key advantages of using a broker:

- Access to 14,000+ mortgage Products: Mortgage brokers have access to an impressive variety of loan products from numerous lenders, some which may not otherwise be readily available directly.

- Customised Advice: They offer tailored mortgage product advice tailored to meet the individual requirements of their clients, helping select one that will best meet their requirements.

- Cost-Effective Options: Certain mortgage brokers operate fee-free, meaning they receive commission from lenders instead of charging you an upfront fee for their services. This can make the process more cost-effective for you.

- Time Saving: Hiring a fee-free mortgage broker can save time by providing comparison services and overseeing much of the application process on your behalf.

- Expertise: Mortgage brokers possess an in-depth knowledge of the mortgage market that can prove invaluable when navigating its complexities and applications processes.

Keep this in mind when selecting a mortgage broker regulated by the Financial Conduct Authority (FCA).

Different Situations for a 3-Year Fixed Rate Mortgage

A 3-year fixed rate mortgage can be suitable in various situations. Here are a few examples.

Moving Home

If you’re moving, a 3-year fixed rate mortgage can provide peace of mind during the transition period. Knowing exactly what your monthly repayments will be helps make budgeting simpler.

Remortgaging

If your current mortgage deal is coming to an end, switching to a three-year fixed rate mortgage might help lower mortgage payments or allow you to borrow more money.

Mortgage Rate 3 year fixed: Conclusion

A 3-year fixed rate mortgage offers predictability in payments, making it a popular choice among homeowners. Before making this decision, however, it’s essential to carefully consider your personal and financial circumstances when making this choice – compare mortgage deals carefully before seeking advice from experts or brokers to make sure you get the best deal possible.

Keep in mind, your home could be taken back if you fail to make payments on time for your mortgage loan. Before taking out a mortgage loan, always ensure you can afford monthly repayments.