Best Mortgage Lenders UK

Home » Best Mortgage Lenders UK

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

Reviewing the top mortgage lenders UK

To purchase a home, unless you are able to pay in cash, you will need to borrow money from a mortgage lender. When getting a mortgage, in the past, you would have needed to visit a building society Nowadays, most banks offer mortgage products for homeowners.

There are over 100 mortgage lenders in the UK, which together offer more than 12,000 different mortgage deals. We have included reviews for the largest mortgage lenders as well as specialist lenders.

The biggest mortgage lenders in the UK are also known as the Big Six, they include Lloyds (including Halifax), Nationwide, Santander, RBS, Barclays, and HSBC. These six lenders account for most of the mortgage lending in the UK.

Specialist lenders, such as Kent Reliance and Fleet, focus on providing mortgages for specific types of customers. If you have a history of bad credit, you may need to consider a specialist lender for your mortgage.

Other lenders, such as Virgin Money, Metro Bank, Clydesdale, and Accord, offer similar mortgage products to the Big Six but are smaller in size.

How many mortgage lenders are there?

There are approximately 100 mortgage lenders in the UK. These are mainly banks and building societies. Some are well-known, while others are specialists who may not be as well-known.

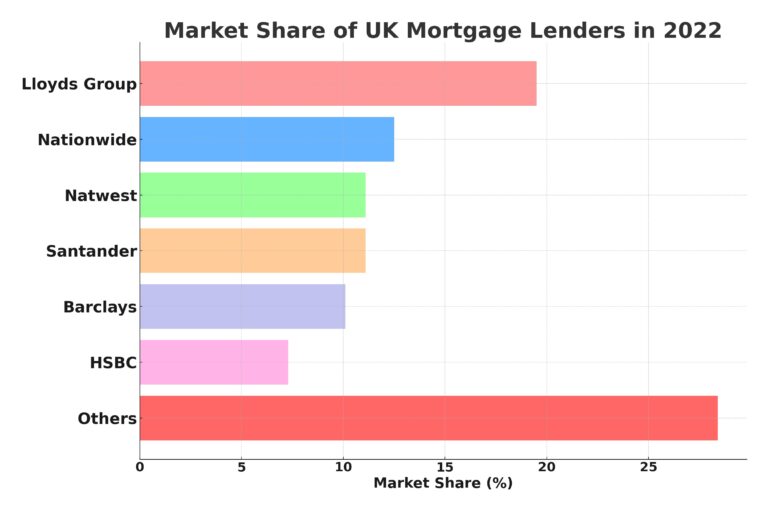

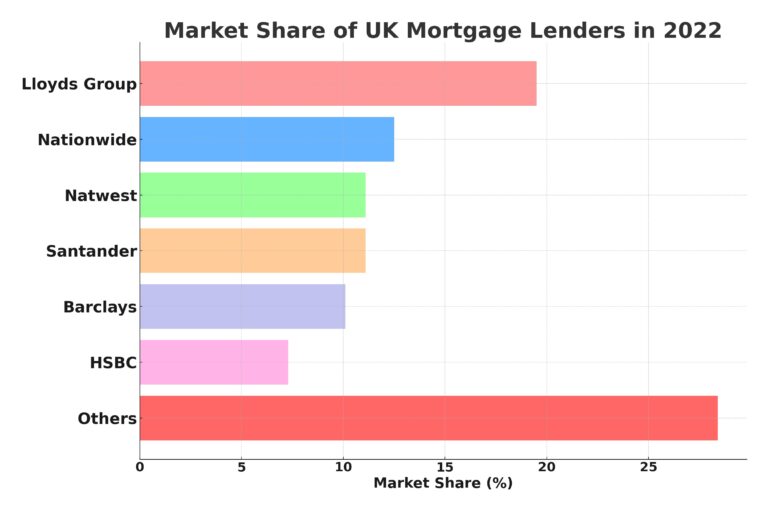

The biggest mortgage lenders UK

The following are the 6 biggest UK mortgage lenders according to the latest data from UK Finance (2022 annual ranking of mortgage lenders by market share). The top 6 spots are almost identical to 2021 however in 2022 Nationwide overtook NatWest to take second place.

The Lloyds Banking Group (includes Halifax) – 19% market share

Nationwide Building Society – 12.5% market share

Natwest Group – 11.5% market share

Santander UK – 11.3% market share

Barclays – 9.9% market share

HSBC Bank – 7.5% market share

Breakdown of Mortgage Lenders market share UK

Should I choose a high-street mortgage lender?

It ultimately depends on your individual circumstances and financial goals. Choosing a high street mortgage lender may offer certain benefits, such as in-person support and a wide range of products to choose from. However, it may also be worth considering other options, such as online lenders, to compare interest rates and find the best deal for you. It’s always a good idea to shop around and compare offers from multiple lenders before making a decision.

The Fastest Mortgage Lenders UK

It has been a turbulent few years for the mortgage market and has been a headache for lenders throughout the pandemic and now into the cost of living crisis.

Although the speed of the mortgage application through to completion is not so important when remortgaging it is essential when purchasing a property otherwise you may not end up owning the property!

Our data shows that the time from mortgage application submission to mortgage approval typically takes lenders about 10 days on our new mortgage submissions. This represents a decrease of 4 days in processing time compared to the average for 2022, indicating a 40% improvement in the speed of mortgage approval.

For more read our indepth guide on: How long does a mortgage application take?

Looking at our own data throughout 2023 we have put a list together of our top 10 fastest UK mortgage lenders according to YesCanDo Money’s 2023 mortgage data.

10 Fastest Mortgage Lenders

From application submission to mortgage approval, these are the fastest mortgage lenders utilised by YesCanDo Money in 2023:

- BM Solutions – 3 days

- Barclays – 5 days

- Coventry – 5 days

- Digital – 6 days

- Halifax – 7 days

- Nationwide – 7 days

- Santander – 7 days

- Leeds – 9 days

- TSB – 9 days

- Skipton – 9 days

Keep in mind that the time it takes for a mortgage to be approved can vary. Some mortgages may be approved more quickly, while others may take longer. If you have bad credit or are self-employed, it may take longer for specialist lenders to approve your application. If you need your mortgage to be approved quickly, consider working with one of our faster lenders. As well as looking for a mortgage deal with the biggest mortgage lenders we advise you not to rule out specialist lenders who may be better suited to your needs, such as those who offer specialised products such as Shared Ownership mortgages.

The best mortgage lenders UK

- interest rate

- fees and charges

- customer service

- process applications the quickest

- lend the most based on your income

- the availability of online services

- have lots of good reviews

It may also be helpful to read customer reviews and check the lender’s reputation before making a decision. It’s also a good idea to consider whether the lender offers the type of mortgage that best suits your needs and financial situation.

Best mortgage lenders as voted by our mortgage advisors

Below are the top mortgage lenders UK as voted by our in-house mortgage advisors.

Halifax

NatWest

Accord Mortgages

Nationwide building society

HSBC

Finding the best mortgage lenders

We always search for the most suitable mortgage deals for your situation. It’s helpful to know which lenders receive the fewest complaints, process applications quickly, and lend the most based on your income. For example, over a 12-month period, our data showed that Natwest took an average of 19.6 days to process our customers mortgage applications, which was the longest among the top 5 biggest lenders. Knowing this information may encourage you to start the application process earlier. We have compiled data on these criteria to give you an idea of which lenders are the best. This can help you prepare for a future mortgage application.

Compare mortgage lenders

When comparing mortgage lenders, there are several key factors to consider. These include the interest rate, fees and charges, customer service, and the availability of online services.

Here are 5 steps you can follow to compare lenders:

1) Identify your financial goals and needs

Before you start comparing lenders, it’s important to have a clear idea of what you’re looking for in a mortgage. Consider factors such as the type of property you’re buying, the size of your deposit, and the length of the mortgage term. This will help you narrow down your options and focus on lenders that offer the products and services that best meet your needs.

2) Research and compare offers

Once you have a clear idea of your financial goals, start researching and comparing offers from multiple lenders. You can use online comparison tools to quickly and easily compare rates and fees, or you can contact lenders directly to request quotes. Make sure to compare offers from at least three or four different lenders to ensure you’re getting a good deal.

3) Consider the lender's reputation and customer service

In addition to comparing rates and fees, it’s also important to consider the lender’s reputation and customer service. Read customer reviews and check the lender’s ratings with organizations such as the Better Business Bureau to see how they compare to other lenders. You may also want to contact the lender directly to ask any questions you may have and get a feel for their customer service.

4) Compare the fine print

Finally, make sure to carefully compare the fine print of each offer. This includes looking at factors such as prepayment penalties, loan origination fees, and other charges that may not be immediately apparent. By carefully comparing the details of each offer, you can ensure you’re getting the best deal for your needs.

5) Speak to a mortgage broker

Mortgage brokers will have a team of advisors that work closely with mortgage lenders on a daily basis. It is always highly recommended to speak to a broker as they will have real-time information on the current speed of lenders, interest rates and affordability criteria. Speak to our fee-free mortgage broker for help finding the best lender for your situation.

Reviewing the best mortgage lenders UK

Remortgage with same lender?

When it comes to renewing your mortgage, it doesn’t always make sence to stay with the same lender.

As there are around 100 UK mortgage lenders, it never makes sense to assume you still have the best deal. Some things to consider before you remortgage are:

- Does your current lender have the best rate?

- Do they have the best overall mortgage deal?

- Do they have the best experience for your current situation?

- If timescales are important to you, is your current lender the fastest?

Specialist mortgage lenders

Specialist lenders, such as Kensington and Aldermore, offer mortgage products that are tailored to the needs of specific groups of borrowers. For example, they may offer deals that are suitable for self-employed individuals or people with poor credit histories. These lenders may be able to offer more flexible terms and rates than traditional lenders, but it’s important to compare offers from multiple lenders to find the best deal for your needs.

Self-employed mortgage lenders

It can sometimes be more challenging when getting a mortgage as self-employed. However, these days there are many lenders who are more willing to offer loans to people in this situation.

If you have saved a significant amount for a deposit, have a good credit score, and have at least two years of steady income on your accounts, you may have better luck getting a mortgage from these lenders.

Some specialist lenders may even be willing to lend to you even if you do not have a large deposit, perfect credit, or years of accounts.

Right to buy mortgage lenders

The Right to Buy scheme is a UK government program that allows certain tenants of public sector housing to purchase their homes at a discount. The discount is usually based on the length of time the tenant has lived in the property.

Right to Buy mortgages are offered by some but not all UK mortgage lenders to help eligible tenants finance their purchases. These mortgages are typically designed to be affordable and accessible to those who may not qualify for other types of home loans.

To qualify for a Right to Buy mortgage, you must be a tenant of a public sector landlord and meet other eligibility criteria, such as having a good credit history and being able to afford the monthly mortgage payments. You can find out more about the Right to Buy scheme and how to apply for a Right to Buy mortgage by contacting your local council or housing association.

Shared ownership mortgage lenders

Not all lenders provide mortgages for shared ownership properties. If you are unsure which lenders offer these types of mortgages, it may be helpful to speak to a mortgage broker. Some lenders that offer shared ownership mortgages include Lloyds, Leeds Building Society, Nationwide, and Kent Reliance. A mortgage broker can help you compare the terms and rates offered by these and other lenders to find the best deal for your situation.

Lenders that accept 5% deposits

Are there any lenders for first time buyers?

In the UK, there are around 90 – 100 mortgage lenders. Approximately only a third of these lenders are first time buyer friendly in terms of offering mortgages for individuals with a 5% deposit (95% loan to value mortgage). Some of the lenders that offer these mortgages include:

Accord

Barclays

Halifax

Nationwide

NatWest

Platform

Post Office/Bank of Ireland

Sainsbury’s

Santander

TSB

Virgin Money

Is buying a home with a 5% deposit right for you?

In the UK, one of the main drawbacks of putting down a 5% deposit on a home is that it may limit the borrower’s options when it comes to securing a mortgage. Many lenders have stricter lending criteria for borrowers with smaller deposits, and some may not offer mortgages to borrowers with a deposit of less than 10% or even 15%. This means that borrowers with a 5% deposit may have to pay higher interest rates or may not be able to access certain mortgage products.

Before committing to a mortgage with a small deposit, such as 5%, it is important to carefully consider whether you can afford the monthly repayments. If you are unsure of what these payments would be, it is a good idea to seek advice from a mortgage broker.

Lenders for bad credit

If you have bad credit, you may need to consider different lenders than those with good credit. You can usually tell if you have bad credit because your credit score will be low. This can be due to falling behind on payments or owing money to lenders or credit card companies. Some lenders may not consider your application if your credit history is poor. However, this does not mean that you will not be able to get a mortgage. It may just take longer to get approved and you may not have access to the best mortgage rates.

There are some lenders who are more willing to lend to individuals with bad credit. These lenders have been known to offer mortgages to customers with poor credit. The following lenders have offered the most mortgages to customers with bad credit:

Our best mortgage lenders for adverse credit

Halifax

Natwest

Kensington Mortgages

Accord

Aldermore Mortgages

Mortgage Lender FAQs

Which mortgage lender lends the most?

The suitability of a mortgage for an individual will vary depending on the lender’s criteria. It is important to consider a wide range of lenders and mortgage deals in order to find the most suitable option and lowest monthly repayments for your circumstances. A mortgage broker, such as YesCanDo Money, can assist you in finding the best mortgage provider with the lowest fixed-rate mortgages.

What documents do mortgage lenders typically need?

The information required for a mortgage application varies depending on the lender, but there are some common pieces of information that are typically needed from all applicants. These usually include:

Passport

Driving licence

Proof of name & address

Proof of deposit

Latest 3 months bank statements

It is important to gather all of the necessary information before beginning the mortgage application process to ensure a smooth and successful outcome.

Read our guide here for more: What information will I need to get a mortgage?

Will a mortgage lender help me with a bad credit score?

If you have a less-than-perfect credit history, you may have difficulty securing a mortgage from the biggest mortgage lenders. However, there are many specialist mortgage lenders working with borrowers who have adverse credit. A mortgage broker can help you identify these lenders and find the one that is most suited to your situation. By working with a mortgage broker, you can increase your chances of securing the cheapest mortgages and finding mortgage providers who are willing to work with you and offer you the most competitive deals.

Working with the best mortgage lenders uk

-

100% FREE mortgage support and advice - We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to 90+ UK mortgage lenders