Are you considering mortgage overpayment as a way to save money and reduce your mortgage amount faster? Before making any financial decision, it is important to take into consideration the advantages and disadvantages of doing so.

In this guide, we will provide insight on the topic of overpaying mortgages in order for you to make an educated choice about whether or not this option would be best for you.

What exactly is a mortgage overpayment?

Boosting your mortgage payments by overpaying on your mortgage is simply when you voluntarily choose to pay more than the minimum monthly payments set by your mortgage lender. Any additional funds sent towards repaying and reducing your mortgage balance are considered an overpayment and this can be done at any time.

Examples of making a successful mortgage overpayment include:

- Regular overpayments – Suppose your mortgage repayments are £700 each month, yet you choose to pay £800. By paying regular monthly overpayments, you would overpay by an impressive amount of £1200 each year! £11,200 over 10 years!

- A one-off lump sum overpayment –If you have some excess funds, why not put them towards reducing your mortgage balance and achieving financial freedom earlier?

- A combination of the two

Our effortless mortgage overpayment calculator will demonstrate to you just how much you can save when making either regular monthly overpayments or a lump sum overpayment. You have the option of a one-time lump sum, recurring monthly payments, or both at once — which offers the biggest paybacks? Try out our simple mortgage overpayment calculator further down and find out fast!

Should you overpay your mortgage?

When you obtain a mortgage, monthly repayment instalments are required to be paid in order for the mortgage loan to be settled over the term. What many homeowners don’t realise is that they have the option to pay more than what is expected of them every month; this technique is known as making mortgage overpayments. Doing so not only will it reduce the amount of interest needed to repay your loan but also lead you on a path towards faster debt-free living!

Despite the potential advantages of overpaying on a mortgage, it’s not for everyone. In particular, if you don’t have an emergency fund in place and use your savings or other disposable income to make large payments towards your loan balance, you’d be left high and dry during times of financial distress should any unexpected costs arise. Additionally, each lender has their own policy when it comes to these kinds of transactions – some may even inflict early repayment charge fees if you exceed certain thresholds with this kind of payment.

Can I make mortgage overpayments?

Before deciding to make mortgage overpayments, the most important thing is to examine your mortgage lender’s policies. Not many lenders allow unlimited overpayment opportunities for borrowers, but most mortgages will allow you to pay 10% of the outstanding mortgage balance each year. It is critical to check these numbers so you know just how much freedom you have whether you increase your monthly payment or even a lump sum overpayment on your loan.

Before you make an overpayment, it is essential to comprehend the terms of your mortgage. Depending on if you have a lifetime tracker mortgage or flexible offset mortgage, for instance, some may allow unlimited overpayments while fixed-rate deals can be more restrictive in their allowances. If you breach the limit established by your lender, then hefty penalty fees could follow suit.

If you’re paying your lender’s standard variable rate (SVR), overpaying may be an option for you. Nonetheless, keep in mind that SVRs are usually more costly than other mortgage options available to you. Therefore, before making any extra payments on your loan, bear in mind that it could be worth remortgaging to a more competitive deal if the cost of your current SVR is not advantageous enough for you.

How to overpay my on mortgage balance

If you determine that making mortgage overpayments is the best decision for your financial situation, inform your mortgage lender about this plan. Many lenders allow you to change and increase the monthly payments online with a direct debit or a standing order sent directly to your mortgage account. Either method will result in ending your mortgage sooner!

Another option would be to link your mortgage account as a payee on your online banking. This way, you can effortlessly make a monthly overpayment whenever it fits into your budget!

Is it better to reduce term of mortgage or overpay?

Are you looking to save on your mortgage? Then there are two options for you:

- Using excess repayments to reduce the mortgage balance.

- or request a reduction in the term of your mortgage. More often than not, this will yield greater savings.

It is essential to evaluate the advantages and disadvantages when determining whether you should overpay and therefore reduce your monthly payments or shorten your mortgage term. Opting for an overpayment plan can bring more flexibility, as you are able to include extra payments if feasible at any time. In addition, this method offers a lower risk factor since it allows you to stop payment anytime depending on your financial status.

On the flip side, shortening your mortgage term could lead to a shorter repayment period and greater savings in the long run. Despite that, this choice comes with a more significant commitment since you’ll be locked into higher monthly payments. This can cause problems if your financial situation changes or interest rates rise.

Deciding between overpaying and shortening the length of your mortgage comes down to your personal financial objectives and comfort level with risk. Weigh up both current and future economic circumstances before making a decision; it may be beneficial to consult an experienced financial advisor for valuable insight into which route is best suited to you.

Should I make my overpayments monthly or as a lump sum?

When you choose to pay more than your required mortgage payment, the decision of how lies in your hands. You can make smaller but regular monthly overpayments each month or opt for a lump sum overpayment at any time you’re able to do so. Both options will lead to interest savings, though of course there are advantages and drawbacks depending on which strategy may be best for you and your budget.

Overpaying Monthly Payments

The highest benefit of paying extra every month is its dependability. Adding the additional cost to your budget each month makes it much easier for you to plan and manage your finances. Furthermore, if ever you discover that the payments are too high, there’s no need to worry—you can reduce or halt them at any point in time and revert back to the standard monthly mortgage repayment rate.

Overpaying with a lump sum

If you want to save money, pay off your mortgage in one lump sum. This strategy can help you clear the mortgage loan faster than if it was spread out over a few years. However, it presents some risk as well. In the case of an emergency like job loss or unexpected expenses, getting that additional cash back may be difficult since most mortgages don’t permit access to such funds once they are applied towards repayment. The only way to tap into those extra payments is by remortgaging and releasing equity from your home — making this option best-suited for individuals who can handle its associated risks with relative certainty!

How much can I overpay on my mortgage?

If you are considering making overpayments on your mortgage, it is important to be aware of any restrictions that may be imposed by your lender. Typically, these limits are set at 10% of the remaining mortgage balance every year; exceeding this limit could result in hefty penalty fees that would reduce or cancel out the savings made from extra payments.

Lenders must protect their profits, after all, they anticipate making a certain amount of interest on the loan over its term. As a result, when you decide to pay off your mortgage early it has an adverse effect on your income and can be costly for them. Because of this lenders usually put in place fees to balance out any losses. It is important that you investigate your specific lender’s policy regarding bonus payments as rules may differ from provider to provider before taking action.

There are a couple of high-street mortgage lenders that allow you to pay off 20% of your outstanding mortgage balance each year. This can be very useful for example if you are expecting to receive an inheritance and want to pay down your mortgage at a fast rate.

Need help figuring out how much to overpay on your mortgage? An overpayment calculator is a perfect tool for you! All you have to do is enter the preferred amount of money and the mortgage overpayment calculator will show you precisely when you’ll be able to pay off your loan and even calculate the total interest savings. It’s so easy, yet effective – a must-have if you want an accurate assessment right away!

Mortgage Overpayment Calculator

Calculate your potential mortgage savings with our calculator below! Overpaying either in monthly payments or a lump sum will help you save money on your mortgage. Check it out and see how much you can save today!

How does overpaying mortgage affect my loan-to-value ratio?

Investing in your mortgage will benefit you and your home equity. By making additional payments, the amount that is owed on the loan decreases, and the portion of ownership for your house increases. This reduces what’s known as a loan-to-value ratio which shows how much of the property is still paid off from a mortgage. Paying extra towards improving this percentage can be beneficial long term!

Not only does having a lower LTV bring financial security, but it also presents more options when you next come to remortgage. Whether you have a repayment mortgage or an interest-only mortgage, remortgaging, many lenders provide reduced interest rates if your LTV is low which could lead to even greater savings in the future! Investing now has so much potential to greatly save money over the mortgage term.

What are the advantages and disadvantages of overpaying on your mortgage debt?

Before making any decisions, it’s essential to consider the advantages and drawbacks of overpaying your mortgage. Although undoubtedly there will be massive benefits, this move might not fit into everyone’s financial plan.

Advantages of Overpaying Your Mortgage

- Lower Interest: By overpaying your mortgage, you’ll pay it off faster and reduce the amount of interest you pay over time, potentially saving you thousands of pounds.

- Increased Equity: Every overpayment you make increases your ownership of your property and brings you closer to paying it off entirely.

- Better Than Savings Accounts: Overpaying your mortgage may be a better option than keeping your money in a savings account, as you’ll earn more in interest savings on your mortgage than you would in a typical savings account.

Disadvantages of Overpaying Your Mortgage:

- Less Cash Available: Overpaying your mortgage reduces the amount of cash you have on hand, which can be problematic if you need money for unexpected expenses or if your financial situation changes.

- Other Debts: Overpaying your mortgage is not always the best option if you have other debts, such as credit card debt, as the interest rates on these debts are often higher than on mortgages.

- Fees and Charges: Some lenders may charge a fee for overpayments that exceed a certain limit. This can cancel out the savings you made by overpaying. The fees are usually known as early repayment charges.

In conclusion, if you are financially stable and have a healthy emergency fund with no pressing debts to worry about then overpaying your mortgage is an excellent choice. On the other hand, if cash savings are sparse it may not be advisable to go down this route.

What is an early repayment charge?

Most mortgage lenders charge an early repayment fee if you pay off your mortgage loan before the agreed term has ended. This cost is designed to make up for any lost interest payments that could have been gained had the original plan gone forward as expected. An early repayment charge can be a costly expense but one worth considering should you wish to free yourself of debt sooner rather than later.

When you consider paying off your mortgage early, make sure to calculate the cost of this move. Early repayment charges could be up to 5% (or more!) of your total loan balance! You should research and compare different lenders in order to discover a deal that offers flexibility while also keeping costs low. Sleeping soundly at night will come easy when you know exactly how much an early payoff will set you back financially—so don’t overlook checking for these charges before making any decisions.

Which lenders allow you to pay extra?

Mortgage lenders generally allow you to initiate extra monthly repayments, yet they might place limits on the quantity and timing of those overpayments.

To better understand the mortgage market’s overpayment policy, please find a summary below.

| Bank | Overpayment Policy |

|---|---|

| Natwest | 20% overpayments per year allowed without early repayment charges for fixed rate or tracker mortgages starting March 2023 |

| Barclays | Non-refundable, secure facility provided for overpayments; customers can check additional overpayment amounts via online banking or branch; underpayment options may be considered |

| Halifax | 10% overpayments of total owed amount allowed each calendar year if paid on January 1st to avoid extra fees |

| Santander | Unlimited overpayments allowed without charges for Follow-on Rate, Standard Variable Rate, and tracker mortgages; 10% allowance for fixed rate mortgages each year |

| TSB | One-time lump sum or up to 10% increase in monthly payments allowed for most products; some products offer a higher cap for overpayments |

| Nationwide | Nationwide allows varying levels of mortgage overpayments depending on the product type and reservation date, with some products allowing unlimited overpayments, some permitting 10% per annum of the original loan amount, and others capped at £500 a month. |

Compare mortgages with YesCanDo

Are you looking for the best mortgage deal? Our UK fee-free mortgage broker is here to make your search easier. We compare prices from over 90 lenders in the market, ensuring that only the right option reaches you. Venturing into different deals can help you save on those hefty repayments; so even if a mortgage has already been set up, there could be an even better offer available! Don’t wait any longer – begin your hunt today and start saving now!

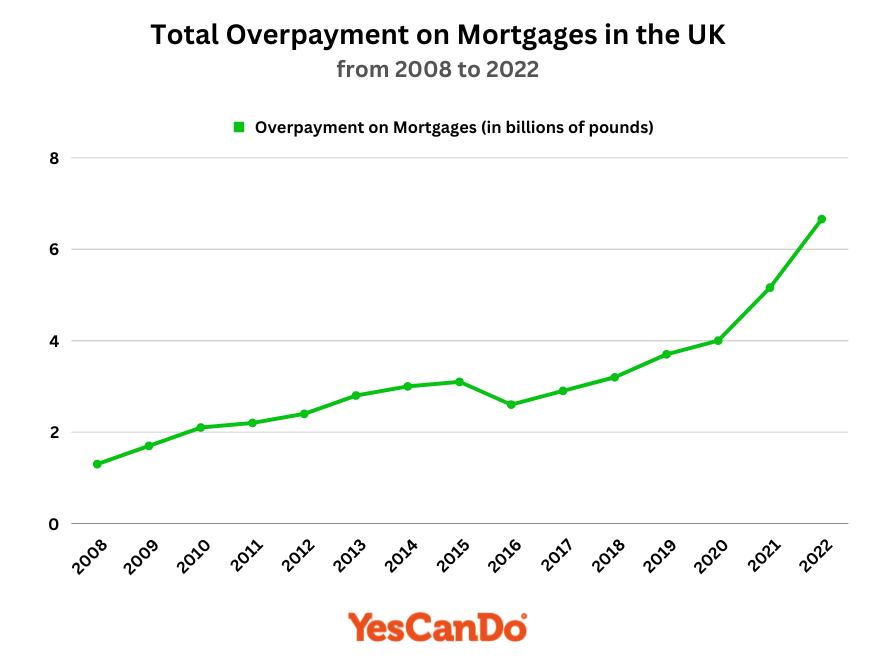

Mortgage overpayments made in the UK between 2008 and 2022

FAQs

When is the best time to make overpayments?

Normally, there is no definite response to the question of when you should make overpayments on your mortgage loan. It all depends on a few variables and the kind of mortgage deal that you have. That being said, if you're eager to save some money along the way then it would be much more prudent for you to pay off as much debt as possible before interest rates are reassessed or reset. Make sure that your lender has properly informed you regarding when these processes take place so that paying additional mortgage repayments can actually benefit your pocket in an effective manner.

If your mortgage interest rate is assessed daily, it makes sense to make overpayments at any time. However, if the interest rate recalculates on a monthly or yearly basis, it may be wise to consider making a lump sum overpayment just before the mortgage anniversary takes place in order to take advantage of potential savings!

Can I get my mortgage overpayments back in an emergency?

Prior to making any decisions about overpaying your mortgage, you must take a step back and evaluate your present financial portfolio, alongside what you will require in the future. Be sure that whatever payment plan or lump sum amounting to extra monthly payments is one with which you are comfortable; additionally, make it an imperative priority to have sufficient funds saved should anything unanticipated arise.

While it is advantageous to overpay on your mortgage loan in order to reduce the amount of interest you pay and boost equity in your property, be mindful that accessing these funds at a later time may not always be as simple. You may have to remortgage which could involve added fees or regulations if interest rates have escalated since then.

Thus, it is prudent to analyse the advantages and disadvantages before making a knowledgeable choice about overpaying your mortgage. Furthermore, you should also have some emergency cash on hand as well as prioritise paying off any high-interest debts prior to allocating extra funds towards an early mortgage repayment.

Should I overpay on an interest-only mortgage?

Making extra payments on either a repayment or interest-only mortgage can be an advantageous way to cut down your loan balance. However, if you opt for the latter, the benefits may not align with those of repaying capital and interest.

Making overpayments on your repayment mortgage can be hugely beneficial, as all of that money goes towards reducing the capital loan. This means you will begin to reduce your overall mortgage balance much quicker!

Unlike an interest-only mortgage, where overpayments can only go towards future interests payments or your total interest amount, with no effect on equity in the property nor reduction of overall mortgage capital balance. Therefore instead of saving money by making extra payments, you could alternatively invest it elsewhere for better returns.

Can I claim back mortgage overpayments?

Generally speaking, mortgage overpayments are non-refundable. However, if you choose the right product type, you can borrow back any extra payments that were made in the past. As an example of this concept in practice, one prominent high street lender offers an "overpayment reserve" which customers may make withdrawals from when necessary. At present time, this is their policy on the matter.

Is it better to overpay on my mortgage or invest my money?

It all depends on what you are investing in. To gain a better understanding of the potential returns, it is essential to research your investment and compare its monetary value against how much interest you will be saving by overpaying on your mortgage.

Do mortgage overpayments include the interest?

Most loan providers limit the overpayment to 10%, depending on your mortgage's remaining capital. When you decide to pay extra, not only will it lower the amount of interest paid each month and in total due to a reduced percentage based on current debt, but also reduce your existing debt faster!

Here are some other mortgage guides that you may be interested in: