Halifax Mortgages Reviewed

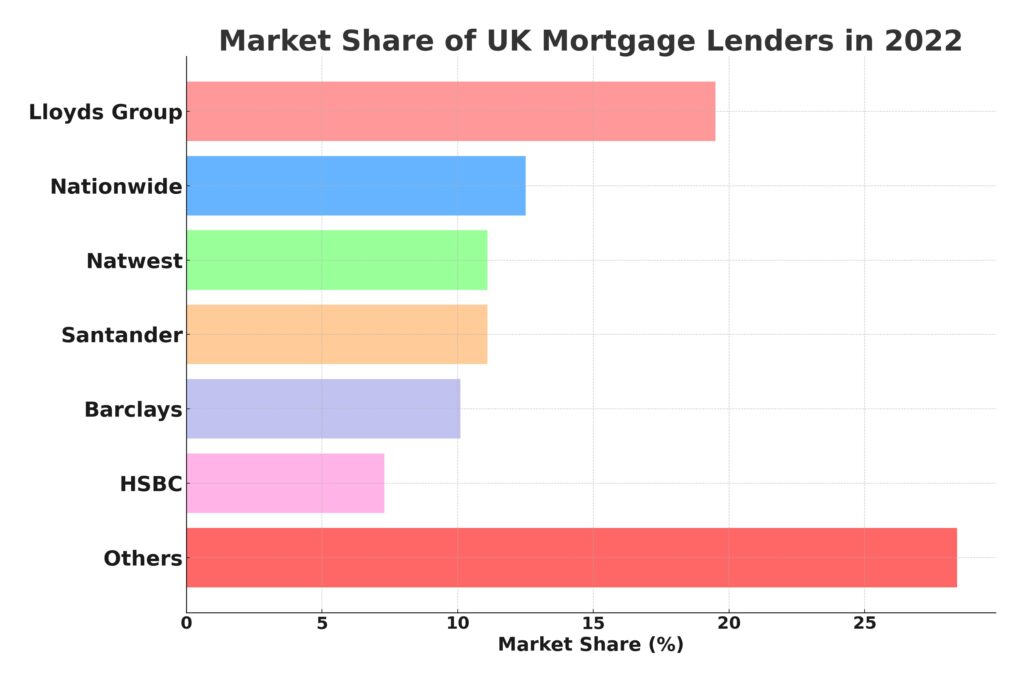

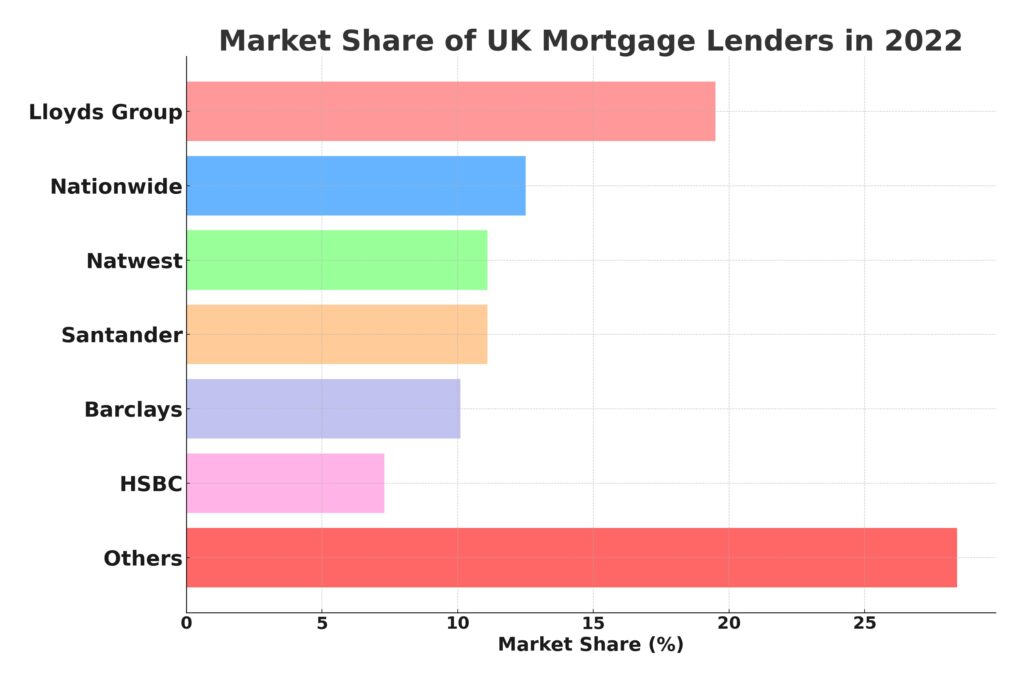

Getting a mortgage with Halifax (Part of the biggest UK mortgage lender - The Lloyds Group)

Home » Best Mortgage Lenders UK » Halifax Mortgages Reviewed

- Fee Free Service

- Fully Protected

- Trustpilot - 5 Star

This comprehensive guide will provide you with an in-depth review of one the Best Mortgage Lenders in the UK and part the Lloyds Group.

Halifax is a leading mortgage lender offering mortgages to first-time buyers, home movers, landlords, and customers wanting to remortgage.

If you’re currently looking for a mortgage, it might be that Halifax is the right lender for you.

We will take a closer look at Halifax mortgages in this guide so keep reading to learn more and then get in touch with our team for up-to-date information on the mortgage deals that this popular high street bank is offering.

About Halifax

Halifax is a bank and mortgage lender that is found on most high streets around the UK. It was established in 1853 as the Halifax Permanent Benefit Building and Investment Society. In 2001, Halifax merged with the Bank of Scotland, forming HBOS plc, which was later acquired by Lloyds Banking Group in 2009.

As well as Bank of Scotland, other brands associated with Lloyds Banking Group include Lloyds Bank, Scottish Widows, and MBNA.

Today, Lloyds Banking Group serves around 30 million customers and it offers a range of mortgage types to residential and buy-to-let borrowers. These include ‘green mortgages,’ which come with a reduced mortgage rate over a fixed term for those remortgaging or purchasing an energy-efficient home with an EPC rating of A or B.

If you would like to know more about what Halifax offers, you can learn more about the bank here.

Compare Halifax mortgages

Halifax offers the following mortgage types to it’s customers in the UK.

Fixed-rate mortgages

With a fixed-rate mortgage, the interest rate on your mortgage will be fixed for the length of your introductory deal (between 2-5 years). After this time, you will fall onto Halifax’s standard variable rate unless you remortgage to a new deal.

A fixed mortgage is a good idea if you want the peace of mind that the repayments on your mortgage won’t change during the introductory period.

Tracker rate mortgages

With a tracker-rate mortgage, the interest rate on your loan will rise and fall in line with Bank of England’s base rate.

If the interest rate drops, your mortgage payments will also drop. But if the rate rises, your monthly repayments will be higher and the total cost of your loan will increase.

Your home or property may be repossessed if you can’t afford to pay your mortgage, so keep this in mind when considering tracker mortgages.

Cashback mortgages

First-time buyers who choose from Halifax’s ‘first-time buyer exclusive range,’ will be given a lump sum of cash on the day they draw down their mortgage.

The amount of cashback you receive will be dependent on the mortgage that you have applied for. Currently, eligible customers can receive between £500 – £1000 as a lump sum.

Buy-to-let mortgages

If you want to make money from renting out properties, you may be eligible for one of Halifax’s fixed buy-to-let mortgages that are offered on either a repayment basis (capital and interest together) or an interest-only basis.

To be eligible for one of Halifax’s buy-to-let mortgages, you will need to be over 18 years of age, have a deposit of at least 25% (or higher for certain properties), and be looking for a property that is worth at least £40,000. Other eligibility requirements will also apply.

Unfortunately, investing in certain types of properties does not qualify for a mortgage from Halifax. Currently, they are unable to provide mortgages on:

- multiple tenancies,

- Homes of Multiple Occupancy (HMOs),

- bedsits,

- holiday lets,

- ‘Related Person’ tenancies,

- or any property that is subject to selective licensing schemes.

Loan-to-value ratio

Secure your future today by taking advantage of Halifax’s generous loan-to-value (LTV) program, which offers up to 95% coverage on the value of your property.

Halifax offers a 95% LTV mortgage that allows you to purchase property with only a 5% deposit! This means your loan will cover up to 95% of the cost of the house.

Example: For a property costing £200,000 and a mortgage with a loan to value of 95%, Halifax will lend you £190,000 if you can put down the £10,000 deposit.

- £190,000 = 95% LTV

- £10,000 = 5% Deposit

90% LTV mortgages

Halifax offers a range of LTV mortgage deals, including home loans with a loan-to-value of 90%.

With a 90% LTV mortgage, the lender will let you borrow 90% of the property value provided you put down a 10% deposit.

In the case of a house costing £200,000, for example, your 10% down payment would equate to £20,000 and your loan from Halifax would be £180,000.

Halifax offers 91-95% LTV mortgages too, so if you can’t afford a 10% deposit, you may be eligible for a higher LTV with a lower down payment. Be aware that higher LTV deals come with higher interest rates so your total loan amount will increase.

Remortgaging with Halifax

Completing a Halifax remortgage provides many benefits including lowering monthly payments, freeing up funds for home improvement projects and changing your mortgage term. Switching to a new deal with Halifax is the perfect way to make sure that you are getting the best value from your current mortgage! Some benefits of remortgaging with Halifax are:

- Mortgages up to £1 million are exempt from any valuation fees!

- Complimentary fundamental legal services (numerous additional charges may arise)

- With Halifax mortgages, you’ll never have to worry about hefty exit fees – though Early Repayment Charges may still be applicable.

Find the best deals on mortgage rates

At the time of writing (March 2023), Halifax has competitive mortgage interest rates, which is good news for borrowers. But is the bank offering the best deal? There are many other lenders on the mortgage market, so before you borrow money, it’s wise to consider all of your options.

At YesCanDo mortgage brokers our experienced team of mortgage advisors can compare Halifax’s mortgage deals with the products being offered by other mortgage providers, and give you up-to-date information on the best deal based on your personal circumstances.

We can also advise you on the steps you need to take to be eligible for the lowest mortgage rates, to ensure your level of borrowing doesn’t exceed what you can afford to pay after you have been given your mortgage offer.

Contact us to learn more and benefit from all the advice and support we offer as a Fee Free broker.

Mortgage Product Transfer

A Halifax Product Transfer allows existing mortgage customers to switch to another loan within Halifax’s range more easily and quickly and benefits those on standard variable rates or those who have expired fixed or discounted rate contracts within six months of expiry. The process involves checking eligibility, submitting a transfer request, and accepting their new deal – with no further income or affordability assessments, wide variety of products offered at competitive rates regardless of direct application versus broker application making the transfer faster, simpler and potentially more beneficial to customers than with competing lenders.

Is Halifax a good mortgage lender?

Based on feedback from Halifax customers on various aspects of their mortgage, such as value for money and application process, Halifax received a customer score of 64%, placing them 10th out of the top 15 mortgage providers.

Halifax mortgages offer a range of benefits such as flexible mortgages with special features to help you manage them more easily, mortgages specifically targeted at first-time buyers and over-55s, and lending at multiples of up to 5.5 times income, depending on salary, affordability, and loan-to-value.

Therefore, Halifax could be considered a ‘good’ lender, but there may be other mortgage lenders that are more suitable for you. We can give you more information should you choose to use our services and we will help you compare Halifax with the other lenders on the market. Get in touch with us by phone, WhatsApp, or our contact form, and we will arrange an appointment with you.

Overcoming Tier 2 Visa Hurdles with Halifax Mortgage

Halifax mortgages how much can I borrow?

Mortgage providers use income multiples as part of their affordability assessments when deciding how much to lend their customers.

Currently, Halifax offers income multiples of:

Up to 5 x annual income for employed borrowers earning more than £30,000

4.49 x annual income for employed borrowers earning less than £30,000, self-employed borrowers, or affordable housing scheme applicants

Up to 5.5 x annual income for borrowers earning more than £75,000 who are borrowing up to £1m at less than 75% LTV

The amount you will be eligible to borrow will depend on the property value of the house you wish to purchase, annual income, and other aspects related to your financial circumstances.

Use the mortgage calculator below to estimate what you may be able to borrow with a Halifax mortgage.

Halifax Mortgage Calculator

Looking to calculate how much you may be able to borrow from Halifax, as well as how much your monthly repayments will be? No problem! Our two simple and easy-to-use mortgage calculators can give you a precise estimate in no time.

For a more detailed and personalised mortgage affordability, use our Mortgage Affordability Calculator here >

Frequently Asked Questions

How long does Halifax mortgage approval take?

You can expect to wait between 2-6 weeks to get your mortgage approved after you have completed your application.

Once approved, you will be given a mortgage offer with details of how much Halifax is willing to lend to you. This will be valid for a specific period, usually around three months. You will need to complete your property purchase within this time frame. If you don’t, your offer will expire (unless you can get an extension), and you will have to reapply for a mortgage.

Are Halifax mortgages hard to get?

Halifax will only let you borrow money if they don’t perceive you as a financial risk. If they think you will struggle to keep up repayments on your mortgage, your application will likely be rejected.

Halifax might be concerned about your ability to keep up repayments on your mortgage if…

You have bad credit

You have a fluctuating income

You don’t have job security

You might also be refused a mortgage from Halifax if…

You don’t have enough money for a deposit

You have recently started a new job

There are issues with the property you want to buy

You exceed the maximum age set for its borrowers

If you are rejected by Halifax or if you don’t think you will pass their checks, you might still be eligible for a mortgage deal from another lender.

How long does Halifax mortgage underwriting take?

The underwriting process takes place after you have completed your mortgage application.

This is when Halifax will determine your suitability for a mortgage by checking your credit history, income, and overall financial situation.

In some cases, it can take up to 2 weeks to complete this process, but if there are any issues, such as missing or incorrect information, or if the lender is busy, it could take longer.

Can I make overpayments on my Halifax mortgage?

With Halifax, you could have the opportunity to repay up to 10% of your current mortgage balance yearly depending on the product type. However, if you surpass this set limit, it’s likely that an early repayment fee will be applicable.

Need to know your overpayment limit? Reach out to Halifax, login into your banking account online, or review the paperwork associated with your account – all three are guaranteed sources of information on what you can pay above and beyond.

Can I port my Halifax mortgage?

Halifax offers the ability to move your mortgage over to a different property known as porting; consequently, you can keep all of the perks from your existing deal including the interest rate. This could be an ideal solution if you are in mid-way with regards to repayment and want to avoid paying any extra fees before time or in case you have locked into a low-interest rate.

It’s crucial to speak with a mortgage advisor or contact Halifax directly so you’re aware of the terms and conditions associated with porting your mortgage. Also, note that transferring a mortgage usually requires going through an updated affordability assessment as well as property valuation. To be approved for the new home, it is necessary to meet all of Halifax’s lending criteria.

Does Halifax charge mortgage fees?

Halifax, like all lenders, charges various fees when you take out a mortgage. These fees may include:

Product fee: With certain mortgage deals, you may need to pay a product fee. This can either be done upfront or added as part of your mortgage balance. Luckily, Halifax also offers some options that don’t require any type of product fees whatsoever!

Valuation fee: This fee covers the cost of assessing the value of your prospective property. The expense may differ depending on the valuation you request and what it’s worth. Halifax occasionally offers mortgage deals with a complimentary standard appraisal included – look out for those!

Booking fee: This is a one-time fee paid at the beginning of the mortgage process to reserve a specific mortgage deal. Not all Halifax mortgage deals have booking fees.

Legal fees: These fees cover the cost of the legal work required for the mortgage process, such as conveyancing. You may need to pay legal fees to both your solicitor and Halifax’s solicitor.

Early repayment charges (ERCs): If you decide to repay your mortgage early or switch to a different mortgage deal before your current deal’s term is over, you may be charged an early repayment fee.

Mortgage account fee: This one-time fee is charged to cover the cost of setting up, maintaining, and closing your mortgage account.

It’s crucial to check Halifax’s website or contact them directly to learn about all the fees associated with their mortgage products and the specific costs involved. Alterntively, speak to our fee-free mortgage advisors.

Halifax Mortgage Advisors

We offer FREE dedicated support throughout out the mortgage process, we have full-market access to the best mortgage rates & deals. We do everything for you, for free!

-

100% FREE mortgage support and advice - We submit the mortgage application for you

- Team of expert online mortgage advisers

- Amazing communication via WhatsApp, email and SMS.

- Access to 90+ UK mortgage lenders

OR FILL IN OUR FORM

Let us know what the best time is for us to call you. We will get one of our mortgage advisors will be in touch to talk through your situation and available options.

"*" indicates required fields

Barclays Mortgage Review

NatWest Mortgages Reviewed

Nationwide Mortgages Reviewed

BM Solutions Mortgage Guide

Generation Home (Gen H)

Santander Mortgages Reviewed

Skipton Mortgages Reviewed

Virgin Money Mortgages Reviewed

HSBC Mortgages Reviewed

Halifax Mortgages Reviewed

Reviewing Accord Mortgages

Reviewing Digital Mortgages by Atom Bank

Grant Humphries (CeMAP)

Grant Humphries (CeMAP) is a proficient Mortgage & Protection Adviser at YesCanDo Money. With a career spanning since 2001, Grant has honed his expertise in understanding mortgage lenders' criteria, complex financial situations, and the nuances of the mortgage market. His deep knowledge enables him to provide tailored solutions, especially for professionals and those with unique financial profiles. At YesCanDo, Grant's commitment to excellence is evident. He takes pride in guiding clients through their mortgage journey, ensuring they feel confident and informed at every step. From first-time buyers to seasoned investors, Grant's analytical approach and dedication make him a trusted adviser in the financial landscape