Barclays Mortgage Calculator

Home » Best Mortgage Lenders UK » Barclays Mortgage Review » Barclays Mortgage Calculator

Barclays is a highly trusted UK highstreet lender with a long-standing reputation. Like most lenders, Barclays offers a user-friendly calculator designed to provide accurate and reliable repayment estimates for mortgage customers.

What is a Mortgage Calculator?

There are many mortgage calculators from an affordability calculator to a repayment calculator. Most lenders use their own affordability calculators that are not available for public use. There are however affordability calculators you can use that will give you a very rough borrowing figure, like the one further down in this guide.

A repayment mortgage calculator helps potential homebuyers estimate their monthly mortgage repayments based on a hand full of factors. This type of mortgage calculator relies on three main factors:

the loan amount,

interest rate,

and loan term.

With this information, you can calculate the amount you’ll need to pay every month for your mortgage. These tools are useful for budgeting, planning, and comparing different mortgage options to ensure you are financially able to afford the mortgage you want.

Why Choose Barclays Mortgage Calculator?

Barclays offers a reliable and user-friendly mortgage calculator, which is highly accurate and has unique features and benefits. As a well-established high-street bank with years of experience in the industry, it’s an ideal choice for potential homebuyers, including first-time buyers.

However, a broker will have access to their own calculator and mortgage tools that are unbiased. This is because they are based on 90+ mortgage lenders’ criteria rather than just one.

Accuracy and Reliability

The Barclays Calculator uses up-to-date data sources to provide accurate repayment estimates. It considers essential factors like interest rates, mortgage term, and insurance costs to give users a comprehensive understanding of their mortgage expenses.

User-Friendly Interface

Designed with simplicity in mind, the Barclays Calculator is easy to navigate for both first-time and experienced users. The intuitive design allows users to input their information and adjust parameters effortlessly.

Customisable Parameters

The Barclays Calculator provides adjustable parameters to help users tailor their calculations to specific needs. Users can explore various loan terms, interest rates, and deposit amounts to determine the most suitable mortgage plan.

How to Use the Barclays Mortgage Calculator

Using the Barclays Mortgage Calculator is a simple process. Follow these steps to obtain accurate mortgage repayment estimates:

Inputting Basic Information

Like most repayment calculators, you will be required to input these essential details of your mortgage, including:

Loan amount: This is the total amount you intend to borrow for your home purchase.

Interest rate: The annual interest rate on your mortgage.

Loan term: The duration of your mortgage, typically ranging from 10 to 40 years in the UK.

Factoring in Additional Costs

To get a more comprehensive estimate, include additional costs such as:

Property taxes: The annual council tax levied on your property by local authorities.

Buildings insurance: The yearly cost of insuring your property against damage or loss.

Mortgage arrangement fee: A one-time fee charged by the lender for setting up your mortgage.

Adjusting for Different Scenarios

The Barclays Mortgage Calculator allows you to explore different scenarios by adjusting parameters such as:

Deposit: Experiment with different deposit amounts to see how it affects your monthly repayments and interest.

Loan term: Compare how shorter or longer loan terms impact your monthly repayments and total interest paid.

Interest rate: Examine the effect of varying interest rates on your mortgage repayments.

Examples of Mortgage Calculators (Try for free)

Barclay’s mortgage calculators are focused on their own lending criteria. You can use some of their calculators on their website. However, being an independent broker we aim to give you an unbiased calculation, therefor we have provided two basic mortgage calculators below.

Affordability Calculator: Work out how much you could borrow

Work out the maximum loan amount you can borrow with our simple mortgage affordability calculator.

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Repayment Calculator: Calculate your monthly payments

Calculate roughly how much your monthly mortgage repayments could be by using our basic mortgage repayment calculator.

Understanding Your Mortgage Calculator Results

After inputting the necessary information, the Barclays Mortgage Calculator will provide a detailed breakdown of your estimated mortgage repayments, including:

Monthly Mortgage Payments

Your monthly mortgage repayment consists of two components:

Capital – The principal is the portion of the payment that goes towards reducing the loan balance.

Interest – The interest part is the cost to you of borrowing the money. The Barclays Calculator will display the estimated monthly repayment, helping you understand your financial commitment.

Repayment Breakdown

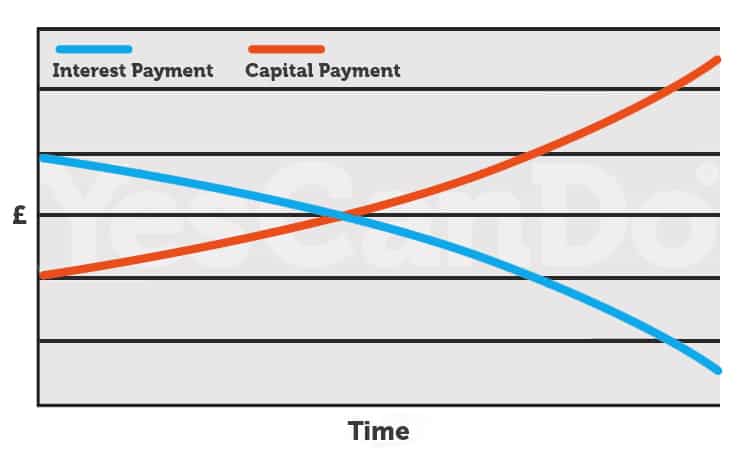

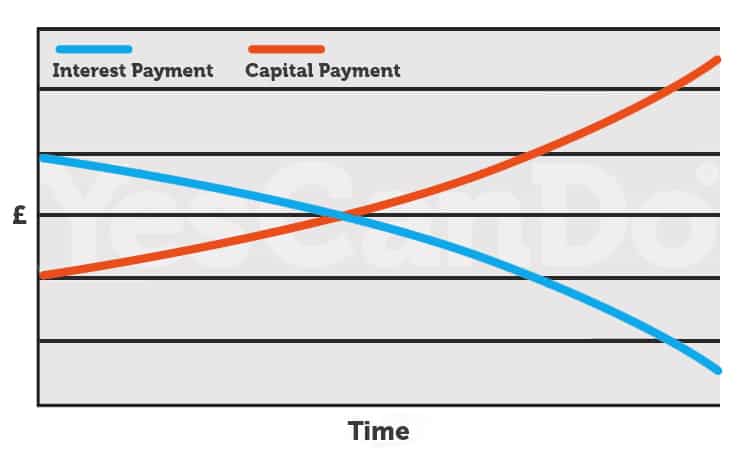

Most mortgages follow a repayment structure, which means that each monthly repayment consists of both capital and interest. Over time, the balance between the capital and interest parts of the mortgage will change. In the first few years of the mortgage, a larger portion of your monthly repayment goes toward the interest. In the later years of your mortgage, a higher percentage goes toward the capital, ultimately paying off the loan. To give you a good visual idea of how this works we have provided the below graph.

The Barclays Calculator provides a detailed breakdown of your repayments, from the initial rate period through to the end of the mortgage term helping you understand how the principal and interest portions change over the loan term.

Total Interest Paid

Understanding the total interest paid over the mortgage term is crucial when choosing a mortgage. The Barclays Calculator calculates this amount based on the loan term and interest rate you input. By comparing different scenarios, you can identify the most cost-effective mortgage option.

Tips for Lowering Your Mortgage Repayments

If you want to save thousands of pounds over the life of your loan, reducing your mortgage repayments could help. Below are some suggestions on how you can achieve that and lower your monthly mortgage repayments.

Increase your deposit: By putting down a bigger deposit you can decrease the total loan amount and usually, this lowers monthly payments and potentially unlocks better interest rates.

Choose a longer loan term: If you choose to extend the term of your mortgage, your monthly repayments will be lower. However, keep in mind that you will end up paying more interest overall.

Improve your credit score: Having a clean credit history and a great credit score usually results in you being offered a lower interest rate. This can also lower your mortgage payments.

Consider an offset mortgage: An offset mortgage is a mortgage product that connects your savings account to your mortgage. This is a great way to reduce the interest charged on your mortgage.

Shop around for the best mortgage rates: To find the most suitable mortgage rate and terms for your new deal, consider reviewing offers from several lenders.

Next Steps After Using the Barclays Mortgage Calculator

Once you have estimated your mortgage repayments using the Barclays Calculator, consider the following steps to move forward in your home-buying journey:

Mortgage Agreement in Principle

To get an idea of how much you can borrow and increase your bargaining power as a buyer, consider getting a Mortgage Agreement in Principle (AIP) from a lender like Barclays, another lender or even better a mortgage broker. An AIP is a conditional mortgage offer based on your financial information.

Comparing Mortgage Options

Explore different mortgage options, such as fixed-rate, tracker mortgages, or discount mortgages, and compare the features and benefits such as arrangement fees of each to determine the best choice for your circumstances.

Working with a Mortgage Advisor

Consider consulting an independent mortgage broker who can guide you through the mortgage process. They can help you understand your options, offer unbiased personalised advice, and assist with the mortgage application process.

Start Your Homeownership Journey with Barclays

Embarking on the journey to homeownership can be both exciting and challenging. Maybe you have an existing mortgage with Barclays. The Barclays Calculator is a valuable tool to help you make informed decisions and take the first step toward your dream home. Estimate your monthly mortgage repayments, explore different scenarios, and confidently navigate the mortgage landscape with Barclays by your side.

Advantages of Using a Mortgage Broker Over Going Direct to a Lender

A mortgage broker who has experience can be very helpful when searching for a mortgage. They offer several advantages compared to approaching a lender directly. By knowing your specific financial situation, a mortgage broker can help you find the best mortgage deals that suit your requirements.

A mortgage broker can:

Find the best mortgage deals

A mortgage broker can help you find the best mortgage deals that match your financial situation and needs by searching across the entire mortgage market. They can also provide you with offers from different lenders and find options that may not be available to you if you were to approach a lender directly.

Save you time and effort

A mortgage broker can assist you with the application process by communicating with the lender and submitting the required paperwork. This will save you time and energy, and help simplify the mortgage application process.

Provide expert advice

By seeking the assistance of a mortgage broker, you can receive personalized guidance relevant to your specific situation. This can aid in ensuring a smooth experience throughout the mortgage process. Leveraging their proficiency and comprehension of the mortgage market, they can empower you to make informed choices and choose the mortgage that suits your requirements.

Assist with paperwork

A mortgage broker can schedule a mortgage appointment, assist you in collecting and submitting the necessary documents, and ensure your mortgage application is thorough and precise. They offer valuable assistance in preventing application delays and possible complications.

In Summary: Choose a Mortgage Broker for a Smoother Homebuying Experience

To sum it up, opting to work with a mortgage broker with a team of unbiased experienced professionals offers several benefits compared to approaching a lender directly. With a mortgage broker who comprehends your unique financial circumstances, you can obtain the most favourable mortgage deal. Brokers provide guidance throughout with extensive market expertise. Having support throughout the application process enables you to achieve your best mortgage for your property goals in a faster and more efficient manner.

Barclays mortgage advisors

- Free Mortgage Services Available

- We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to 90+ UK mortgage lenders

OR FILL IN OUR FORM

Let us know what the best time is for us to call you. We will get one of our mortgage advisors will be in touch to talk through your situation and available options.

"*" indicates required fields

Grant Humphries (CeMAP)

Grant Humphries (CeMAP) is a proficient Mortgage & Protection Adviser at YesCanDo Money. With a career spanning since 2001, Grant has honed his expertise in understanding mortgage lenders' criteria, complex financial situations, and the nuances of the mortgage market. His deep knowledge enables him to provide tailored solutions, especially for professionals and those with unique financial profiles. At YesCanDo, Grant's commitment to excellence is evident. He takes pride in guiding clients through their mortgage journey, ensuring they feel confident and informed at every step. From first-time buyers to seasoned investors, Grant's analytical approach and dedication make him a trusted adviser in the financial landscape